Separation Action (PY) - Correct Erroneous Separation Date

Use this procedure to correct the separation date of an employee who had the incorrect effective date entered during a separation action.

This procedure will take you through the steps to delete the infotypes created and extend the end date of infotypes delimited during the erroneous separation action. Once all roles have completed their deletions and/or corrections, the personnel administration processor will enter a new separation action with the correct separation date.

The personnel administration, benefits, and time and attendance processors must correct all entries made during the erroneous separation action. It is important to communicate with these other roles once you have completed the corrections below to identify and remedy any over/underpayment situations if necessary.

Effective Dates for all records should follow the Effective Dating Infotypes guidelines.

The personnel administration processor should always delete the Organizational Assignment screen last. This will ensure that all of the processors still have security access to the employee while making corrections.

This is a generalized example of correcting a Separation Date. The steps may vary depending on the infotypes that were delimited during the Separation Action. For specific instructions, please contact HereToHelp@ofm.wa.gov.

Please Note: for this example, we will use an employee whose original incorrect Separation Date was 8/1/2018 and the employee’s Separation Date should have been 8/16/2018. Each infotype delimited or created during the Separation Action will be extended or deleted and a correct PA40 separation action will be entered.

-

Step 1

Ensure the time and attendance and benefits processors have extended all end dates that were delimited or deleted infotype records that were created during their portions of the erroneous Separation Action. They should refer to the Separation Action (BN) - Correct Erroneous Separation Date procedure.

TIPS:When the correct Separation Action is entered:

- Infotypes extended to 12/31/9999 will be delimited with the correct end date according to the Effective Dating Infotypes table.

- Infotypes deleted will need to be re-entered with the correct effective date.

-

Step 2

Identify each payroll infotype that was created or delimited with an erroneous separation effective date.

Infotype Number Infotype Name Corrections for Erroneous Separation Date 0014 Recurring Payments/Deductions Extend to 12/31/9999 0015 Additional Payments Delete 0027 Cost Distribution Extend to 12/31/9999 0194 Garnishment Document Extend to 12/31/9999 0195 Garnishment Order Extend to 12/31/9999 0554 Hourly Rate Per Assignment Extend to 12/31/9999 0696 Absence Pools Extend to 12/31/9999 or date no longer eligible If the employee was set up to process out-of-state taxes for Oregon or Idaho and you have completed the steps in Additional Steps for Out-of-State Employees - End Out-of-State Employee, please consider the following additional infotypes:

Infotype Number Infotype Name Corrections for Erroneous Separation Date 0207 Residence Tax Area Extend the OOS record to 12/31/9999 0208 Work Tax Area Extend the OOS record to 12/31/9999 0235 Other Taxes US Extend the OOS record to 12/31/9999 TIPS:Each erroneous record created will need to be deleted and the previous record will need to be adjusted prior to processing the separation action with the correct date.

When the correct Separation Action is entered:

- Infotypes extended to 12/31/9999 will be delimited with the correct end date according to the Effective Dating Infotypes table.

- Infotypes deleted will need to be re-entered with the correct effective date.

Be sure to only delete or extend infotype records created or delimited during the separation action. For example, do not extend the Cost Distribution (0027) record if it has an older end date and was not delimited during the separation action.

-

Step 3

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 4

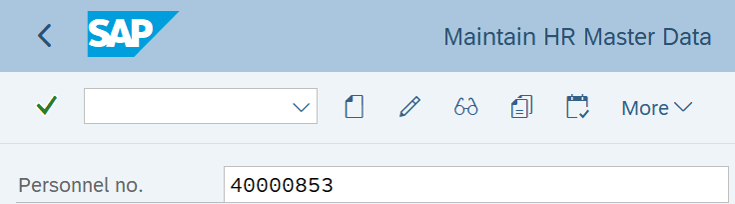

Complete the following field:

- Personnel no.

-

Step 5

Click Enter to populate the employee information.

-

Step 6

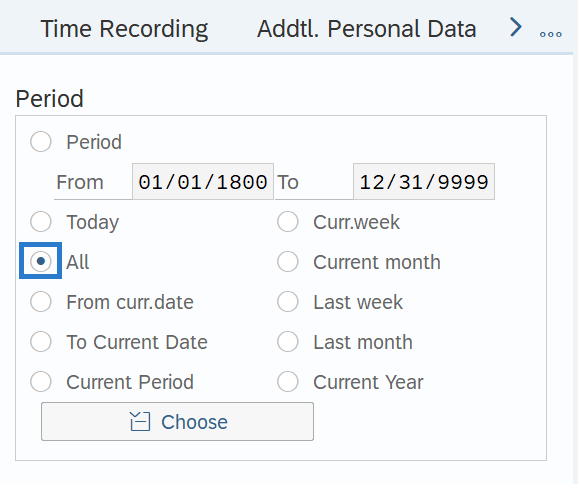

Select the All radio button in the Period Selection box.

-

Step 7

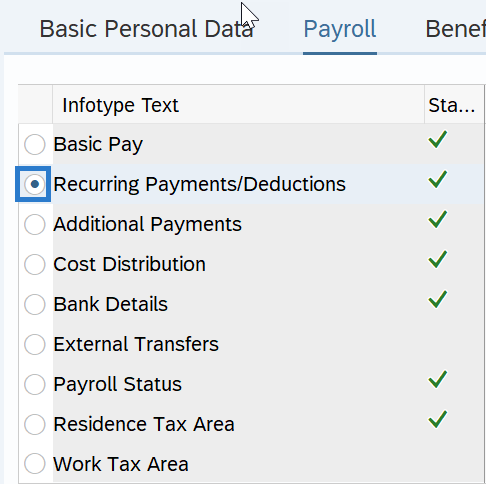

On the Payroll tab, select the Recurring Payments/Deductions radio button.

-

Step 8

Click the Overview button.

-

Step 9

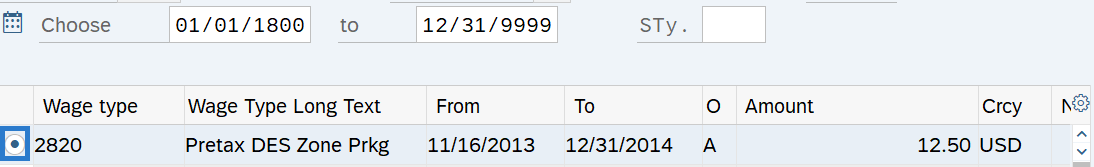

Select the Recurring Payments/Deductions radio button record erroneously delimited in the Separation Action.

-

Step 10

Click the Change button.

-

Step 11

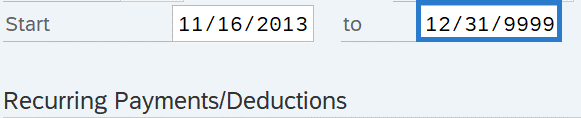

Update the To date to 12/31/9999 to extend the record.

-

Step 12

Click the Enter button to validate the information.

-

Step 13

Click the Save button.

TIPS:After clicking Save, you will be taken back to the Recurring Payments/Deductions infotype. Correct additional Recurring Payments/Deductions records if necessary. If there are no other records to correct on the Recurring Payments/Deductions infotype, click the Back button to return to the Payroll tab and repeat steps with other infotypes, as necessary.

Stop:Once all time, benefits, and payroll erroneous records have been corrected in HRMS, notify the personnel administration processor so they may proceed with the Separation Action (PA) - Correct Erroneous Separation Date procedure. The personnel administration processor will notify you when they are completed with their portion of the correct Separation Action, then follow the Separation Action (PY) – Create Separation Action procedure.

Again, it is important to communicate with all impacted roles to identify and remedy any over/underpayment situations as needed.