Retirement Overpayment - Recover an Overpayment

Use this procedure to create a retirement overpayment recovery on the Recurring Payments/Deductions (0014) infotype. A retirement overpayment occurs when the employee’s retirement contributions were not deducted or not enough was deducted and the employee erroneously received the amounts as net pay instead.

Before you begin the collection of a retirement overpayment, the following steps must be completed:

- The employee’s master data is corrected,

- The overpayment amount has been determined using Payroll Simulation – Find an Overpayment; and

- Retirement Overpayment – Offset an Overpayment has been processed.

Additionally, it is important to work with your payroll office to identify and remedy any over/underpayment situations as necessary.

Prior to collecting an overpayment, you should have identified the correct overpayment amounts using Payroll Simulation – Find an Overpayment.

Retirement contributions are tax deferred, therefore must be offset and collected with a tax deferred wage type. Crossing a calendar year does not change the requirement to use tax deferred wage types.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

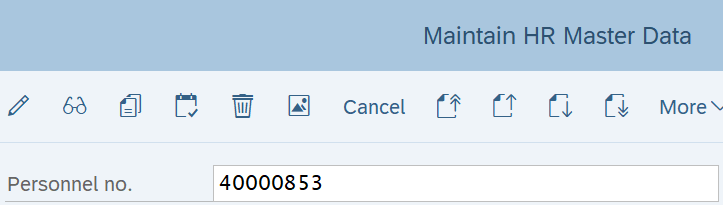

Complete the following fields:

- Personnel no.

-

Step 3

Click the Enter button to populate the employee information.

-

Step 4

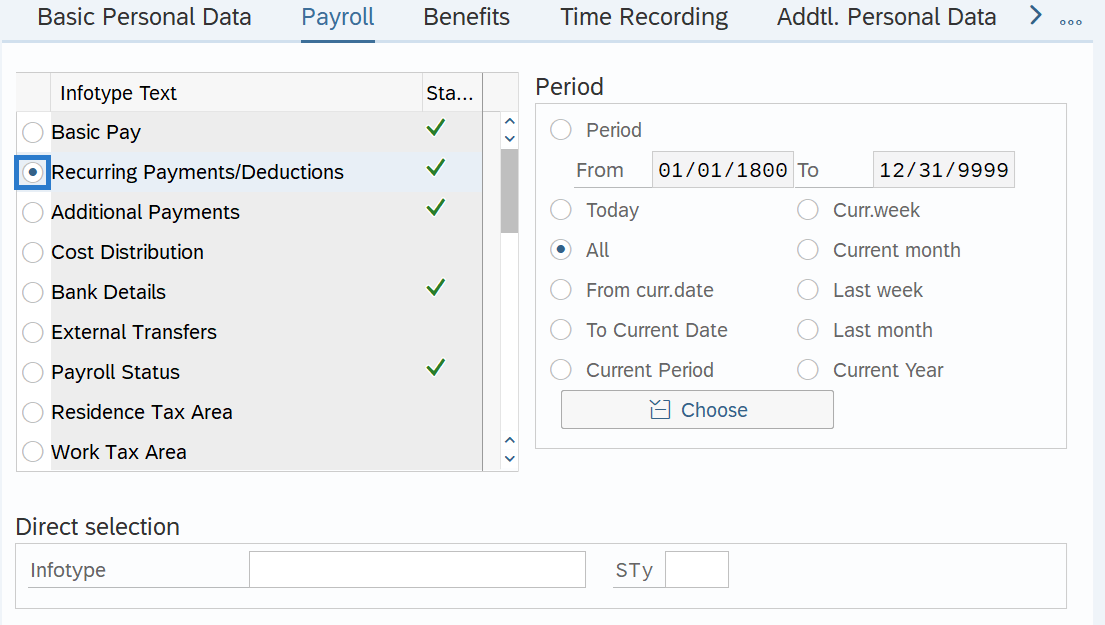

On the Payroll tab, select the Recurring Payments/Deductions radio button.

-

Step 5

Click the Create Button.

-

Step 6

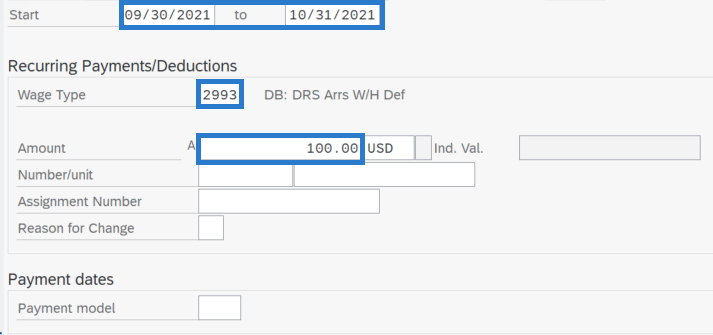

Complete the following fields:

The following fields are mandatory:

- Start

- To

- Wage Type

- Amount

The following fields are optional:

- Payment Model

TIPS:

TIPS:Retirement contributions are tax deferred, therefore must be offset and collected with a tax deferred wage type. Crossing a calendar year does not change the requirement to use tax deferred wage types.

Collect a retirement overpayment using wage type 2993 as a positive amount. This repayment will post to GL 1324.

If the Payment Model is left blank, the system will default to WA04 – Every Pay Period – Full Amount.

Choose from one of the following Payment Model codes based on the agreement with the employee:

- WA01: Every Pay Period- Half Amount

- WA02: 25th Pay Period – Full Amount

- WA03: 10th Pay Period – Full Amount

- WA04: Every Pay Period – Full Amount

Do not use Payment Model codes other than those listed above.

-

Step 7

Click the Enter button to validate the information.

-

Step 8

Click the Save button.

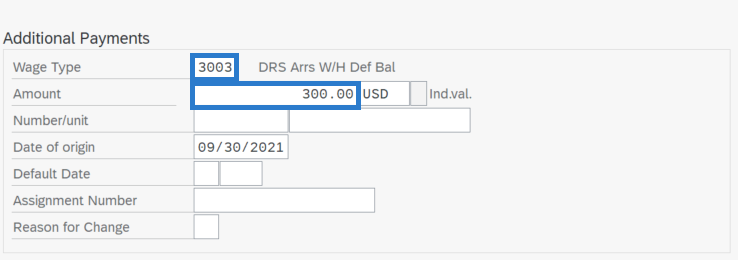

TIPS:Wage type 2993 created in Recurring Payments/Deductions (0014) will result in a dynamic action to create an Additional Payments (0015) infotype record for the balance of the overpayment using wage type 3003. If the collection is an odd amount, this will require two Recurring Payments/Deductions entries using wage type 3003 to collect the correct amount.

-

Step 9

Complete the following fields:

- Wage Type

- Amount

TIPS:

TIPS:During the dynamic action, the Date of Origin will default to the Start Date used on the Recurring Payments/Deductions (0015) infotype.

The Amount should reflect the balance of the overpayment collection, as a positive amount.

-

Step 10

Click the Enter button to validate the information.

-

Step 11

Click the Save button.