Separation Action (PY) - Create Separation Action

Use this procedure to complete the payroll portion of the Separation Action. The personnel administration portion of the Separation Action must be completed first.

As a payroll processor, you will not process this action until you have received a separation packet from the personnel administration processor indicating they have completed their portion of the action. The personnel administration processor should have confirmed with the time and attendance processor that all the items listed below were completed before starting the Separation Action (PA40).

- Deleted any future-dated time, compensation, and leave entries beyond the employee's separation date from CATS, the Employee Remuneration Info (2010) infotype, and the Absences (2001) infotype.

- Manually generated leave accruals if the employee has earned leave but is separating from the agency before the system generates their last accruals. Refer to the Quotas Generate Accruals Manually procedure.

- Executed ZT60 and ZCAT6 to ensure the employee has accurate leave accruals with correct end dates.

If the Separation is a result of a layoff, the employee has the option of deferring the payment of their vacation leave buyout for 30 working days. If they elect to defer their leave, the employee's Payroll Status (0003) infotype record will need to be changed to continue running payroll for that employee until the date of the deferred buyout. Refer to the Payroll Status - Change Existing Record procedure.

If the employee has separated from state service prior to the completion of six continuous months and has accrued vacation leave, the accrued amount will need to be removed so it is not accessible to the employee if they return to state service at a later date. Refer to the Quota-Removing Accrued Leave procedure.

This procedure may require hand-offs to the other roles (benefits processor and time and attendance processor) depending on the structure of your agency and your role at your agency. Refer to the Separation Action (BN) - Create Separation Action procedure for completing the benefits portion of the action.

-

Step 1

Enter transaction code PA40 in the command field and click the Enter button.

-

Step 2

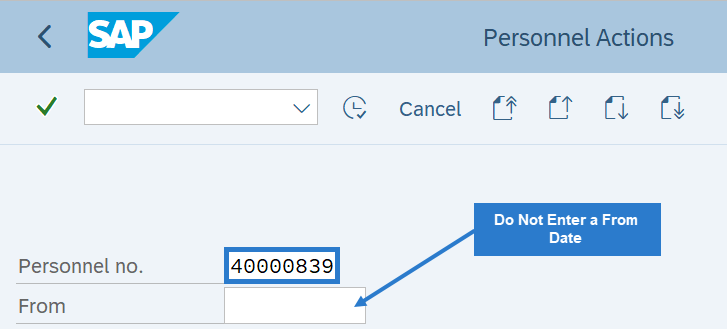

Complete the following field:

- Personnel no.

TIPS:

TIPS:Do not enter a From date on the Personnel Actions screen.

-

Step 3

Click Enter to populate the employee information.

-

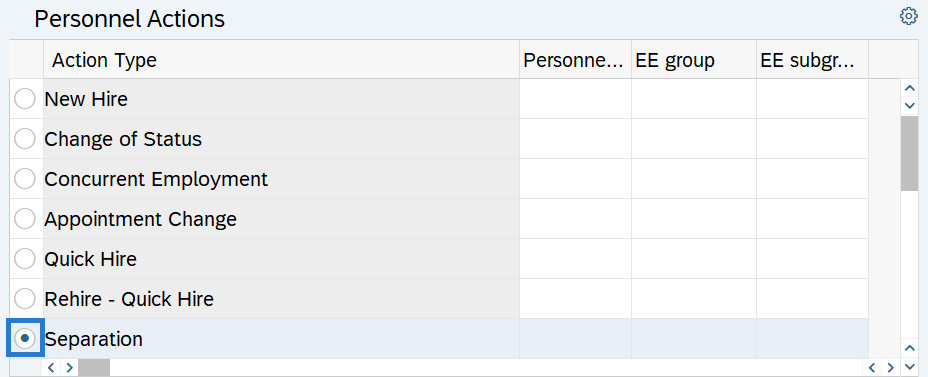

Step 4

Select the Separation radio button.

-

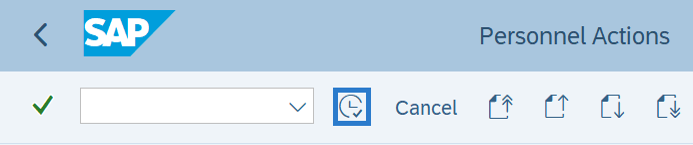

Step 5

Click the Execute button to begin the transaction.

-

Step 6

Verify the Actions (0000) infotype contains the correct action you need to execute.

-

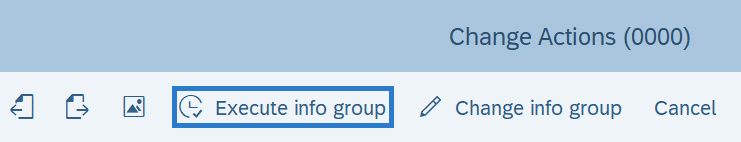

Step 7

Click the Execute info group button.

-

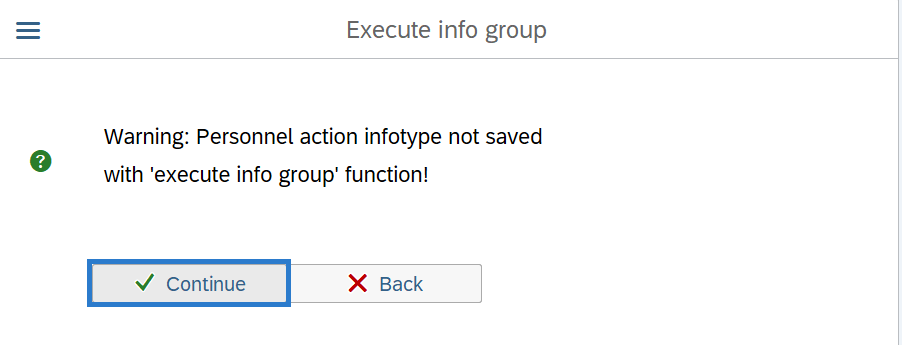

Step 8

Click Continue in the Execute info group dialog box.

-

Step 9

Click the Next Record button until you reach the Delimit Recurring Payments/Deductions (0014) infotype.

-

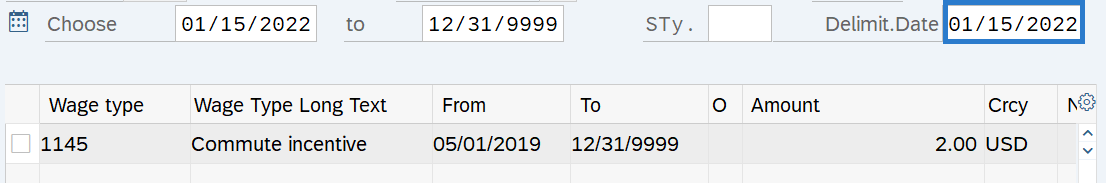

Step 10

Complete the following field:

The following field is mandatory:

- Delimit.Date

TIPS:

TIPS:The Delimit Date allows you to set an end date for a record, establishing when it will no longer be valid. Delimited records are retained as a historical record.

Verify the delimit date. The wage type record(s) should end on the last day of the pay period (the 15th or the last day of the month). The system will end date the record one day before the delimit date.

Example: if you want the record to end on 4/30/2019, enter a delimit date of 5/1/2019.

-

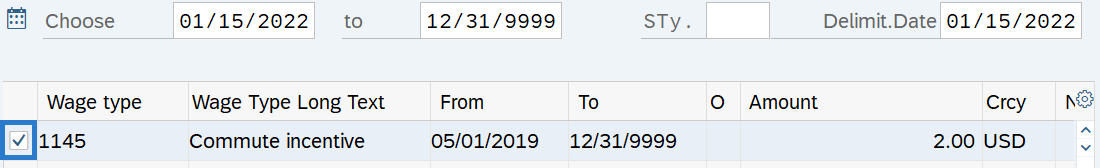

Step 11

Click the box or boxes to the left of the wage type records to be delimited.

TIPS:

TIPS:You can select more than one record to delimit.

-

Step 12

Click the Delimit button.

-

Step 13

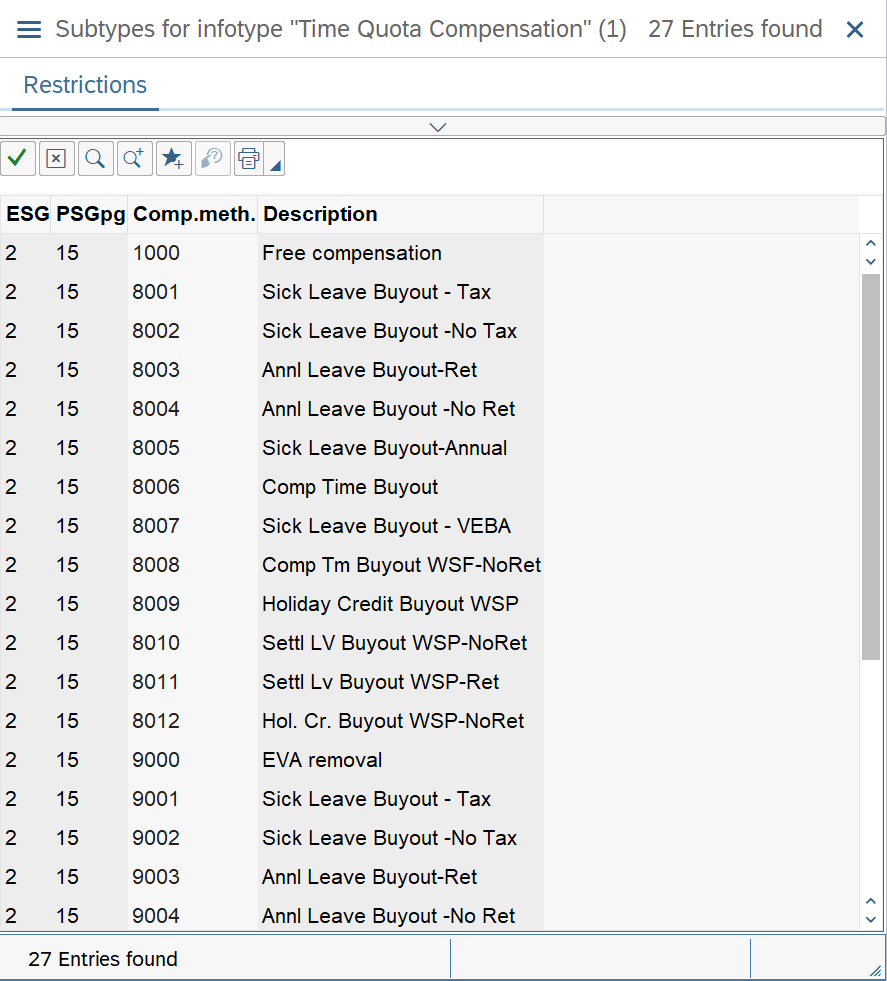

Click the Next Record button until you reach the Subtypes for infotype Time Quota Compensation window.

-

Step 14

Select the appropriate Compensation method in the Subtypes for infotype Time Quota Compensation window.

TIPS:

TIPS:The compensation method 9003 (Annl Leave Buyout-Ret) should be used for Plan 1 employees. Leave buyout information to PERS Plan 1, TRS Plan 1, and WSPRS Plan 1 members commissioned prior to July 1, 2001 should only be reported to DRS up to 240 hours. The remaining hours are not reportable to DRS.

The compensation method 9004 (Annl Leave Buyout-No Ret) should be used for Plan 2, Plan 3, and for any hours over 240 for Plan 1 employees.

If an incorrect infotype is created, the buyout will be reported to DRS and will need to be deleted.

-

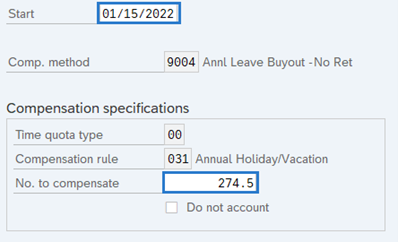

Step 15

Complete the Time Quota Compensation (0416) infotype.

The following fields are mandatory:

- Start

- No. to compensate

The following field is conditional:

- Do not account

TIPS:

TIPS:The Start date is the last day of employment. This will ensure the employee will be paid on their last day.

No. to compensate is the number of hours or days of a quota type for the time quota compensation.

If Do not account is selected, the employee will not be compensated for the leave buyout and the quota will be reduced.

When reducing hours for the employee’s Personal Holiday, use quota compensation method 1000 and check the Do not account box.

Prior to activating the Voluntary Employee Beneficiary Association buyout, verify the employee’s eligibility. Your agency must be participating in VEBA, and your agency’s voting group must have a current vote in favor of VEBA participation.

Refer to the Compensatory time cash-out payments for terminating employees document to determine whether the system-calculated regular rate or the average regular rate should be used to calculate a comp time payment.

To remove accrued vacation leave when an employee separates from state service prior to completing six continuous months of employment, follow the Quota - Removing Accrued Leave user procedure.

-

Step 16

Click the Enter button to validate the information.

-

Step 17

Click the Save button.

TIPS:Only one buyout can be processed during the Separation Action (PA40). If there are additional quota types to buyout follow the Quota - Time Quota Compensation (Buyout) procedure.

Stop:This marks the end of the Separation action using PA40. The remaining steps in this procedure will direct you to make additional updates if necessary.

-

Step 18

If the employee has any active garnishment records, refer to the Garnishments - Standard Processing - Delimit Garnishment procedure.

-

Step 19

Return any unused shared leave, if applicable. Refer to the following user procedures:

-

Step 20

If the employee was living or working in Oregon or Idaho, then follow the Additional Steps for Out-of-State Employees – End Out-of-State Employee user procedure to end the employee's out-of-state status upon separation.

-

Step 21

If the employee has any active tax exemptions, refer to the Other Taxes (US) user procedures to end the exemptions. Most all exemptions should be delimited upon separation, as many exemptions do not follow the employee.

One exception is employees with a permanent ESD approved exemption to the WA Cares Fund / LTSS program. When the exemption is permanent, the employee's Exempt status should remain active upon separation. All other WA Cares Fund / LTSS exemptions (such as non-localized work or conditional exemptions) should be ended upon separation.

TIPS:For more information on LTSS premiums and exemptions, see the Employer Long Term Services and Supports FAQ on the Payroll Reconciliation webpage.

-

Step 22

Work with your time and attendance processor to end any quota balances, if necessary:

- Comp Time

- Personal Holiday

- Personal Leave Day

- Vacation Leave

Refer to the Quota - Removing Accrued Leave procedure.

Stop:For the payroll processor, this will mark the end of the Separation Action. After saving, click the Exit button and transfer the separation packet to the benefits processor who will continue the action. The benefits processor should refer to the Separation Action (BN) - Create Separation Action procedure to complete their portion of the action.