Recurring Payments/Deductions - Change Existing Record

Use this procedure to make a correction to or end an employee’s existing Recurring Payments/Deductions (0014) infotype record.

The Wage Type Report (ZHR_RPTPY004) provides information about wage types, such as short text, permissibility and amount and may be useful in identifying the correct wage type.

-

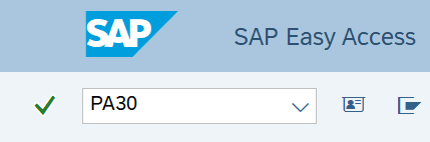

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

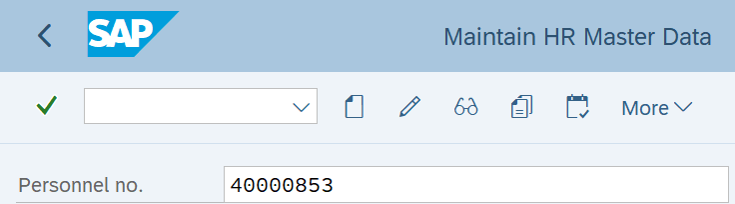

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

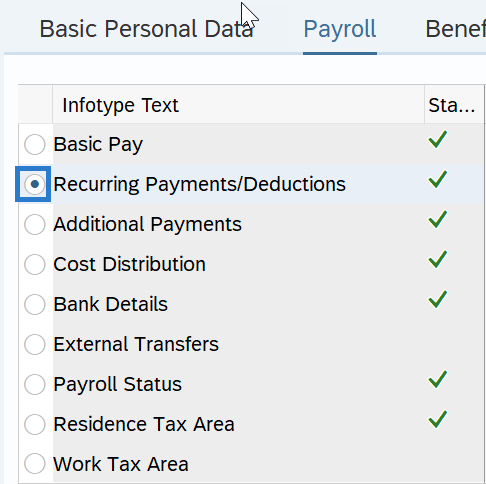

Step 4

On the Payroll tab, select the Recurring Payments/Deductions radio button.

-

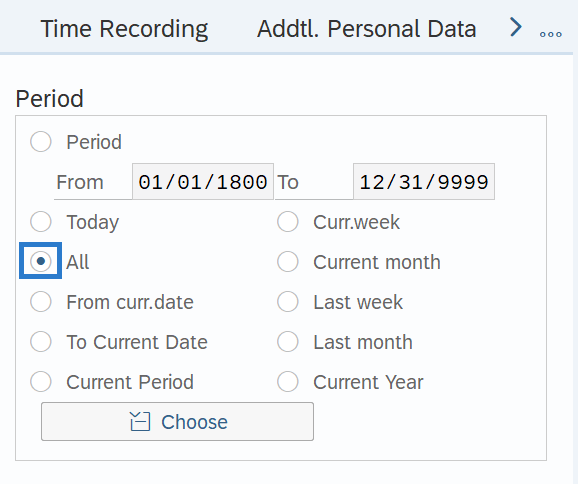

Step 5

Select the All radio button in the Period Selection box.

-

Step 6

Click the Overview button.

-

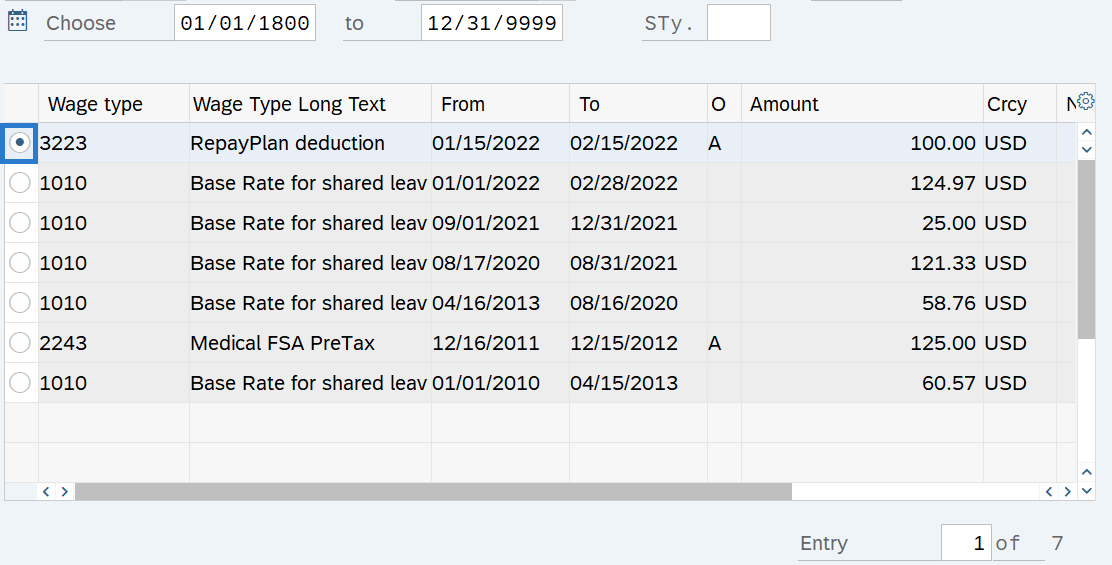

Step 7

Select the record you wish to correct or end.

-

Step 8

Click the Change button.

TIPS:Using the Change button overwrites the existing record and should only be used when making corrections or ending the record.

-

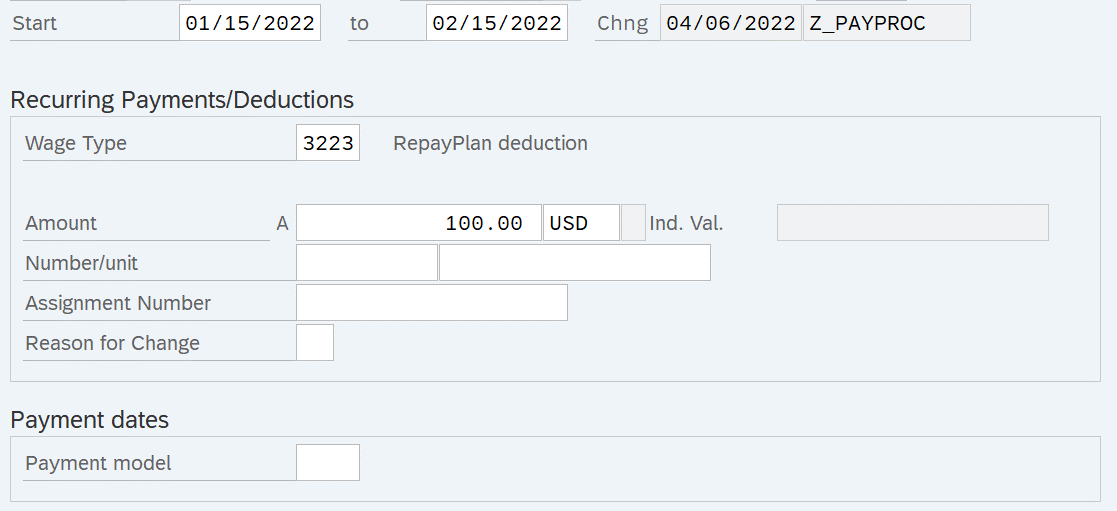

Step 9

Complete the necessary changes to the infotype record.

TIPS:

TIPS:If the Payment Model is left blank, the system will default to WA04 – Every Pay Period – Full Amount.

Choose from one of the following Payment Model codes:

- WA01: Every Pay Period - Half Amount

- WA02: 25th Pay Period - Full Amount

- WA03: 10th Pay Period - Full Amount

- WA04: Every Pay Period - Full Amount

- 1162: April 10 and October 10

- 1163: Jan 25 - Annually

Do not use Payment Model codes other than those listed above.

If the Wage Type selected requires an amount and you have not entered an amount in the Amount field, you will receive the following error:

Enter the Amount and click Enter to correct.

If the Wage Type selected has a standard Amount/Rate/Max and cannot be changed, do not enter an amount in the Amount field; otherwise, you will receive the following error:

Remove the Amount and click Enter to correct.

If this recurring payments/deductions record is no longer needed, end the record by changing the To date to the last day of the pay period in which the payment/deduction is active.

-

Step 10

Click the Enter button to validate the information.

-

Step 11

Click the Save button.