Tax Exempt Status Report

Use this report to view employees’ Tax Exemption Indicator(s) from their Withholding Info W4/W5 US (0210) infotype records.

Perform this procedure at year end to identify employees whose exempt status may expire.

The HRMS Processor Guide recommends running this report yearly to check for employees who are exempt from withholding taxes.

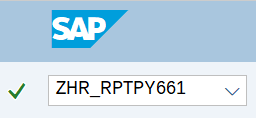

Enter transaction code ZHR_RPTPY661 in the command field and click the Enter button.

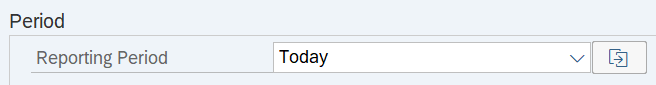

Complete the Period section.

The following field will default:

- Reporting Period

Tips:

Tips:The Period section will determine the time period of the data that will display in the results.

Reporting Period will default to Today, but can be changed to a different date selection.

Complete the Selection Criteria section.

The following field is recommended:

- Personnel area

The following fields are optional:

- Personnel Number

- Employment Status

- Personnel subarea

- Employee group

- Employee subgroup

Tips:

Tips:The Selection Criteria section will assist in getting only the information needed. A selection is not required for each field.

Additional fields can be added to the Selection Criteria section using the Selection Fields button.

Leaving the Employment Status field blank will bring Withdrawn (0) employees into your reports results. Use this selection field to restrict your report results to only active (3) and/or inactive (1) employees.

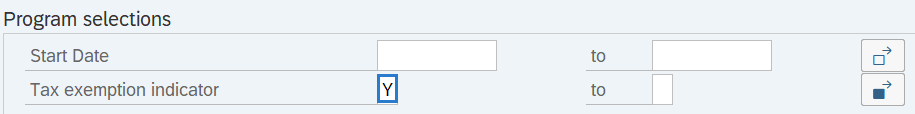

Complete the Program selections section:

The following field is optional:

- Start Date

The following field is required:

- Tax exemption indicator

Tips:

Tips:Tax exemption indicator will default to the following selections:

- Y: Exempt, not reportable

- R: Exempt, reportable

- X: Exempt, partly reportable

Use the Multiple Selection button to change the default Tax exemption indicator selections.

The state of Washington does not use X: Exempt, partly reportable.

Completing the Start Date field will filter report results to those with a Withholding Info W4/W5 US (0210) infotype start date within the date range(s) entered. Enter a start date or range of start dates if you want to narrow the data based on the start date of the record. Leaving the Start Date field blank will return exemptions on all Withholding Info W4/W5 US (0210) infotype records.

- Tips:

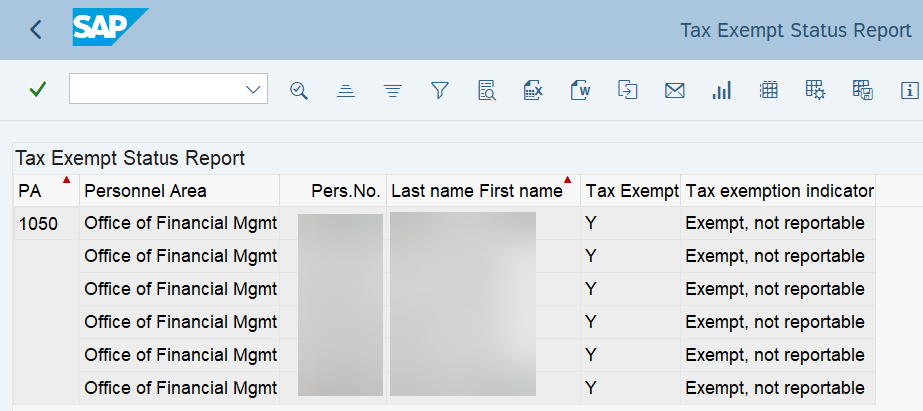

Columns included in the report results depend on your default layout for this report. The report layout can be changed, saved or a previously saved layout can be selected.

The full column names will display when hovering the cursor over the column headings.

The Tax Authority field is not included in this report. However, the report will return results for employees with tax exempt statuses for all tax authorities. You may need to review employees’ Withholding Info W4/W5 US (0210) infotype records for further details.

The following table maps each field to the infotype:

Example Scenario

Below is an example of running the Tax Exempt Status report. It is not a comprehensive list of every scenario.

Example - Identify employees who may require an updated Form W-4 – Employee’s Withholding Allowance Certificate.

In this scenario, I need to identify employees who may require an updated Form W-4 – Employee’s Withholding Allowance Certificate due to tax exemptions. As a payroll processor, I am going to run the Tax Exempt Status report to review which employees have reportable tax exemptions. An updated form must be submitted by February 15 of the new tax year.

On the report selection screen: