Retirement Overpayment - Offset an Overpayment

Use this procedure to offset a retirement overpayment within Additional Payments (0015) infotype.

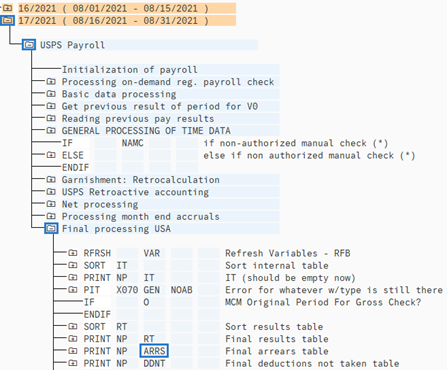

A retirement overpayment occurs when the employee’s retirement contributions were not deducted or not enough was deducted and the employee erroneously received the amounts as net pay instead. The employee’s master data must be corrected prior to offsetting an overpayment. Refer to Payroll Simulation – Find an Overpayment to determine overpayment amounts. Retirement overpayment amounts can be located in the Arrears (ARRS) table within the paysim located in the period prior to current period.

Additionally, it is important to work with your payroll office to identify and remedy any over/underpayment situations as necessary.

An offset is required for a retirement overpayment if you have not received an authorization for payroll deduction from the employee with the repayment agreement.

Refer to Payroll Simulation – Find an Overpayment to determine an overpayment amount. The retirement overpayment amount is located in the Arrears (ARRS) table by running a paysim in the current period after master data corrections have been completed. The overpayment total will be equal to the retirement in the period prior to current period.

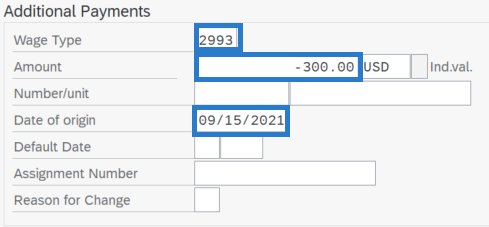

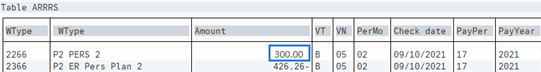

The following scenario you have corrected master data in payroll period 18/2021 (Sep. 1 – 15, 2021) and have executed your paysim to determine the overpayment amount. The overpayment amount is determined by viewing the ARRS table in period 17/2021:

Your total overpayment amount is $300.00:

Retirement contributions are tax deferred, therefore must be offset and collected with a tax deferred wage type. Crossing a calendar year does not change the requirement to use tax deferred wage types.

-

Step 1

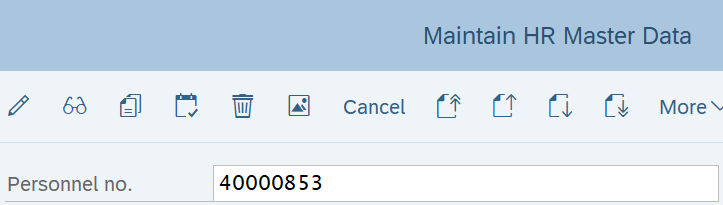

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

Complete the following fields:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

Step 4

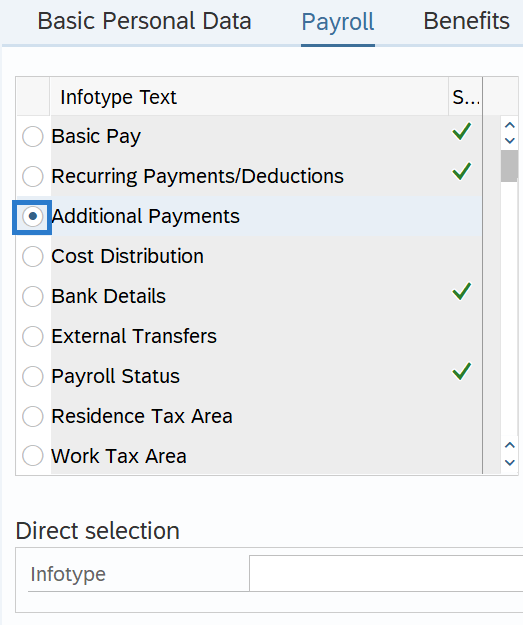

On the Payroll tab, select the Additional Payments radio button.

-

Step 5

Click the Create Button.

-

Step 6TIPS:

Retirement contributions are tax deferred, therefore must be offset and collected with a tax deferred wage type. Crossing a calendar year does not change the requirement to use tax deferred wage types.

Offset a retirement overpayment by entering the total overpayment in current period using wage type 2993 as a negative amount. This will set up the receivable in the agency’s General Ledger 1324.

-

Step 7

Click the Enter button to validate the information.

-

Step 8

Click the Save button.

TIPS:Run the Payroll Simulation to verify desired results.