Add. Withh. Info. US - Change Existing Record

Use this procedure to make a correction to an employee's Add. Withh. Info. US (0234) infotype record.

If the employee is covered by Washington’s workers compensation program, they must have an active Federal (FED) Add. Withh. Info. US (0234) record containing a valid Washington risk classification in the Employee Override Group field.

Employees covered under Oregon’s or Idaho’s workers compensation program do not require an active Additional Withholding Info US record unless they require a federal, Oregon, or Idaho withholding override.

An Add. Withh. Info US record cannot be changed to a different Subtype (STy: Fed, ID, OR). If there is no existing record with the same Subtype, use the Add. Withh. Info US – Create New Record user procedure to create a record with the correct Subtype.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

Step 4

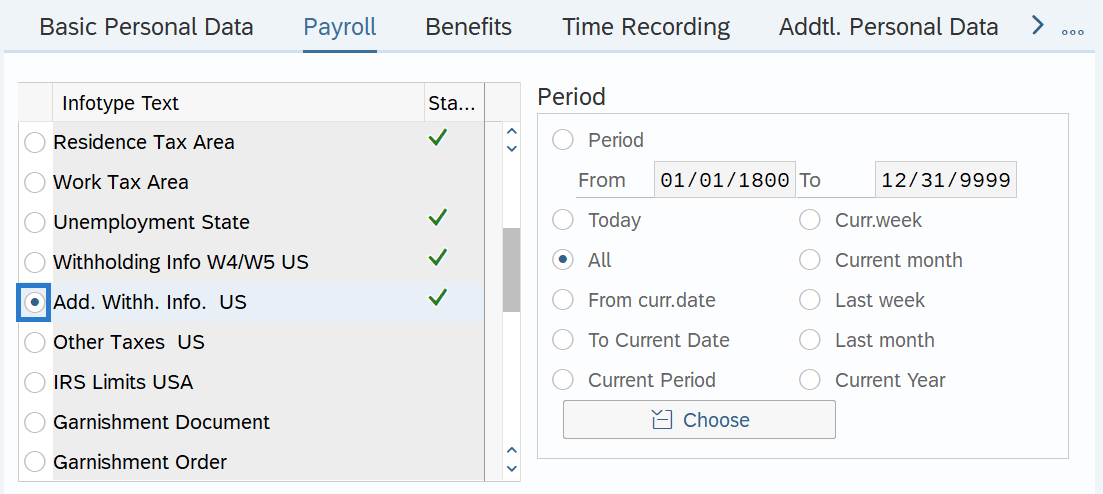

On the Payroll tab, select the Add. Withh. Info. US radio button.

-

Step 5

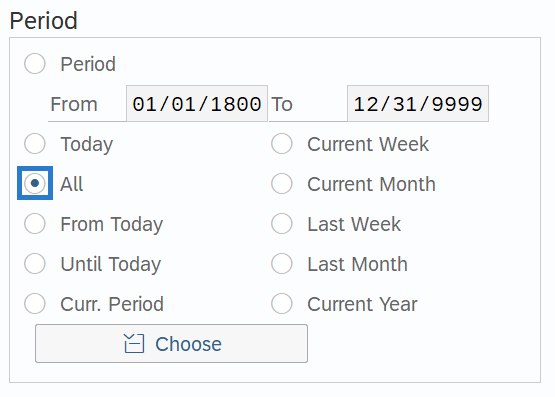

In the Time period section, select All.

-

Step 6

Click the Overview button.

-

Step 7

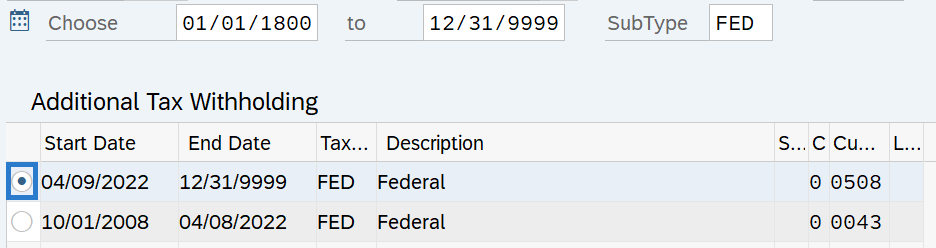

Select the record you wish to correct.

-

Step 8

Click the Change button.

TIPS:Using the Change button overwrites the existing record and should only be used when making corrections.

-

Step 9

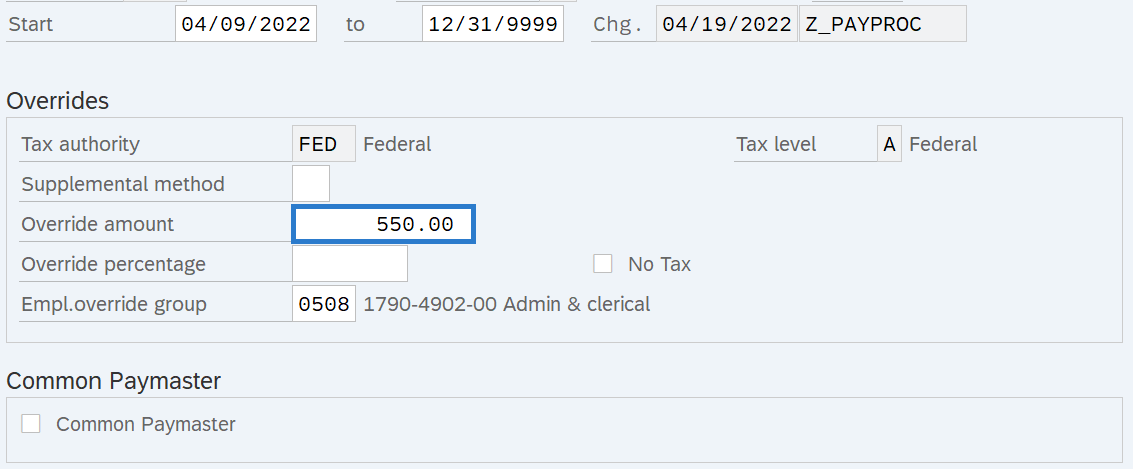

Enter the necessary changes to the record.

TIPS:

TIPS:In most cases, the Start and To dates should remain the same. Changing the Start or To dates will delete the record being updated.

If updates are made to the Start and To dates outside of delimiting a record in the current or future periods, HRMS will not retroactively collect taxes from an employee but will refund an employee and correctly adjust the employer amounts (both collect or refund). Do not make retroactive change across business areas or calendar years.

The Supplemental Method field should be left blank. Do not enter a selection.

Empl.override group (Employee Override Group) is the Washington Workers' Compensation risk classification that an employee holds for a particular job.

The Employee Override Group must match your agency Business Area. For this example, the employee works in Business Area 1790 - Department of Enterprise Services. If the numbers do not match, it will cause incorrect Medical Aid amounts to be withheld from the employee. Additionally, employer costs will be incorrect.

An Employee Override Group is needed for employees covered by Washington’s workers’ compensation program. Workers’ compensation coverage is set on the Unemployment State (0209) infotype record.

Employees covered under Oregon's or Idaho’s workers’ compensation programs do not need an active Add. Withh. Info US (0234) record unless they require a withholding override.

If an employee was covered in Idaho or Oregon, and returns to workers’ compensation coverage in the state of Washington, then an active and valid Employee Override Group is required. Failing to update the Employee Override Group will result in a payroll redline.

The Common Paymaster field should be left blank. Do not use this checkbox.

The No Tax field should be left blank. Do not use this checkbox.

-

Step 10

Click the Enter button to validate the information.

-

Step 11

Click the Save button