Garnishment Details Report

Use this report to display garnishment information for a specific time period.

This report will only return information for employees who have Garnishment Document (0194) and Garnishment Order (0195) infotypes in HRMS.

This is an SAP standard report. The state of Washington does not customize SAP standard reports.

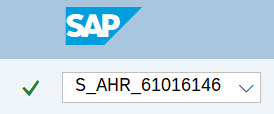

Enter transaction code S_AHR_61016146 in the command field and click the Enter button.

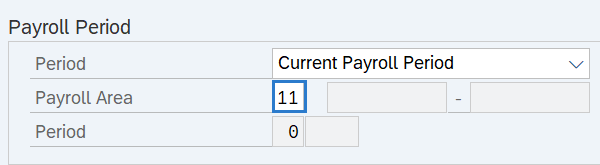

Complete the Payroll Period or Period section. This section will change depending on which period option is selected.

To run by pay period, use one of the following Period field selections:

- Current Payroll Period

- Other Payroll Period

The following field is required:

- Payroll Area

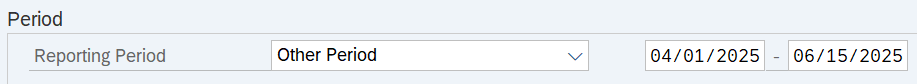

To run by key date or date range, use one of the following Reporting Period field selections:

- Today

- Key Date

- Other Period

- Current Month

- Current Year

- Past (until today)

Tips:

Tips:The Payroll Period or Period section will determine the time period of the employees and data that will display in the results. The report will return results for any employee who had an active garnishment during the selected time period.

The Period field will default to Current Payroll Period but can be changed.

The Payroll Area field is required if you selected Current Payroll Period or Other Payroll Period.

The state of Washington only uses Payroll Area 11 – Semi-Monthly.

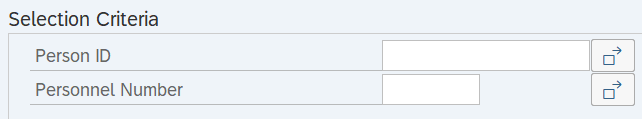

Complete the Selection Criteria section.

The following field should be left blank:

- Person ID

The following fields is optional:

- Personnel Number

Tips:

Tips:The Selection Criteria section will assist in getting only the information needed.

Additional fields can be added to the Selection Criteria section using the Selection Fields button.

The State of Washington does not use Person ID.

Click the Execute button.

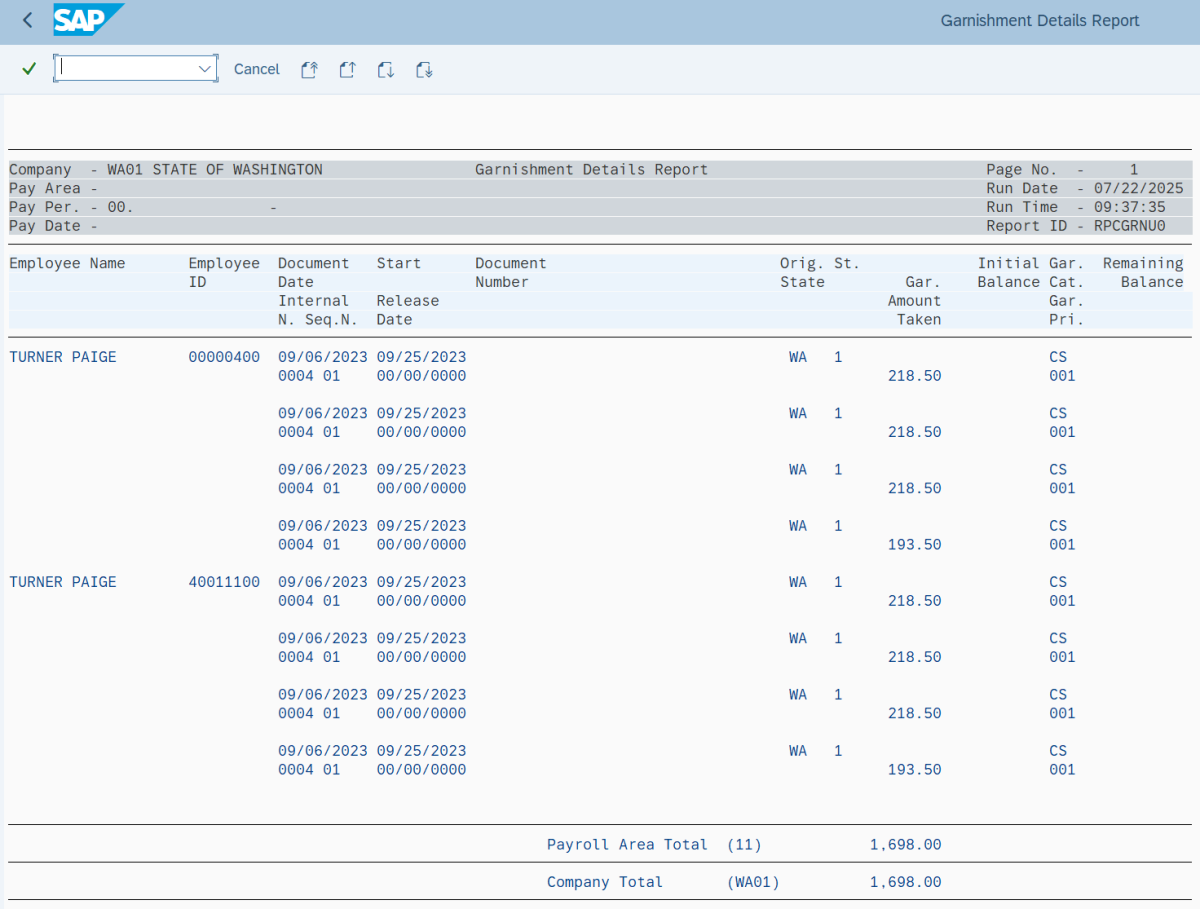

Sample report results :

The following table maps each field to the infotype:

Scenarios

Below are examples of running the Garnishment Details report. This is not a comprehensive list of every scenario.

Example 1 - Find a Writ General Ledger (GL) discrepancy.

In this scenario, my Payroll Manager believes there may be a discrepancy in GL 5189 and they have requested a report identifying every garnishment that was processed in Period 24/2024 to compare with the amount in the GL. As a payroll processor, I am going to run the Garnishment Details Report to identify the garnishments processed during the requested period.

On the report selection screen:

Example 2 - Review garnishments for a year.

In this scenario, I need to conduct a full year audit for garnishments. As a payroll processor, I am going to run the Garnishment Details Report to view what has processed.

On the report selection screen: