Overpayment - Offset an Overpayment

Use this procedure to offset an overpayment on the Additional Payments (0015) infotype.

The employee’s master data must be corrected prior to offsetting an overpayment. Refer to Payroll Simulation – Identify an Overpayment or ALAS Error to determine overpayment amounts.

An offset is required for an overpayment even if you have not received an authorization for payroll deduction from the employee with the repayment agreement.

Prior to offsetting an overpayment, you must identify the overpayment amounts using Payroll Simulation – Identify an Overpayment or ALAS Error.

If you need assistance with a cross-calendar year overpayment, please refer to the Collecting Prior Year Overpayments resource document.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

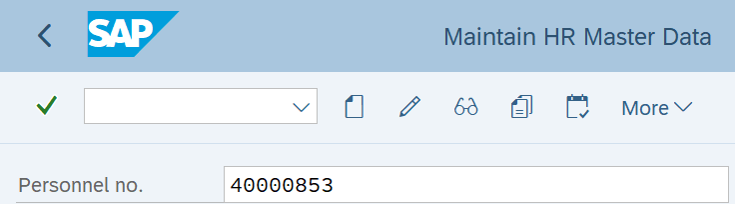

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

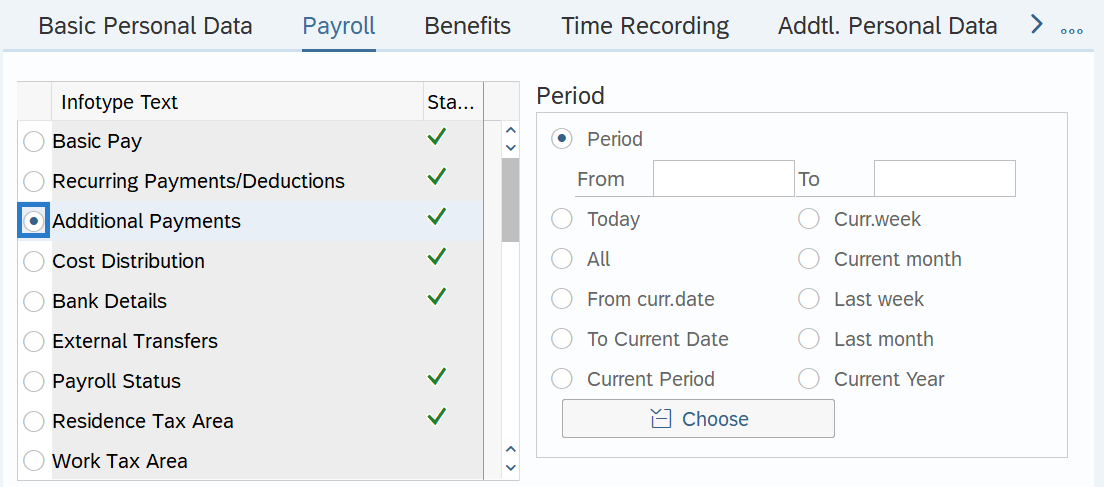

Step 4

On the Payroll tab, select the Additional Payments radio button.

-

Step 5

Click the Create button.

-

Step 6

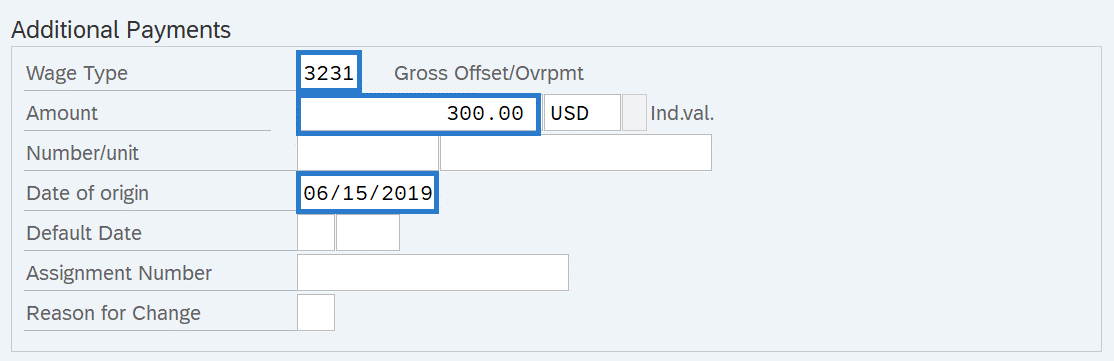

Complete the following fields:

The following fields are mandatory:

- Wage Type

- Amount

- Date of origin

TIPS:

TIPS:Overpayments are most commonly offset using wage type 3231. This will set up the receivable in the agency's General Ledger 1324.

If the amount is not subject to retirement, there may be different wage types used to offset and collect the amount. For assistance, contact HereToHelp@ofm.wa.gov.

Date of origin should be a date within the pay period the overpayment occurred. If the overpayment occurred over multiple pay periods, an offset must be created in each of the pay periods the overpayment occurred.

In the screen shot above, the offset is for a $300 overpayment that occurred in pay period 12. However, if periods 10, 11, and 12 each have an overpayment of $100 (for a total overpayment of $300), then you would create the following offsets:

- 5/15 - $100

- 5/31 - $100

- 6/15 - $100

-

Step 7

Click the Enter button to validate the information.

-

Step 8

Click the Save button.

TIPS:Run the Payroll Simulation to verify that no money will be withheld from the employee and no Difference or Claim remains.