Federal W-4 HRMS Guidance

Use this guidance when copying or correcting a Federal Withholding Info W4/W5 US (0210) record.

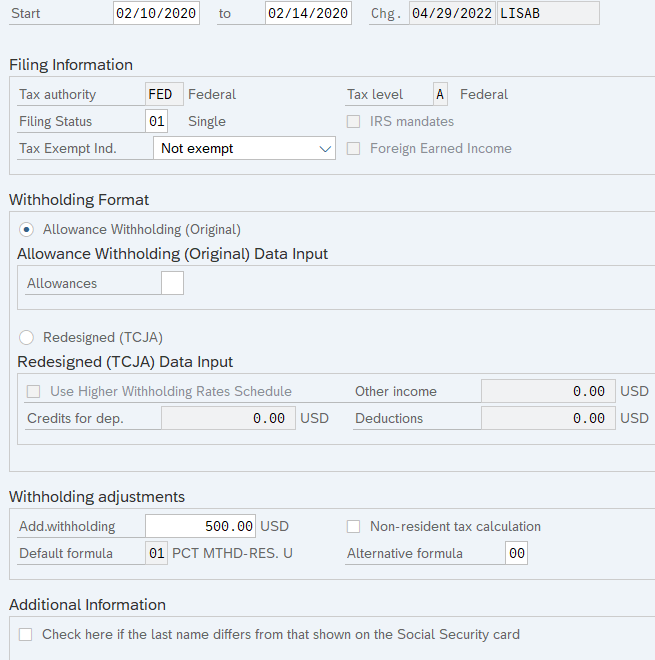

Enter the necessary changes to the record.

The Allowance Withholding (Original) should only be used if the employee’s form is dated prior to January 2020. Use Redesigned (TCJA) if the employee’s form is dated January 2020 to current.

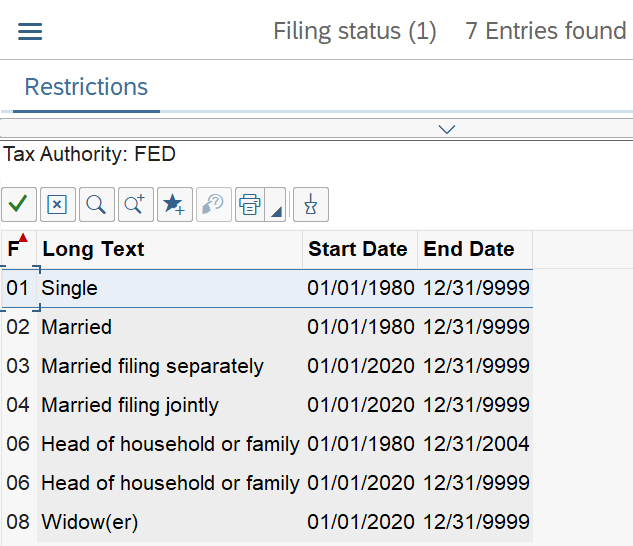

Filing Status should contain the box checked in Step 1(c) of the Form W-4:

- Single or Married filing separately:

- 01 or 03

- Married filing jointly (or Qualifying widow(er))

- 04 or 08

- Head of household

- 06

- NOTE: Do not use 02 as it is for employees that have an active Form W-4 from 2019 or earlier.

The Use Higher Withholding Rates Schedule indicator should be checked if the employee has checked the box in Step 2 of the Form W-4.

Credits for dep. should reflect the total amount in Step 3 of the Form W-4.

The Tax Exempt Ind. field determines if the employee is exempt from taxation. The field will default to not exempt.

Using the Tax Exemption indicator “Y” will make the wages exempt from taxation and not reportable to the IRS.

- Example for this indicator: Payments processed for deceased employees.

Using the Tax Exemption indicator “R” will make the wages exempt from taxation and earnings reportable to the IRS.

- Example for this indicator: Employees who submit a W-4 with the filing status of “exempt.” Employees claiming except from withholding will write the word ‘Exempt’ in the space under Step 4(c) of the Form W-4.

Add.withholding should contain the amount in Step 4(c) of the Form W-4.

The Non-resident tax calculation indicator should be selected for an employee designated as a non-resident for payroll tax calculation purposes. See Publication 515, Withholding of Tax on Nonresident Aliens and Foreign Entities.

Other income should contain the amount in Step 4(a) of the Form W-4.

Deductions should contain the amount in Step 4(b) of the Form W-4.