Corrections and Returns for Agency Action

Use this report daily to identify any Notification of Change (NOC) or Notification of Return (NOR) received in relation to employees’ Bank Details (0009) infotype data. Failure to monitor this report may result in automatic deposits being processed inaccurately. Failure to take appropriate action may result in Automated Clearing House (ACH) compliance violations or penalties.

The HRMS Processor Guide recommends running this report daily.

Information provided within the Corrections and Returns for Agency Action Report is sent by the employee’s financial institution and reported to payroll processors through HRMS. Errors will appear exactly as the financial institution reports them since HRMS has no control over the data.

ACH Rules require an originator make changes specified in a NOC within six banking days of receipt of the NOC or prior to initiating another entry to the Receiver’s account, whichever is later.

Agencies are encouraged to review internal NOC procedures and ensure compliance with the following ACH Rules Text:

Subsection 2.11.1 ODFI and Originator Action on Notification of Change (NOC).

…Except as noted below, the Originator must make the changes specified in the NOC or corrected NOC within six banking days of receipt of the NOC information or prior to initiating another entry to the Receiver’s account, whichever is later.

Enter transaction code ZHR_RPTPY151 in the command field and click the Enter button.

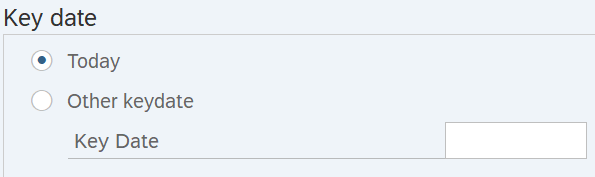

Complete the Key date section.

The following radio buttons are available for selection:

- Today

- Other keydate

Tips:

Tips:The Key date section will determine the effective date of your report results.

Key date defaults to Today but can be changed to a different date.

You will receive a message if Other keydate is selected and the Key Date field is blank.

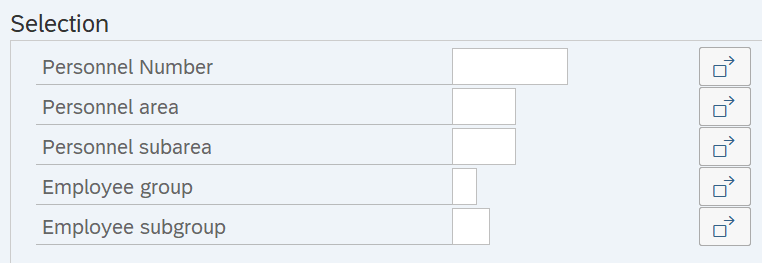

Complete the Selection section.

The following fields are optional:

- Personnel Number

- Personnel area

- Personnel subarea

- Employee group

- Employee subgroup

Tips:

Tips:The Selection section will assist in getting only the information needed. A selection is not required for each field.

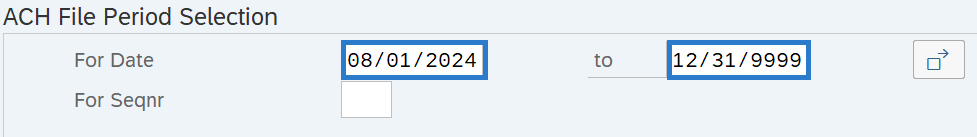

Complete the ACH File Period Selection section.

The following fields are required:

- For Date

- To

The following field is optional:

- For Seqnr

Tips:

Tips:The ACH File Period Selection section will assist in getting only the information needed.

For Seqnr is the sequence number for the date selected in the ACH file. It is recommended to leave this field blank.

Additional fields can be added to the Selection section using the Further selections button. The Further selections button is not available for use until all required entries are made in the ACH File Period Selection section.

The ACH File Period Selection - For Date is driven from the date the financial institution effective dates the error, not the date the Bank Details record is created or updated. Ensure the date selection begins on or prior to the period of time you are attempting to check. OFM recommends always using 12/31/9999 for the To date.

Click the Execute button.

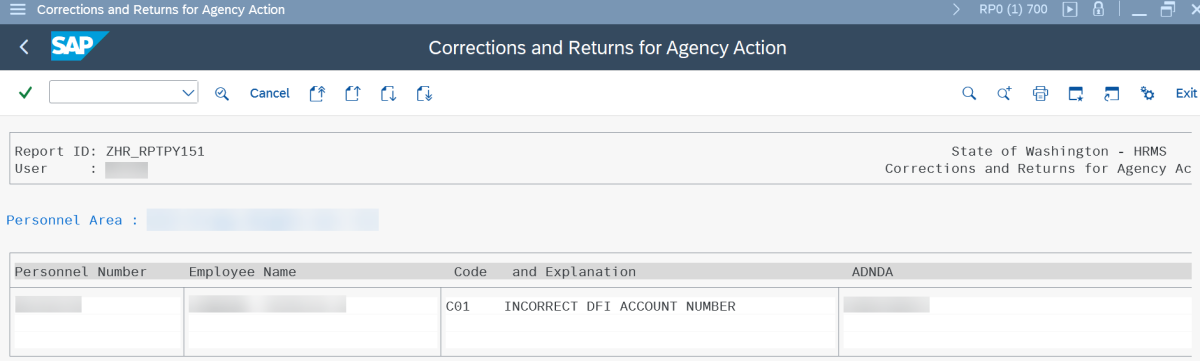

Sample report results:

Tips:

Tips:When a Notice of Return (NOR) is reported, the employee should immediately work with their financial institution to identify incorrect banking information.

A Notice of Correction (NOC) indicates the bank has sent a correction to the banking information. This is typically informational only for the agency, such as an updated account number or routing number due to a merger.

The agency should gather and update any direct deposit form(s) as needed per your internal agency policy.

If necessary, payroll processors should use the Bank Details – Copy and Update Record user procedure to update an employee’s Bank Details (0009) infotype information.

Once information is updated in HRMS, the updated banking information will automatically transfer into the Agency Financial Reporting System (AFRS). There is no further action required on the AFRS side.

The following is a list of commonly used codes as provided by the Automated Clearing House (ACH):

Code Reason Description R01 INSUFFICIENT FUNDS Available balance is not sufficient to cover the value of the debit R02 ACCOUNT CLOSED Previously active account has been closed R03 NO ACCOUNT Acct # structure valid but doesn't match individual or not open R04 INVALID ACCOUNT NUMBER Acct # structure not valid. Check digit/number of acct digits failed R06 RETURNED PER ODFI REQUEST ODFI has requested RDFI to return a duplicate or erroneous entry R07 AUTHORIZATION REVOKED Acct holder has revoked authorization from the originator R08 PAYMENT STOPPED Acct holder requests stop of a single entry R09 UNCOLLECTED FUNDS Value of uncollected items brings avail. bal. below debit amount R10 NOT AUTHORIZED/NOT KNOWN Originator is not known to receiver and/or is not authorized R11 NOT IN ACCORDANCE WITH AUTH Entry not in accordance with the terms of the authorization R14 DECEASED The account holder is deceased; cease future payments R15 BENEFICIARY DECEASED Beneficiary entitled to benefits is deceased; cease future payments R16 ACCOUNT FROZEN Funds not available due to action by RDFI or legal action R20 NON-TRANSACTION ACCOUNT Policies and/or regulations restrict activity to account indicated R23 PAYMENT REFUSED Acct holder refuses transactions because amount is disputed R24 DUPLICATE ENTRY Transaction appears to be a duplication R29 CORPORATE NOT AUTHORIZED Receiver has notified RDFI that corporate entry is not authorized R30 RDFI NOT IN TRUNCATION PROGRAM RDFI not in check truncation program R31 ODFI PERMITS LATE RETURN ODFI agrees to accept a return R38 PAYMENT STOPPED ON BOC ITEM Acct holder requests stop of a single entry on the source document C01 INCORRECT ACCOUNT NUMBER Change account number C02 INCORRECT TRANSIT ROUTE Change transit routing number C03 INCORRECT ACCT & ROUTE Change transit routing number and account number

The following table maps each field to the infotype:

Scenarios

Below is an example of running the Corrections and Returns for Agency Action report. It is not a comprehensive list of every scenario; however, it is recommended that this report is run in this format daily.

Example - Identify employees who returned a rejection or correction.

In this scenario, I need to identify employees who have a correction or rejection from their financial institution. As a payroll processor, I am going to run the Corrections and Returns for Agency Action report to view which employees have corrections or rejections.

On the report selection screen: