Payroll Reconciliation Report

Use this report to assist in reconciling cumulated payroll results for a specified time period against employee or employer taxes ensuring tax compliance, and agency financial balancing. This report will help you with 941 and Form W-2.

Perform this report when you need to review and reconcile balances from a particular wage type found on Form 941 or Form W-2. You can run the using the Tax Company or a narrowed selection by Personnel Number.

Statewide variants have been set up to execute 941 reports for each quarter to assist agencies with reconciliation. You can search by any Form 941 wage type (e.g., /403 social security).

Larger agencies may need to execute the report in the background due to longer run times.

Statewide variants are available for the Payroll Reconciliation Report:

- SWV IRS RECON

- SWV IRSQTR*

The variants beginning with SWV IRSQTR* may be selected based on the quarter that suits your needs. Once selected, update the year accordingly in the Period selection within Step 6 of this procedure. Refer to the Statewide Variant List for more information.

Enter transaction code PC00_M10_REC in the command field and click the Enter button.

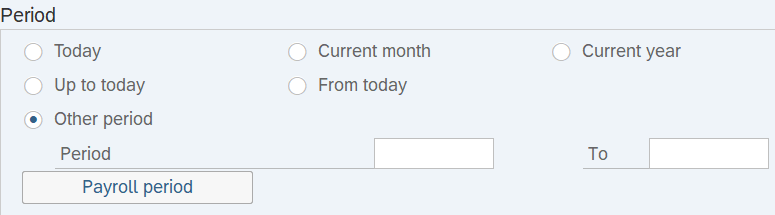

Complete the Period section.

The following radio button will default:

- Other period

The following radio buttons are available for selection:

- Today

- Up to today

- Current month

- From today

- Current year

The following button is available for selection:

- Payroll period

Tips:

Tips:The Period section will determine the time period of the employees and data that will display in the results.

The period will default to Other period but can be changed to a different selection.

This report is frequently used to pull quarterly data. To see data for the current quarter, select Other period and enter the corresponding dates:

- Quarter 1: 01/01/20xx to 03/31/20xx

- Quarter 2: 04/01/20xx to 06/30/20xx

- Quarter 3: 07/01/20xx to 09/30/20xx

- Quarter 4: 10/01/20xx to 12/31/20xx

If SWV IRSQTR* Statewide Variant was selected, update the year accordingly.

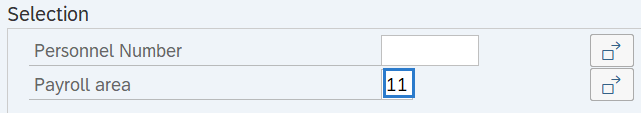

Complete the Selection section.

The following field is optional:

- Personnel Number

The following field is required:

- Payroll area

Tips:

Tips:The Selection Criteria section will assist in getting only the information needed. A selection is not required for each field, except for Payroll area.

The state of Washington only uses Payroll Area 11 – Semi-Monthly.

Additional fields can be added to the Selection section using the Further selections button.

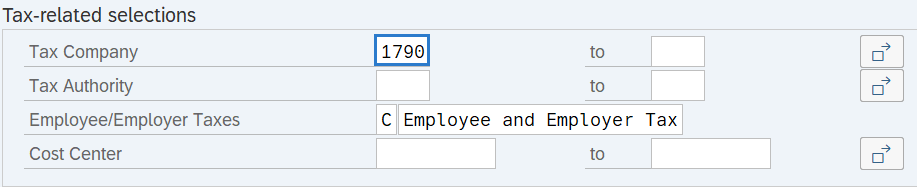

Complete the Tax-related selections section.

The following field is required:

The following field will default:

- Employee/Employer Taxes

The following fields are optional:

- Tax Authority

- Cost Center

Tips:

Tips:The Tax-related selections section will assist in getting only the information needed. A selection is not required for each field.

The Employee/Employer Taxes field will default to C (Employee and employer taxes). The following options are available for selection:

- A (Employee taxes)

- B (Employer taxes)

- C (Employee and employer taxes)

Complete the Wage Type Selections section.

The following radio buttons are available for selection:

- Wage Type Application

- Wage Type

Tips:

Tips:The Wage Type Selections section will assist in getting only the information needed. A selection is not required.

If using a Statewide Variant, this section will populate based on the criteria of the variant.

Click the Wage Type radio button and enter wage type details if you would like to narrow results to certain wage types.

The state of Washington does not use the Wage Type Application selection.

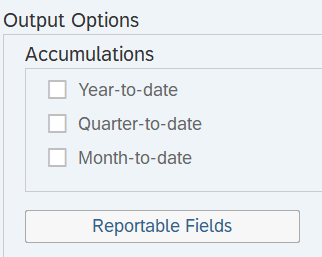

Complete the Output Options section.

The following Accumulation checkboxes are available for selection:

- Year-to-date

- Quarter-to-date

- Month-to-date

The Reportable Fields button is optional.

Tips:

Tips:Click the appropriate check box to determine how accumulations should be calculated: Year-to-date, Quarter-to-date, or Month-to-date.

You can add additional reporting fields to the report results by clicking on the Reportable Fields button. For example, if you did not use a statewide variant, you may wish to add Personnel Number.

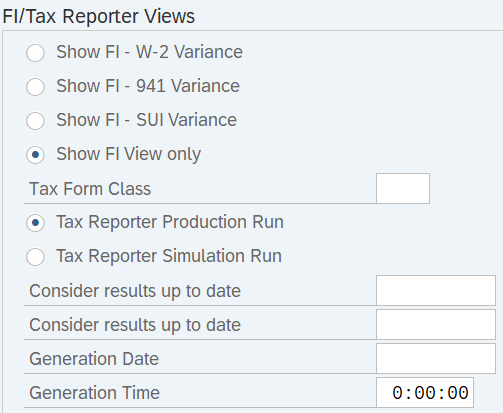

Complete the FI/Tax Reporter Views section:

The following radio button will default (recommended):

- Show F1 view only

The following radio buttons are available for selection:

- Show FI – W-2 Variance

- Show FI – 941 Variance

- Show FI – SUI Variance

The Tax Form Class field should be left blank.

The following radio button will default:

- Tax Reporter Production Run

The following radio button is available for selection:

- Tax Reporter Simulation Run

The following fields are optional:

- Consider results up to date

- Consider results up to date

- Generation Date

- Generation Time

Tips:

Tips:It is recommended to leave the Show F1 View only button as default.

Enter a date in the Consider results up to date field if you have made retroactive changes and want to view simulated results. That date should reflect the first day of the next year. This will allow HRMS to incorporate any changes made within the previous tax year.

The Generation Date field should reflect the last day of the reporting period.

The State of Washington does not use the Generation Time field.

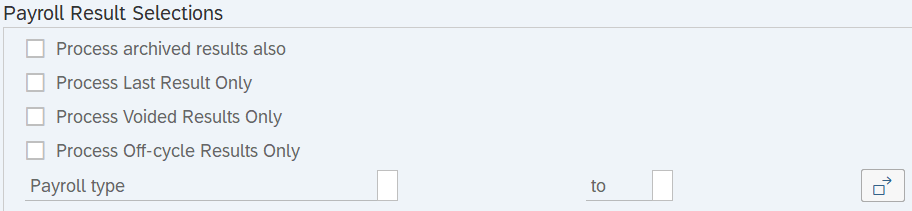

Leave the check boxes in the Payroll Results Selections section blank. Also, leave the Payroll type field blank.

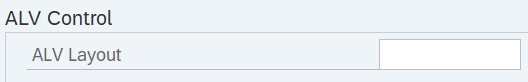

Complete the ALV Control section.

The following field is available for selection:

- ALV Layout

Tips:

Tips:An ALV Layout is not required. Leaving this field blank will result in a default layout for this report.

If using a Statewide Variant, this section may populate based on the criteria of the variant.

Click the Execute button.

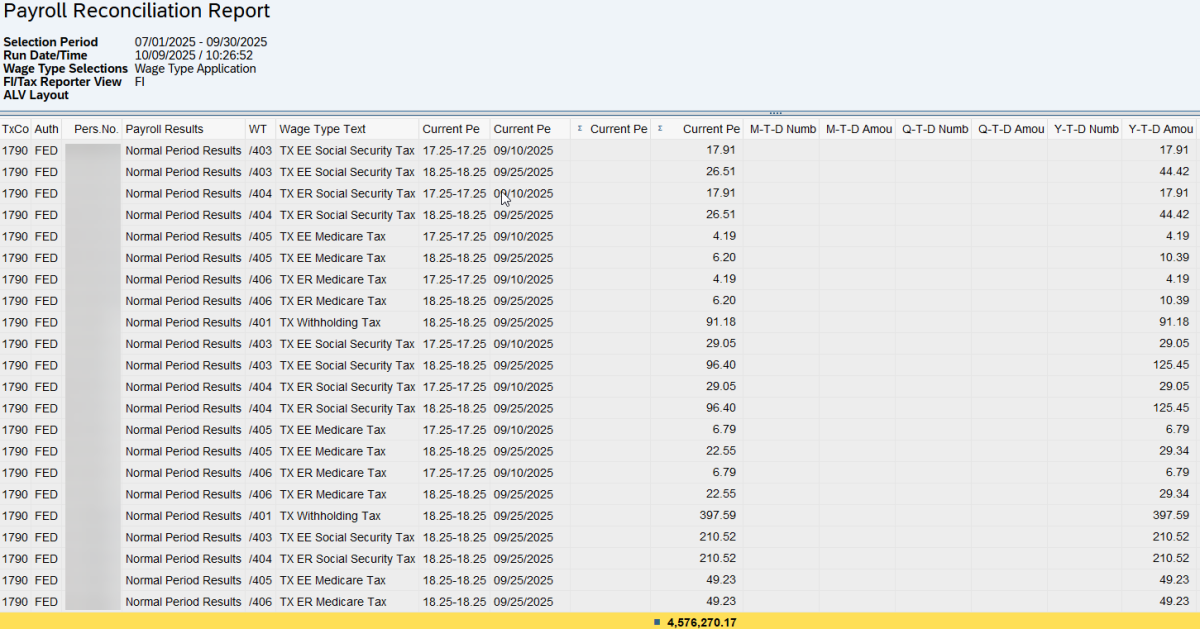

Sample report results:

Tips:

Tips:Columns displayed in the report results will vary based on the report selections prior to executing.

Columns included in the report results depend on your default layout for this report. The report layout can be changed, saved, or a previously saved layout can be selected.

The full column names will display when hovering the cursor over the column headings.

Example Scenarios:

Below are examples of running the Payroll Reconciliation report. It is not a comprehensive list of every scenario.

Example 1 – Reconcile quarterly employee taxes.

In this scenario, our agency tax reporter has asked me to provide them with total employee federal and out-of-state taxes collected in third quarter 2025. They ran a report in Enterprise Reporting and provided me with the following employee tax totals to validate:

As payroll processor, I am going to validate these numbers directly against payroll results to ensure they reconcile:

Example 2 – Identify out of balance amounts for 941 federal withholding.

In this scenario, our tax reporter has notified me that our third quarter 2025 941 is out of balance by $80. They need assistance identifying what is causing the imbalance in federal withholding.

As a payroll processor, I will begin by validating that we are out of balance by $80 in the third quarter.

To investigate this further, I will narrow my selection to view only the period in question, including Personnel Numbers: