Payroll Status - Change Existing Record

Use this procedure to make a correction to an employee’s existing Payroll Status (0003) infotype record.

The most common correction to this infotype record is to the Earl.pers.RA date, which is the date up to which the system carries out retroactive accounting. This is commonly referred to as the retro wall and helps eliminate retro entries made in error. When a processor updates master data which impacts payroll calculations prior to the Earl.pers.RA date, the system will display the following error message:

“Change too far in payroll past XX/XX/XXXX”.

A process runs during payroll processing to automatically update existing Earl.pers.RA date to the first day of the pay period 6 months prior to the current payroll period.

Example: During payroll processing on November 20, 2018, all employees’ existing Earl.pers.RA dates changed to 05/01/2018.

Be aware that processing retroactive transactions in HRMS will cause the payroll accounting to re-post, even if there is no change. You may be contacted by your agency's finance office for assistance with fixing errors in the Agency Financial Reporting System (AFRS). For further assistance with AFRS error correction, you can contact OFM’s Statewide Accounting Division.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

Step 4

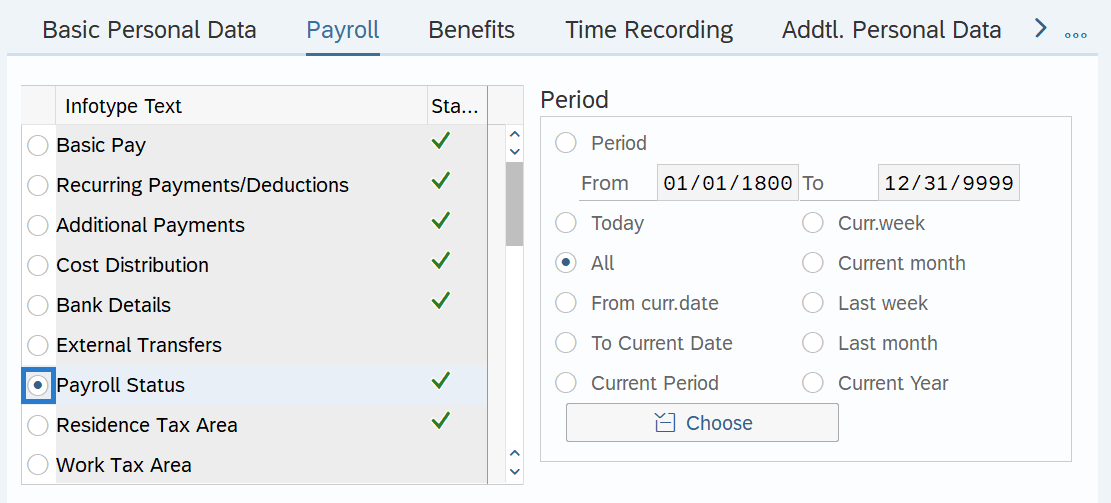

On the Payroll tab, select the Payroll Status radio button.

-

Step 5

Click the Change button.

TIPS:This infotype can only have one record. Using the Change button overwrites the existing record.

-

Step 6

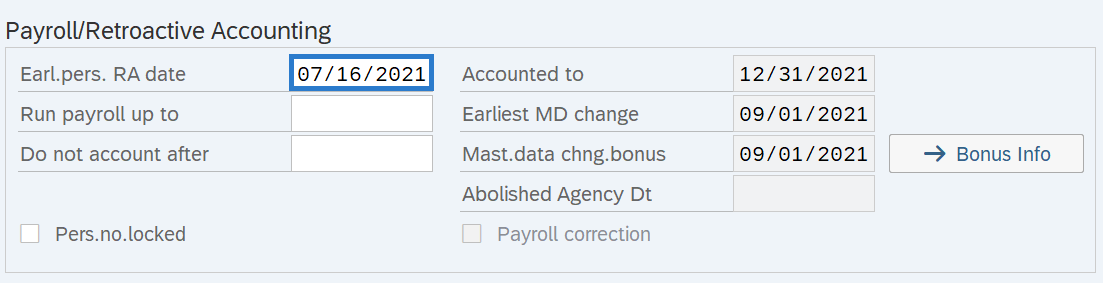

Enter necessary corrections to the record.

TIPS:

TIPS:Earl.pers.RA Date: This date is most commonly known as the retro wall. The Earl.pers.RA date must be the first day of the payroll period to which the records should retroactively account. The only exception would be when it is necessary to retroactively process back to a payroll period during which an employee was newly hired mid-period. In this case, the Earl.pers.RA date should be the mid-period Hire Date. The Earl.pers.RA date for rehired employees must be the first day of the payroll period.

Run payroll up to: This defines the date up to which the payroll is run for the employee, even if they have separated. This is most commonly used when paying a sum of money to an employee who has not been active for a period of time and you do not want the system to retro to past periods.

Do not account after: This is the final date up to which payroll is run for the employee. If there is an entry in this field, the system will not process payroll beyond that date. Agencies should not use this field.

Accounted to: This is the date up to which payroll accounting has been run for the employee. This date is updated as part of payroll processing and cannot be changed by agencies.

Earliest MD change and Mast.data chng.bonus: When an employee’s master data is changed that is relevant to payroll, the system stores the earliest date from which the master data change is valid. These dates are updated as part of payroll processing and cannot be changed by agencies.

Abolished Agency Dt: An Abolished Agency Date specifies a date in which the employee should not retro past because they worked for an agency which has since been abolished. OFM approval is required to remove the date and allow the system to retro beyond an Abolished Agency Date. To request such approval, please send an email to HereToHelp@ofm.wa.gov with an explanation of necessity.

-

Step 7

Click the Enter button to validate the information.

-

Step 8

Click the Save button.