Miscellaneous Plans - Create New Record

Use this procedure to create an employee’s Miscellaneous Plans (0377) infotype record for the DreamAhead Program (529P).

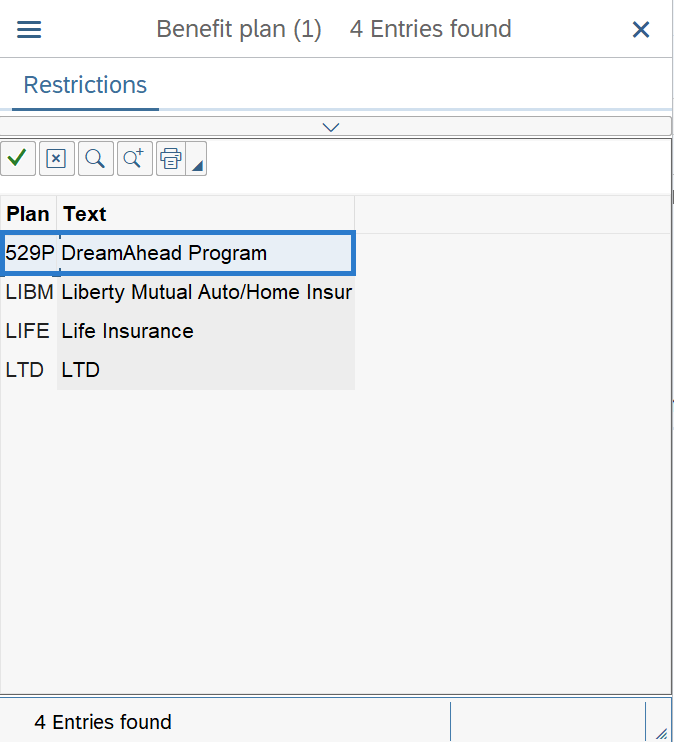

Available Miscellaneous Plans are DreamAhead Program (529P), Liberty Mutual Auto/Home Insurance (LIBM), Life Insurance (LIFE), and LTD (LTD). The DreamAhead Program (529P) is the only plan that benefits processors should maintain directly when performing this procedure.

Employees should be directed to contact the third-party plan administrators to request a new Liberty Mutual Auto/Home Insur (LIBM), Life Insurance (LIFE), or LTD (LTD) enrollment because these records are maintained within HRMS through GAP files from the plan administrators

For the DreamAhead Program, before beginning this transaction, the benefits processor should have received a new DreamAhead Payroll Deduction Form completed by the employee. The employee must open the DreamAhead account prior to submitting the DreamAhead Payroll Deduction Form to the benefits or payroll office.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

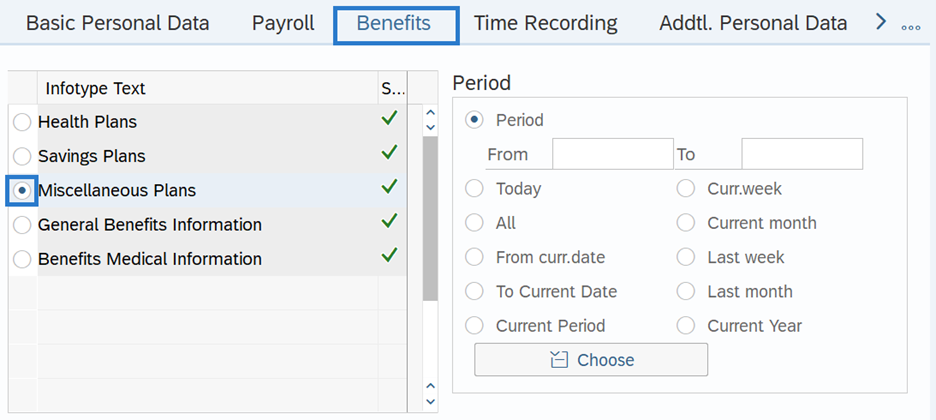

Step 4

On the Benefits tab, select the Miscellaneous Plans radio button.

-

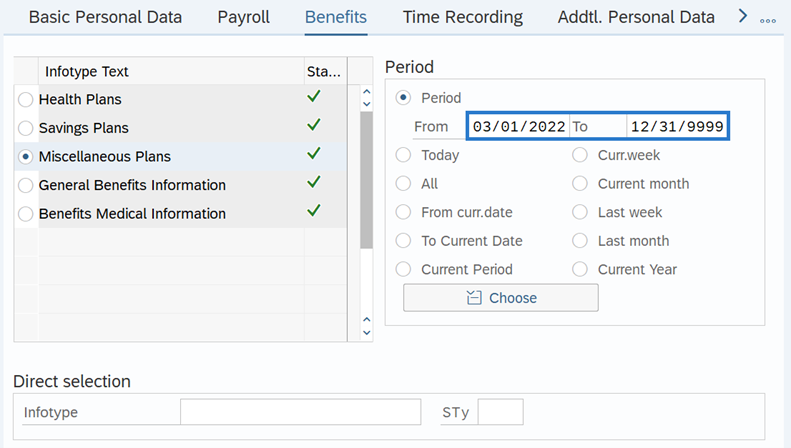

Step 5

In the Time period section, select the Period radio button and enter the effective dates of the Miscellaneous Plans record.

TIPS:

TIPS:The From date should reflect the 1st date of the pay period the employee elects to begin deductions.

If the deduction is ongoing, the To date should reflect the end date of 12/31/9999. If the deduction is to end, use the last day of the pay period in which the deduction is to process.

Creating a retroactive record will cause HRMS to retro within payroll, however it will not retro-collect deductions. It is recommended to enter the first day of the current pay period.

-

Step 6

Click the Create button.

-

Step 7

Double click the 529P DreamAhead Program to select.

-

Step 8

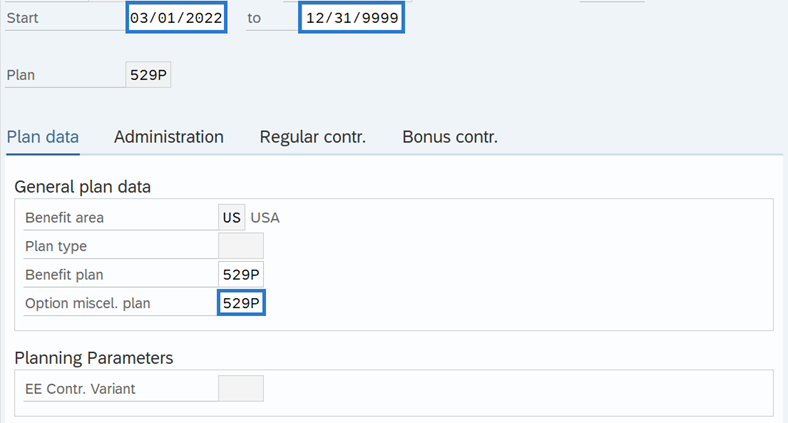

On the Plan Data tab, complete the following fields:

The following fields are mandatory:

- Option miscel. plan

TIPS:

TIPS:Option miscel. plan is 529P for the DreamAhead program.

-

Step 9

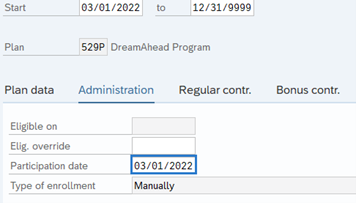

Select the Administration tab.

-

Step 10

Complete the following fields:

The following field is mandatory:

- Participation date

TIPS:

TIPS:The Participation date should match the record start date which is the 1st day of the pay period the employee elects to begin deductions.

-

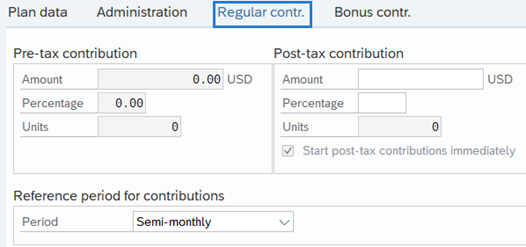

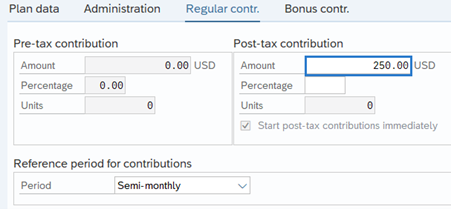

Step 11

Select the Regular contr. tab.

-

Step 12

Complete the following fields:

The following field is mandatory:

- (Post-tax contribution) Amount

TIPS:

TIPS:DreamAhead contributions are post-tax. The minimum contribution for DreamAhead is $5.

-

Step 13

Click the Enter button to validate the information.

-

Step 14

Click the Save button.