Recurring Payments/Deductions - Create New Record

Use this procedure to create a new recurring payment or deduction for an employee on the Recurring Payments/Deductions (0014) infotype.

The Wage Type Report (ZHR_RPTPY004) provides information about wage types, such as short text, permissibility, and amount. This report may be useful in identifying the correct wage type.

-

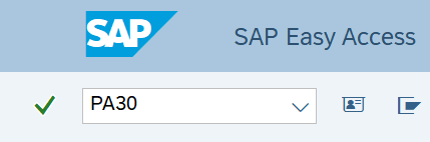

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

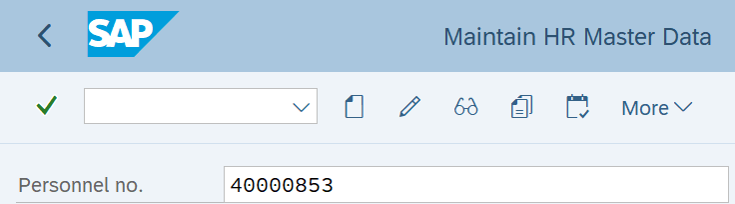

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

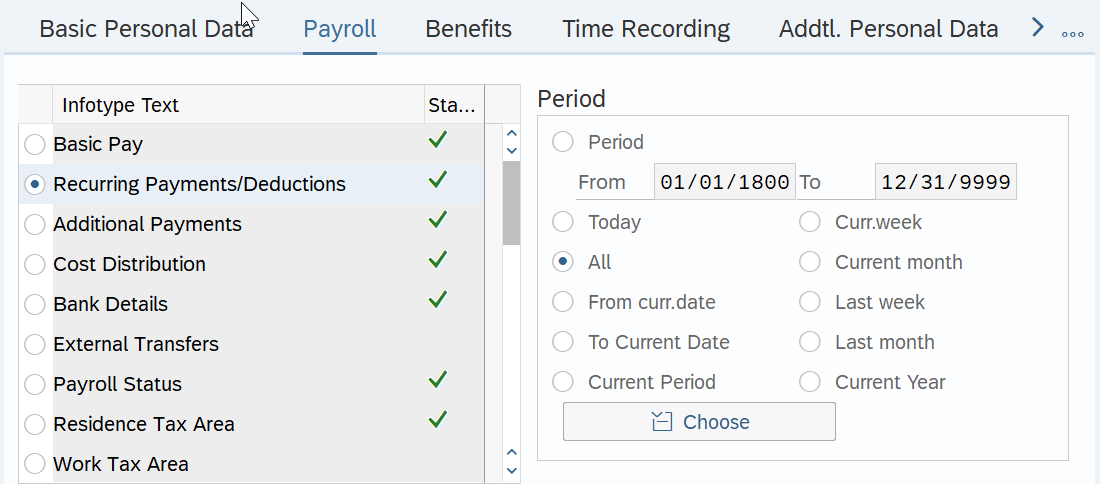

Step 4

On the Payroll tab, select the Recurring Payments/Deductions radio button.

-

Step 5

Click the Create button.

-

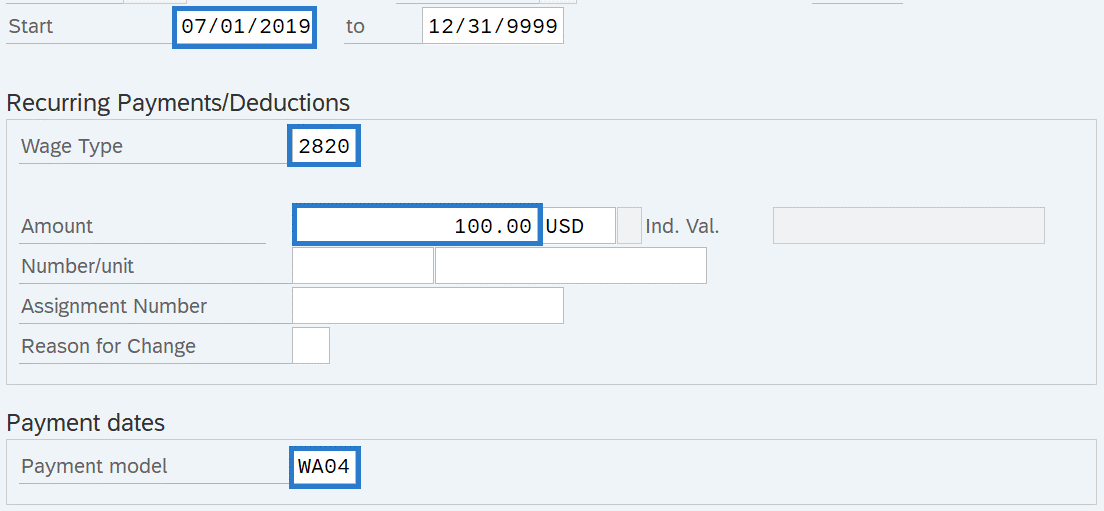

Step 6

Complete the following fields:

The following fields are mandatory:

- Start

- Wage Type

- Amount

- Payment Model

TIPS:

TIPS:If the Payment Model is left blank, the system will default to WA04 - Every Pay Period - Full Amount.

Choose from one of the following Payment Model codes:

- WA01: Every Pay Period - Half Amount

- WA02: 25th Pay Period – Full Amount

- WA03: 10th Pay Period – Full Amount

- WA04: Every Pay Period – Full Amount

- 1162: April 10 and October 10

- 1163 : Jan 25 – Annually

Do not use Payment Model codes other than those listed above.

If the Wage Type selected requires an amount and you have not entered an amount in the Amount field, you will receive the following error:

Enter the Amount and click Enter to correct.

If the Wage Type selected has a standard Amount/Rate/Max and cannot be changed, do not enter an amount in the Amount field; otherwise, you will receive the following error:

Remove the Amount and click Enter to correct.

-

Step 7

Click the Enter button to validate the information.

-

Step 8

Click the Save button.