IRS Limits USA - Create New Record

Use this procedure to create an override to an employee’s exemptions using the IRS Limits USA (0161) infotype. An override is necessary when you have received an IRS mandate ordering a specific withholding status and exemption for an employee.

When an IRS Limits USA (0161) record exists, HRMS will use either the IRS Limits USA (0161) infotype or the employee’s Withholding Info W4/W5 (0210) infotype exemptions, whichever is more favorable to the IRS.

Please note per the Education Jobs and Medicare Assistance Act the W5 is no longer used.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

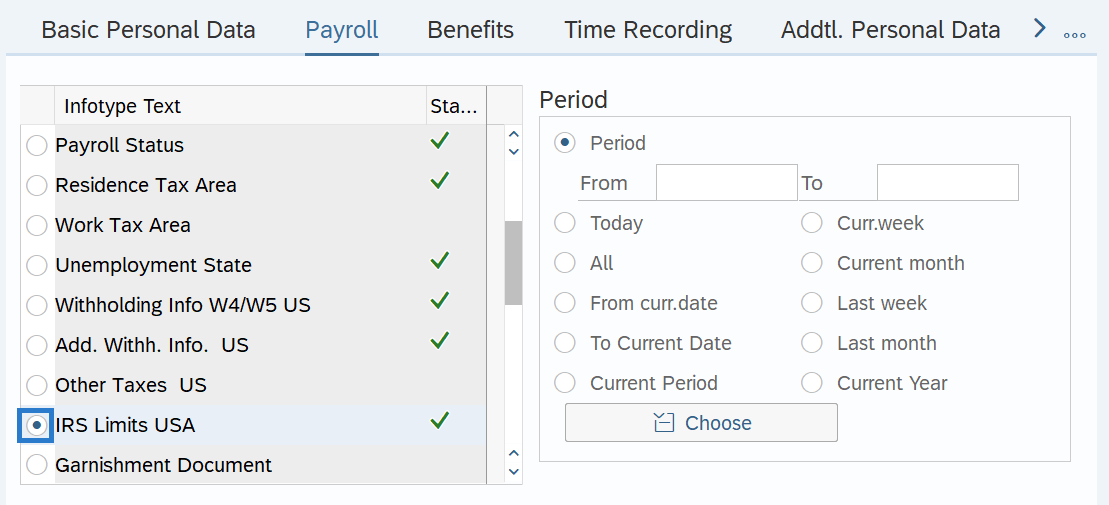

Step 4

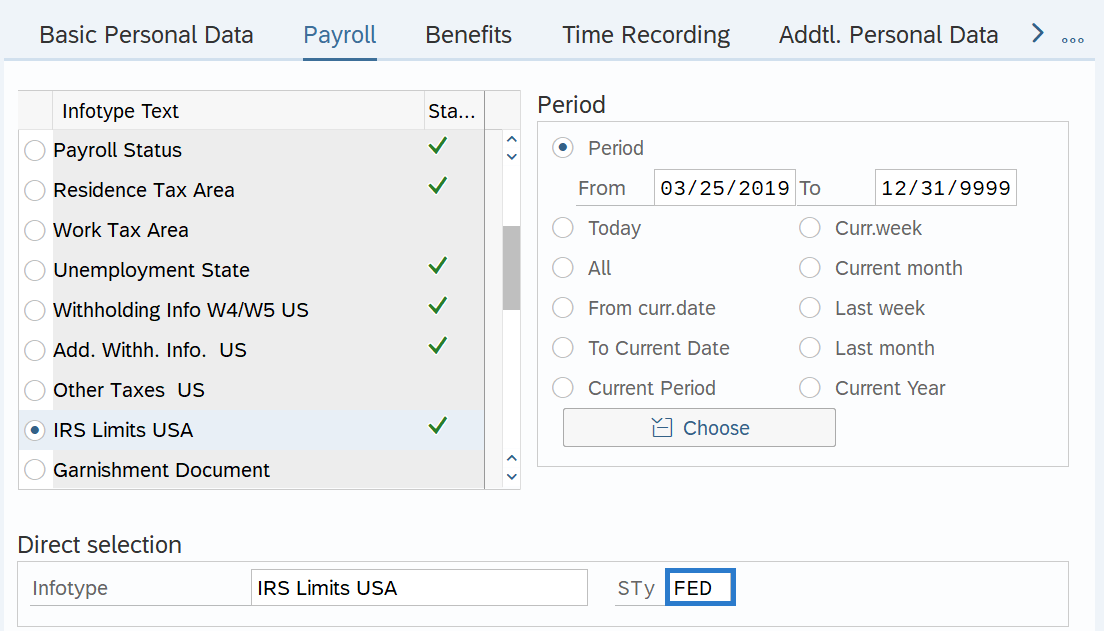

On the Payroll tab, select the IRS Limits USA radio button.

-

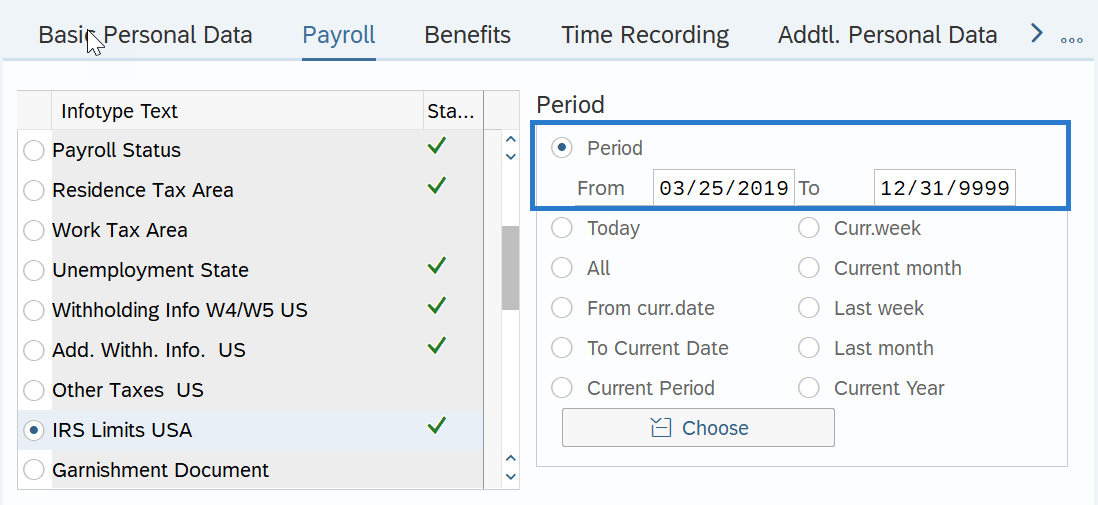

Step 5

In the Time period section, select the Period radio button and enter the effective dates of the new record.

TIPS:

TIPS:The From date should reflect the actual check date the elections are to begin or the New Hire start date for a new employee. If you are uncertain of the check date, refer to the Payroll Calendar.

The To date should reflect the end date of the elections. For example:

- If you are creating an exemption and the exemption is ongoing, use 12/31/9999 as the end date.

- If the exemption is to end, use the day before the check date in which the exemption ends.

When making a retroactive change in accordance with a specific check date, use the day after the last check date. For example, if the change you are making affects the July 10th check date, enter a start date of June 26th.

HRMS will not retroactively collect taxes from an employee, but will refund an employee and correctly adjust the employer amounts (both collect or refund). Do not make retroactive changes across business areas or calendar years.

-

Step 6

In the Direct Selection Infotype STy, enter FED.

TIPS:

TIPS:FED (Federal) is the only Tax authority used by the State of Washington.

-

Step 7

Click the Create button.

-

Step 8

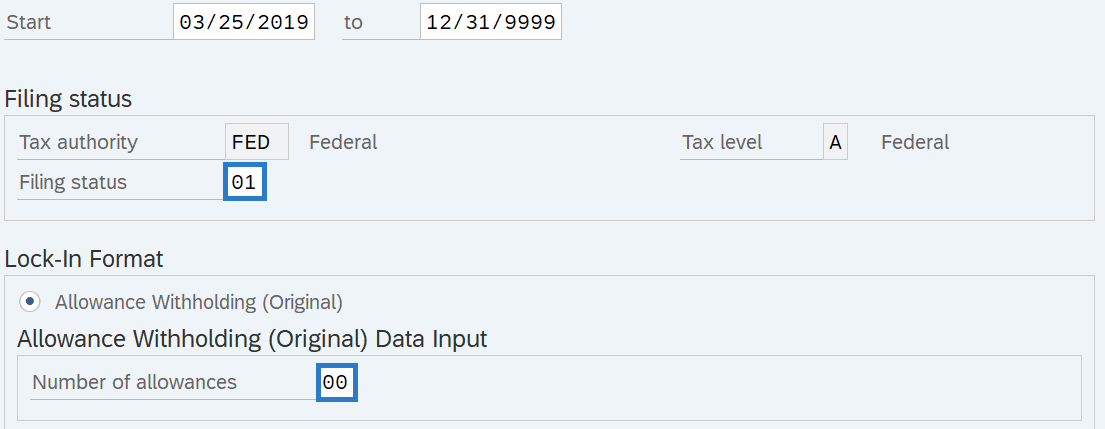

Complete the following fields:

The following fields are mandatory:

- Start

- Filing Status

- Allowances

-

Step 9

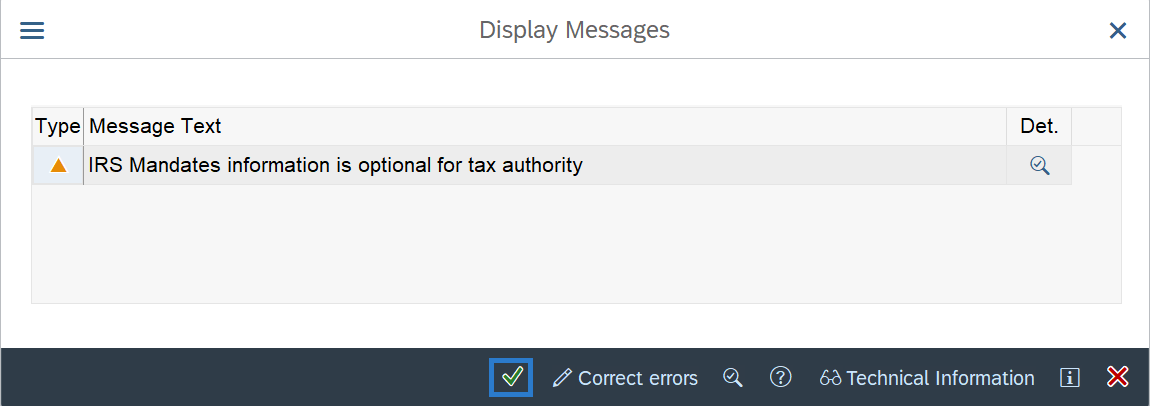

Click the Enter button to validate the information.

TIPS:If you receive a warning message, click enter to continue.

-

Step 10

Click the Save button.

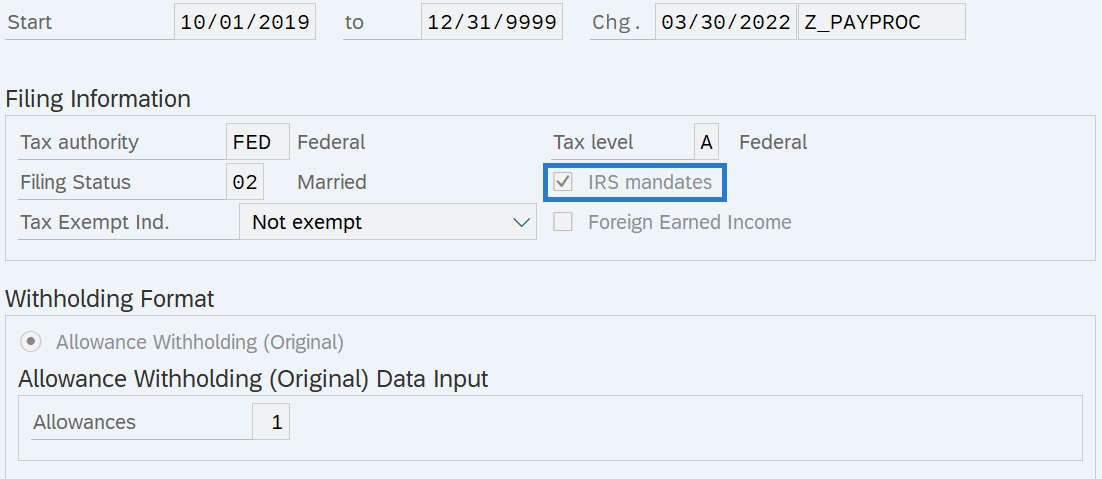

TIPS:Creating the IRS Limits USA (0161) infotype record will not create a new Withholding Info W4/W5 US (0210) record, it will only turn on the indicator in the IRS mandates box on existing records.

To verify the entry was processed correctly, view the employee's Withholding Info W4/W5 US (0210) record to ensure the IRS mandates box is now checked.

The system defaults to collect the most amount of funds from the employee depending on what is keyed on the IRS Limits USA (0161) or Withholding Info W4/W5 US (0210) infotype records.

The Exemptions # field on the employee's Earnings and Deductions Statement will continue to reflect the number of exemptions entered on the Withholding Info W4/W5 US (0210) infotype.