Exemption Expiration Report

Use this report to identify employees with an active tax exemption and their exemption expiration date.

This report will only return employees who have an active tax exemption during the period.

This is an SAP standard report. The state of Washington does not customize SAP standard reports.

Enter transaction code S_PH9_46000360 in the command field and click the Enter button.

Complete the Period section or the Payroll period section.

If using the Period section, select one of the following radio buttons:

- Today

- Current month

- Current year

- Up to today

- From today

- Other period

Or, if using the Payroll period section, enter the Payroll area and select one of the following radio buttons:

- Current period

- Other period

Tips:

Tips:The Period or Payroll period section will determine the time period of the employees and data that will display in the results.

Reporting Period will default to Today or Current period but can be changed to a different key date, date range, or payroll period.

Reporting Period will default to set the Data Selection and Person Selection the same (recommended).

The state of Washington only uses Payroll Area 11 – Semi-Monthly.

Complete the Selection section.

The following fields are optional:

- Personnel Number

- Employment status

- Company Code

- Personnel area

- Personnel subarea

- Payroll area

- Pers.area/subarea/cost center

- Employee group/subgroup

Tips:

Tips:The Selection section will assist in getting only the information needed. A selection is not required for each field.

Typically, this report is run for one or more personnel areas.

Click the Execute button.

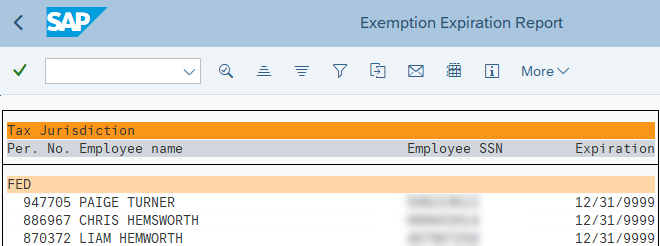

Sample report results: Tips:

Tips:This report will only show employees who have an active tax exemption. Otherwise, the report will show the following message: “List does not contain any data.”

The following table maps each field to the infotype:

Example Scenarios

Below is an example of running the Exemption Expiration report. It is not a comprehensive list of every scenario.

Example - Identify employees who may require an updated Form W-4 – Employee’s Withholding Allowance Certificate.

In this scenario, I need to identify employees who may require an updated Form W-4 – Employee’s Withholding Allowance Certificate. As a payroll processor, I am going to run the report to ensure our agency complies with the IRS requirement that an individual's exemption from federal tax withholding, claimed on a Form W-4, is only valid for the calendar year in which it is filed. An updated form must be submitted by February 15 of the new tax year.

On the report selection screen: