State of Idaho W-4 HRMS Guidance

Procedure Updated:

Wednesday, September 11, 2024

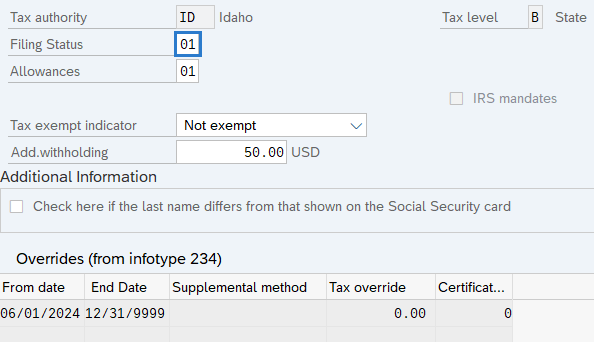

Use this guidance when copying or correcting an Idaho Withholding Info W4/W5 US (0210) record.

Enter the necessary changes to the record.

Tips:

Filing Status should contain the Withholding Status selection of the Form ID W-4:

- 01 - Single

- 02 - Married

- 15 - Married, but withhold at Single Rate

Allowances should contain the Total Number of Idaho Allowances listed in box 1 of the Form ID W-4, if entered.

Add. Withholding should contain the Additional Amount listed in box 2 of the Form ID W-4, if entered.

Enter the appropriate Tax Exempt Indicator if the employee wrote “Exempt” on line 1 of the Form ID W-4.

The state of Idaho does not currently use any other selections that are available on the Withholding Info W4/W5 US (0210) infotype.