Preemptive Compensation Data Check

Use this report to identify employees with missing infotype records or payroll related errors during payroll processing. Run this report during payroll processing Days 2-3. OFM must have stored payroll for the period before you can run this report.

Use this report to help identify compensation-related errors including:

- Missing or incomplete master data

- RPCIPE errors caused by a lack of funding within Cost Distribution (1018) or Employee Cost Distribution (0027) infotypes

- Deductions in arrears (ARRS)

- Deductions not taken (DDNTK)

- Claims in prior periods

- Garnishment errors

Run this report after payroll results are stored and prior to the final Payroll Day 3 payroll run. The HRMS Processor Guide recommends running this report at minimum, on Payroll Day 2, report results are not available until Day 2 of Payroll cutoff.

This report will display missing infotype data for multiple functional areas, such as Payroll and Benefits. Only payroll processors will be able to see report results, so be sure to work with other processors to clean up data or errors as needed.

Enter transaction code ZHR_RPTPYN08 in the command field and click the Enter button.

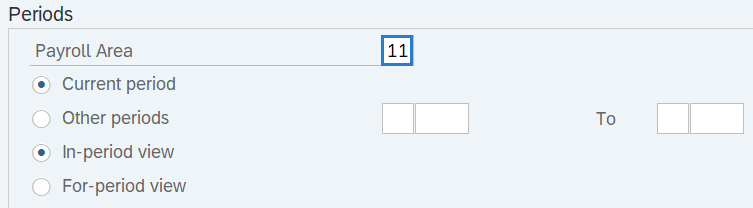

Complete the Period section.

The following field is mandatory:

- Payroll Area

The following radio buttons will default:

- Current period

- In-period view

The following radio buttons are available for selection:

- Other periods

- For-period view

Tips:

Tips:The Periods section will determine the time period of the report results.

The state of Washington only uses Payroll Area 11 – Semi-Monthly.

This section defaults to the Current period but can be changed to a different date.

When selecting the Other period radio button, enter a payroll period.

This section defaults to In-period view but can be changed to a different selection.

The following radio buttons are available for selection:

- In-period view: When checked, this selection will return results for the payroll period in which a payroll result is generated.

- For-period view: When checked, this selection will return results for the payroll period for which a payroll result is generated.

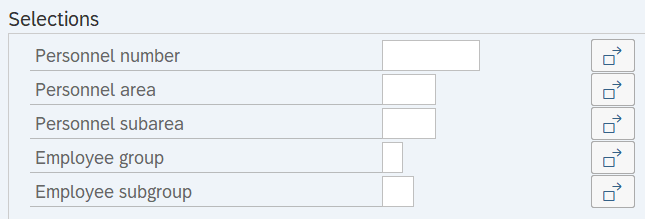

Complete the Selections section.

The following fields are optional:

- Personnel number

- Personnel area

- Personnel subarea

- Employee group

- Employee subgroup

Tips:

Tips:The Selections section will assist in getting only the information needed. A selection is not required for each field.

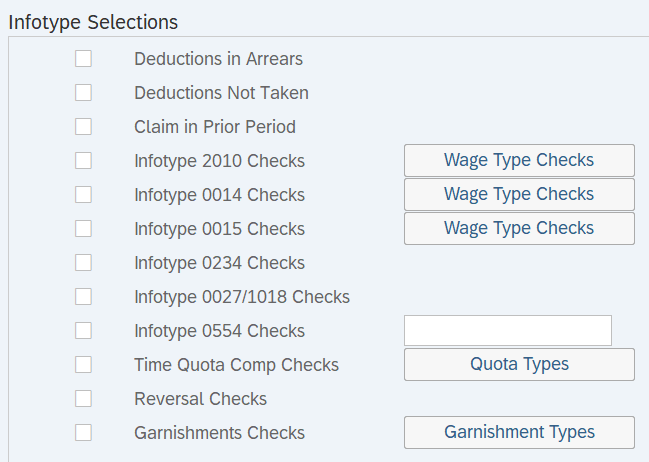

Complete the Infotype Selections section.

The following selections are optional:

- Deductions in Arrears

- Deductions Not Taken

- Claim in Prior Period

- Infotype 2010 Checks

- Infotype 0014 Checks

- Infotype 0015 Checks

- Infotype 0234 Checks

- Infotype 0027/1018 Checks

- Infotype 0554 Checks

- Time Quota Comp Checks

- Reversal Checks

- Garnishment Checks

Tips:

Tips:Selecting (or deselecting) the check boxes in the Infotype Selections section will assist in getting only the information needed.

The following check boxes are available for selection:

- Deductions in Arrears: When checked, this selection will identify employees who do not have enough money for their deduction wage types, which process through arrears, to be taken in full for the current pay period. Examples include health related deductions such as Health Plans or Long Term Disability (LTD), as well as retirement deductions. Items processing in arrears will continue to stay in arrears until the employee has enough money to process them in a period.

- Deductions Not Taken: When checked, this selection will identify employees who do not have enough money for a deduction to be taken. Examples include employees in overpayment recovery status who does not have enough money to process their repayment in the period or an employee processing less funds than usual and their Deferred Compensation Plan (DCP) cannot be collected in full. Uncollected funds will move to the Deductions Not Taken (DDNTK) table as there is not enough money to process them.

- Claim in Prior Period: When checked, this selection will identify employees with a Claim, or who were overpaid in a previous period and there are not enough funds in the period to process items through a Difference. Examples include employees who had a retroactive Leave without Pay (LWOP) entry reducing an employee’s pay for the retroactive period. Though the master data was corrected by entering LWOP, the overpayment has not been offset. The overpayment must be offset to correct the Claim in the Prior Period.

- Infotype 0027/1018 Checks (Employee Cost Distribution or Cost Distribution): When checked, this selection will identify missing costing records causing a RPCIPE error for the payroll period. This check includes retroactive periods processing within the current period. Example of missing data: An employee has separated and has retroactivity over a period they were not Active. Note: If an Employee Cost Distribution (0027) infotype record is created and deleted in the period, this selection will not report the missing data.

- Reversal Checks: When checked, this selection will identify employees who have had reversals in the pay period, pay periods running within the current period (retroactive processing), or a reversal in their employment history which never processed. A reversal that never processed means the retroacticity at that time had to be killed as HRMS was unable to process it. The reversal was most likely caused from crossing business areas and would have been corrected through manual entries in PU19.

- Garnishment Checks: When checked, this selection will verify that vendor information for writs or standard garnishments have been entered correctly.

- Click the Garnishment Types button to add additional garnishment vendors and types. This button is available for Garnishment Checks.

OFM does not recommend checking the following selections since they do not always include customized items:

- Infotype 0234 Checks (Add. Withh. Info US): When checked, this selection will verify that the employees have valid Additional Withholding Info US (0234) entries for the pay period.

- Infotype 2010 Checks (Employee Remuneration Info): When checked, this selection will verify that the employee's compensation related to hours worked are not causing a conflict for the period.

- Infotype 0014 Checks (Recurring Payments/Deductions): When checked, this selection will verify that employees have a valid Recurring Payments/Deductions (0014) for the pay period.

- Infotype 0015 Checks (Additional Payments): When checked, this selection will verify that the employees have valid Additional Payments (0015) entries for the pay period.

- Infotype 0234 Checks (Add. Withh. Info US): When checked, this selection will verify that the employees have valid Additional Withholding Info US (0234) entries for the pay period.

- Infotype 0554 Checks (Hourly Rate Per Assignment): When checked, this selection will verify that employees have a valid Hourly Rate per Assignment (0554) for the pay period.

- Time Quota Comp Checks: When checked, this selection will identify employees whose time entered does not match their employee status.

- Tips:

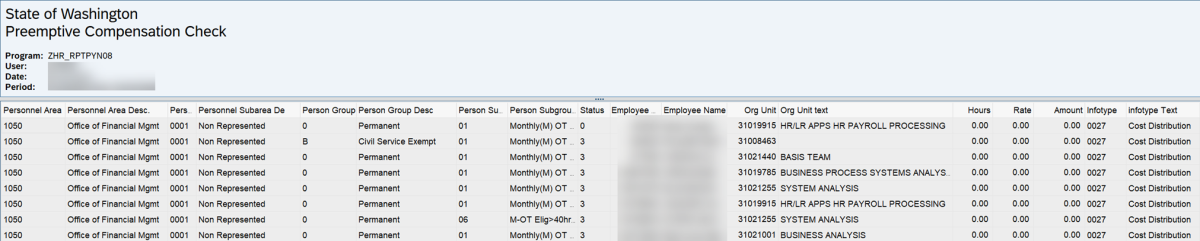

Columns included in the report results depend on your default layout for this report. The report layout can be changed, saved or a previously saved layout can be selected.

The full column names will display when hovering the cursor over the column headings.

The following table maps each field to the infotype:

Person Group (EE Group)

Person Group Desc (EE Group)

Person Subgroup (EE Subgroup)

Person Subgroup Desc (EE Subgroup)

Status (Employment Status)

Scenarios

Below are examples of running the Preemptive Compensation Data Check report. It is not a comprehensive list of every scenario.

Example 1 - View employees who are missing costing to avoid RPCIPE errors.

In this scenario, it is the afternoon of Payroll Day 3 (3/19/2025). The organizational management processor has notified me that they have completed a Position Cost Distribution audit and made many updates to position records. As a payroll processor, I am going to run the Preemptive Compensation Data Check report to ensure that I do not have employees missing costing to avoid lockouts due to a RPCIPE error.

Example 2 - View employees whose deductions are not processing.

In this scenario, it is the afternoon of Payroll Day 2 (6/4/2025). As a payroll processor, I am going to run the Preemptive Compensation Data Check report to find which employee deductions were not processed due to a change in pay.