Overpayment - Recover an Overpayment

Use this procedure to create an overpayment recovery on the Recurring Payments/Deductions (0014) infotype.

The employee’s master data must be corrected prior to offsetting or recovering an overpayment. Refer to the Payroll Simulation - Find an Overpayment report to determine overpayment amounts.

RPCIPE errors are often caused from improper collection of overpayments. To avoid this, refer to the Common RPCIPE Errors resource.

If an employee is withdrawn and you are collecting a repayment in the same year the overpayment occurred, additional steps are necessary after the master data has been corrected and a Payroll Simulation has been run to determine the gross overpayment.

- Refer to the Overpayment - Offset an Overpayment procedure to create an offset in the last active period for the gross overpayment.

- Refer to Additional Payments - Create One-Time Payment or Deduction procedure to create a record with wage type 1120 Red Tax/Ret Post Sep Rec dated in the last active period for the gross overpayment; this amount should be negative.

- Run a Payroll Simulation in the current period to determine the /559 Payment amount, which is the amount of adjusted taxes and retirement. The difference between the gross overpayment and this adjustment is the net overpayment (the amount the employee owes). However, processing other retroactive payments at the same time may alter this calculation.

- On the Additional Payments (0015) infotype, lock or delete the negative record you created with wage type 1120 Red Tax/Ret Post Sep Rec.

- Notify the employee of the overpayment and stop processing until the funds are received.

Once funds are received from the employee, follow the Terminated Employee Pays via Personal Check (Current Year Only) instructions on page 9 of the Overpayment Identification and Recovery resource document.

For detailed assistance in recovering an overpayment within the same payroll year, please email HereToHelp@ofm.wa.gov and include the Personnel Number and a detailed explanation of the steps you have taken.

If you need assistance with a cross-calendar year overpayment, please refer to the Collecting Prior Year Overpayments resource document.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

Step 4

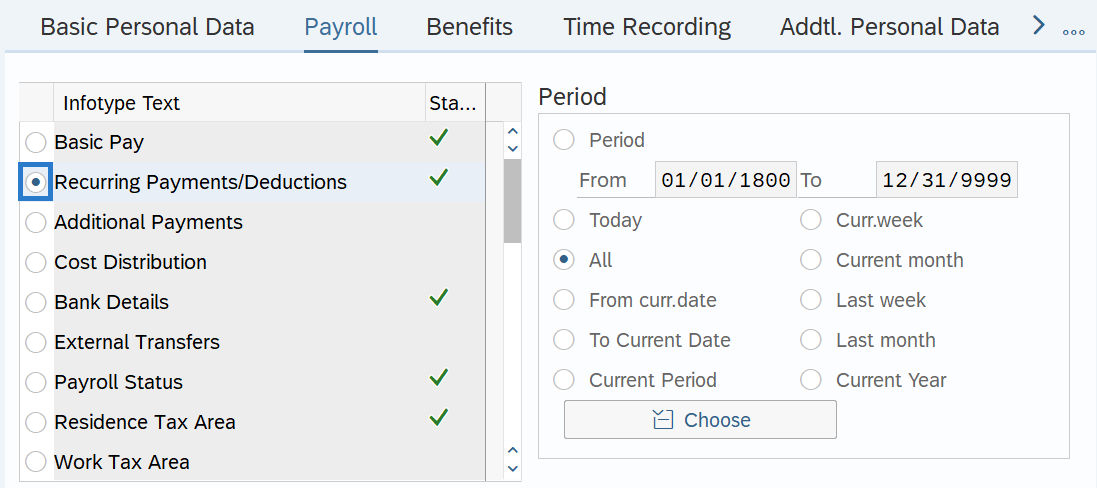

On the Payroll tab, select the Recurring Payments/Deductions radio button.

-

Step 5

Click the Create button.

-

Step 6

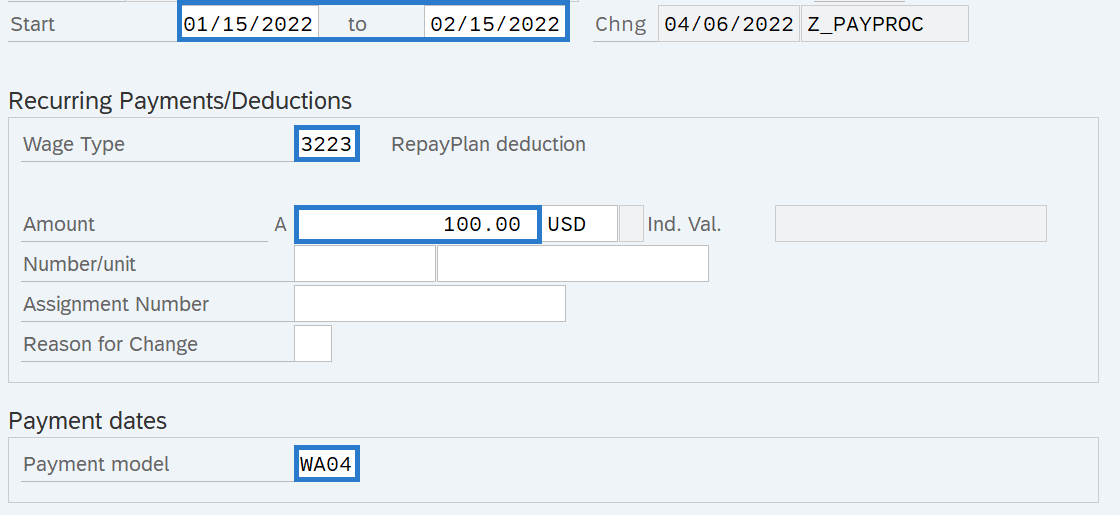

Complete the following fields:

The following fields are mandatory:

- Start

- To

- Wage Type

- Amount

- Payment Model

TIPS:

TIPS:The Start Date must be for current or future periods only.

If the Payment Model is left blank, the system will default to WA04 - Every Pay Period - Full Amount.

Choose from one of the following Payment Model codes based on the agreement with the employee:

- WA01: Every Pay Period - Half Amount

- WA02: 25th Pay Period - Full Amount

- WA03: 10th Pay Period – Full Amount

- WA04: Every Pay Period – Full Amount

Do not use Payment Model codes other than those listed above.

In the screen shot above, the recovery will collect $100 per period for three periods; totaling $300.

-

Step 7

Click the Enter button to validate the information.

-

Step 8

Click the Save button.

TIPS:Most recovery wage types found in Recurring Payments/Deductions (0014) will result in a dynamic action to create an Additional Payments (0015) infotype record for the balance of the overpayment.

If the collection is an odd amount, you will need to create two Recurring Payments/Deduction records to collect the full amount.

For example, if the overpayment was $298 split over three periods, you could enter $100 for two periods in Step 6. Then after you create the balance of the overpayment on the Additional Payments (0015) infotype (Steps 9-11), you could create one more Recurring Payments/Deduction record for the remaining $98 for one period.

-

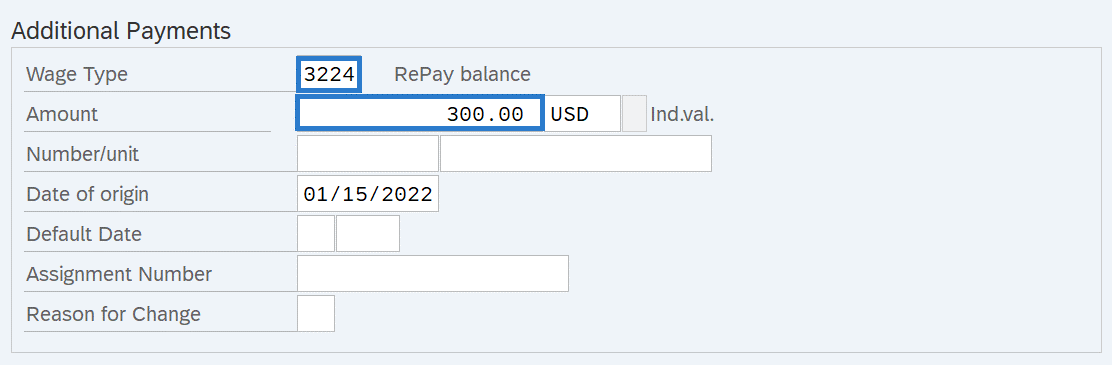

Step 9

Complete the Additional Payments (0015) infotype.

The following fields are mandatory:

- Wage Type

- Amount

TIPS:

TIPS:During the dynamic action, the Date of Origin will default to the Start Date used on the Recurring Payment/Deduction (0015) infotype.

The Amount should reflect the full balance of the overpayment collection.

-

Step 10

Click the Enter button to validate the information.

-

Step 11

Click the Save button.