Separation Action (BN) - Create Separation Action

Use this procedure to complete the benefits portion of the Separation Action. The personnel administration and payroll portions of the Separation Action must be completed first.

As a benefits processor, you will not process this action until you have received a separation packet from the payroll processor indicating they have completed their portion of the action. The personnel administration processor should have confirmed with the time and attendance processor that all the items listed below were completed before starting the Separation Action (PA40).

- Deleted any future-dated time, compensation, and leave entries beyond the employee's separation date from CATS, the Employee Remuneration Info (2010) infotype, and the Absences (2001) infotype.

- Manually generated leave accruals if the employee has earned leave but is separating from the agency before the system generates their last accruals. Refer to the Quotas Generate Accruals Manually procedure.

- Executed ZT60 and ZCAT6 to ensure the employee has accurate leave accruals with correct end dates.

This procedure may require hand-offs to the other roles (time & attendance processor) depending on the structure of your agency and your role at your agency.

-

Step 1

Enter transaction code PA40 in the command field and click the Enter button:

-

Step 2

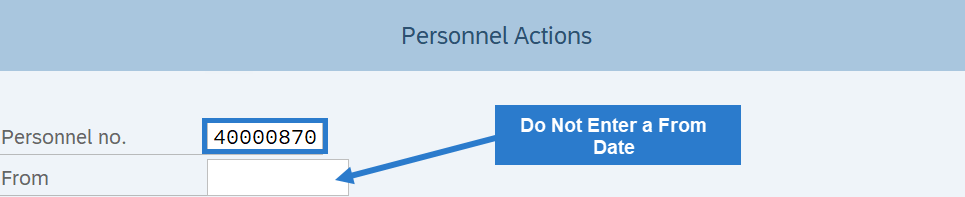

Complete the following field:

- Personnel no.

TIPS:

TIPS:Do not enter a From date on the Personnel Actions screen.

-

Step 3

Click Enter to populate the employee information.

-

Step 4

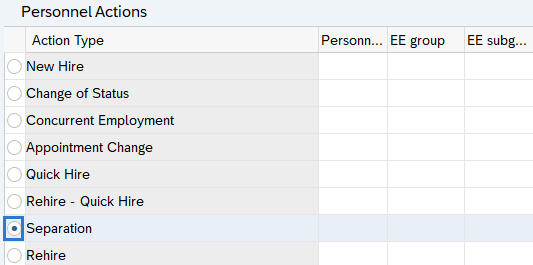

Select the Separation radio button.

-

Step 5

Click the Execute button to begin the transaction.

-

Step 6

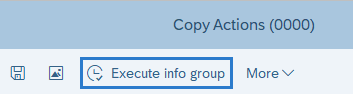

Verify the Copy Actions (0000) infotype contains the correct action you need to execute.

-

Step 7

Click the Execute info group button.

-

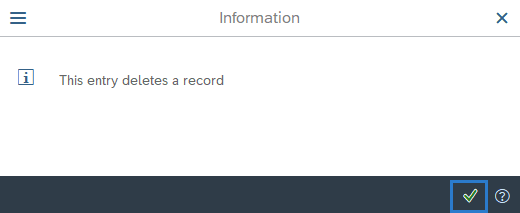

Step 8

Click the Enter button.

-

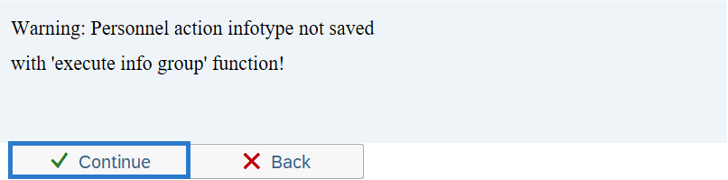

Step 9

Click Continue in the Execute info group dialog box.

-

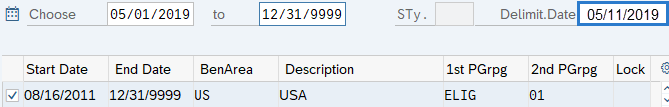

Step 10

Click the Next Record button until you reach the General Benefits Information (0171) infotype.

-

Step 11

Complete the following field:

The following field is mandatory:

- Delimit Date

TIPS:

TIPS:The Delimit Date allows you to set an end date for a record, establishing when it will no longer be valid. Delimited records are retained as a historical record.

Verify the delimit date. The General Benefits Information (0171) infotype record should end on the final check date for the employee. The system will end date the record one day before the delimit date.

Example: if you want the record to end on 5/10/2019, enter a delimit date of 5/11/2019.

-

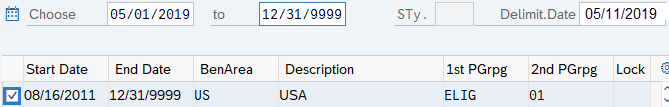

Step 12

Click the box(s) to the left of the records to be delimited.

-

Step 13

Click the Delimit button.

-

Step 14

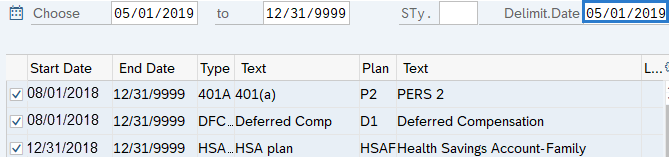

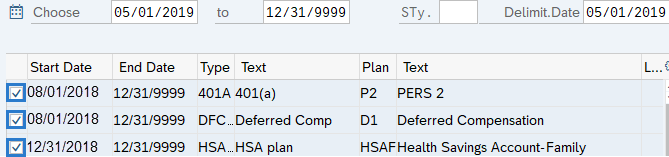

On the Savings Plans (0169) infotype, complete the following field:

The following field is mandatory:

- Delimit Date

TIPS:

TIPS:The Delimit Date allows you to set an end date for a record, establishing when it will no longer be valid. Delimited records are retained as a historical record.

Verify the delimit date. The Savings Plans (0169) infotype record should end on the last day of the pay period. The system will end date the record one day before the delimit date.

Example: if you want the record to end on 4/30/2019, enter a delimit date of 5/1/2019.

-

Step 15

Click the box to the left of the record to delimit.

TIPS:

TIPS:You can select more than one record to delimit.

-

Step 16

Click the Delimit button.

Stop:For the benefits processor, this will mark the end of the Separation Action within PA40. After exiting the separation action, contact the time and attendance processor who may have entries to complete for the employee.

We recommend manually delimiting the Health Plans (0167) infotype record. Delimit the Health Plans (0167) infotype record by following the Health Plans – Change Existing Record user procedure. Health Benefits should always be delimited effective the last day of the employed month.

Visit Health Care Authority (HCA) Personnel and Payroll section for information regarding ending employees in medical coverage within Pay1. Medical benefit elections are entered into Pay1 and subsequent records sent directly to HRMS within a GAP file to process through payroll. For assistance related to Pay1, please contact HCA Help Desk at 360-725-1111 or by emailing ISPEBBSR@HCA.WA.GOV.