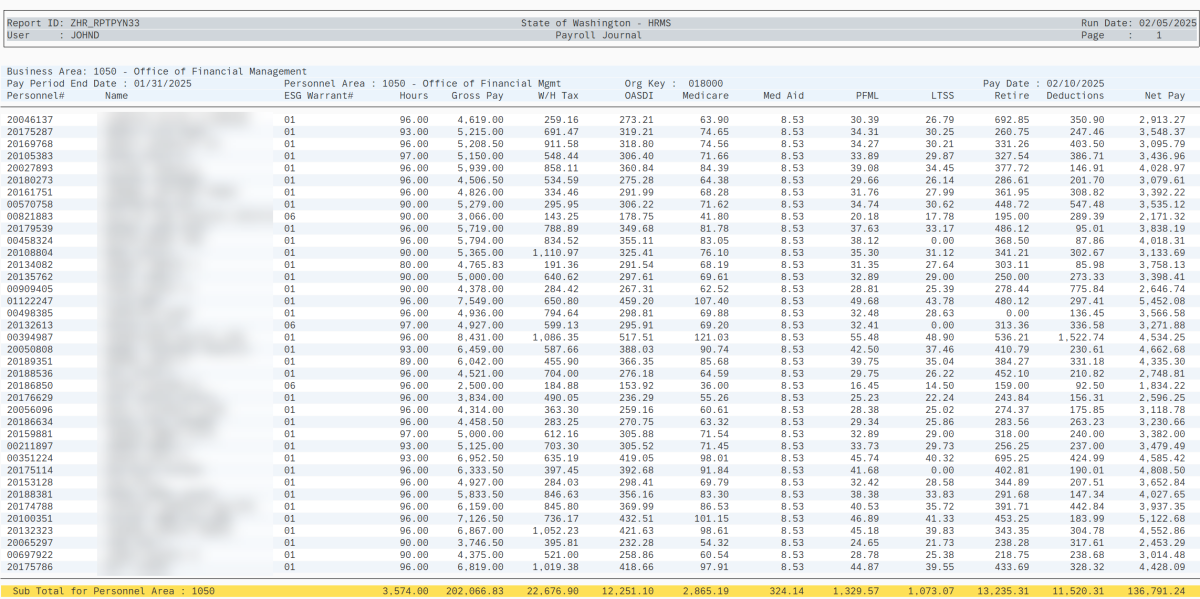

Payroll Journal

Use this report to verify earnings and deductions for employees. Run the report during payroll processing Days 1-3. OFM must have stored payroll for the period before you can run this report.

The HRMS Processor Guide recommends running this report at minimum, on Payroll Day 2, however processors can begin using this report on the morning of Day 1.

This report is also used to certify payroll, based on OFM and your internal agency policies. Signatures for certification should not occur until OFM has processed the final payroll run the evening of Day 3.

Enter transaction code ZHR_RPTPYN33 in the command field and click the Enter button.

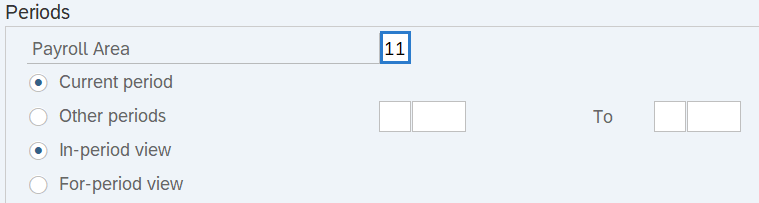

Complete the Periods section.

The following field is mandatory:

- Payroll Area - 11

The following radio buttons will default:

- Current period

- In-period view

The following radio buttons are available for selection:

- Other periods

- For-period view

Tips:

Tips:The Periods section will determine the time period of the employees and data that will display in the results.

The state of Washington only uses Payroll Area 11 – Semi-Monthly.

The radio buttons will default to Current period and In-period view but can be changed to different selections.

Current period: When checked, this selection will return information for the most recent pay period.

Other periods: When checked, this selection will return information for a specific pay period or periods.

In-period view: When checked, this selection will return information for the payroll period in which a payroll result is created. This selection should be used when certifying payroll.

For-period view: When checked, this selection will return information for which a payroll result is created. In the case of a retro calculation, the For-period will be a prior period than the pay period in which the payroll results were created.

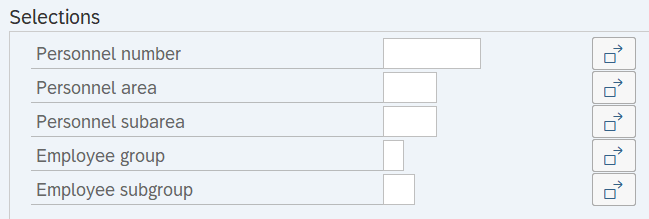

Complete the Selections section.

The following fields are optional:

- Personnel number

- Personnel area

- Personnel subarea

- Employee group

- Employee subgroup

Tips:

Tips:The Selections section will assist in getting only the information needed. A selection is not required for each field.

Additional fields can be added to the Selections section using the Further selections button.

Entering one or more personnel numbers and/or personnel areas is recommended.

If your agency has more than one Personnel Area and you do not wish to narrow results by Personnel Area, you may select Business Area located in the Additional Selections section (see next step).

If you use the Org. structure button to restrict your results by specific Organizational Units, results will automatically be restricted to Active (3) employees only. Results will not include Inactive (1) or Withdrawn (0) employees.

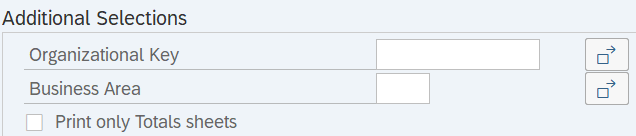

Complete the Additional Selections section.

The following fields are optional:

- Organizational Key

- Business Area

- Print only Totals sheets

Tips:

Tips:The Additional Selections section will assist in getting only the information needed. A selection is not required for each field.

If your agency has more than one Personnel Area and you do not wish to narrow results by Personnel Area, you can use the Business Area selection instead. If entering a Business Area, you are not required to enter a Personnel number or Personnel area. However, if you want to return results by Business Area then you should execute the report in the background due to size.

Print only Totals sheets will compile agency totals only, separated into entire Org Key sections. Selecting Print only Totals sheets will not provide individual employee data.

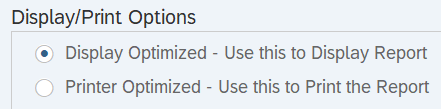

Complete the Display/Print Options section.

Select one of the following radio buttons:

- Display Optimized – Use this to Display Report

- Printer Optimized – Use this to Print the Report

Tips:

Tips:The Display/Print Options section determines the format of the report results.

Display Optimized – Use this to Display Report: When checked, this selection will optimize report results for viewing on computer monitors.

Print Optimized – Use this to Print Report: When checked, this selection will optimize the viewing of printed report results. This selection should be used when printing the report for payroll certification.

- Tips:

Employees will have two lines of data for the following:

- *Retro: These are employees with retroactivity within the period. Retroactive changes in any of the data provided in this report will also be outlined. For example: If an employee has retroactivity impacting their Gross Pay, the employee will have a second line of data beginning with *Retro. The changes to the Gross Pay amount will be listed under the Gross Pay section.

- Out of State Deductions included in above: These are employees living or working in Idaho or Oregon whose master data is set up to process out-of-state (OOS) taxes. The amount of out-of-state taxes collected will be itemized under the W/H Tax section. For example: If an employee processed $725.47 in federal withholding and $397.35 in OOS taxes, the employee will have a second line of data beginning with Out of State Deductions included in above. The total amount of federal and state taxes collected within the period will be outlined in the first line of data outlined in the W/H Tax section and the amount of OOS taxes will be itemized directly below.