Health Plans - Create New Record

Use this procedure to create a new Health Plan (0167) infotype record. Creating a new record is only necessary when the employee’s health benefit information has been entered into Pay1 on payroll processing day 3.

All updates to an employee’s health plan should be entered in Pay1. These procedures should only be used if an employee’s health benefit information in Pay1 has been updated on Day 3 of payroll processing and the information will not have the necessary time to GAP into HRMS.

Enter the employee's elections based on the information keyed into Pay1 or the standard default elections if the PEBB Employee Enrollment/Change form was not submitted within the allowed timeframe.

For information regarding employee eligibility for PEBB benefits, contact Health Care Authority toll free at 1-800-700-1555.

Be sure to communicate with your payroll processor before entering retroactive changes to an employee's record.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

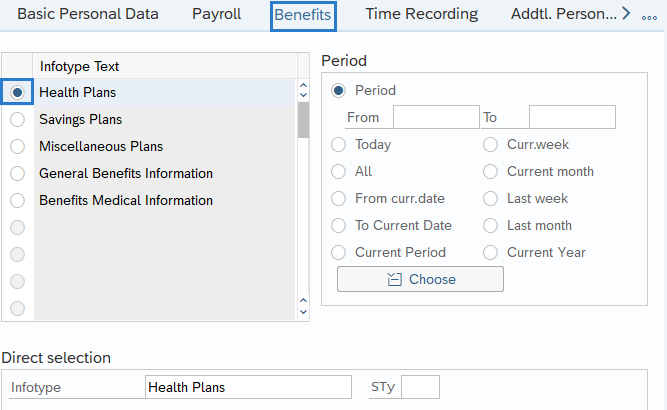

Step 4

On the Benefits tab, select the Health Plans radio button.

-

Step 5

Click the Create button.

-

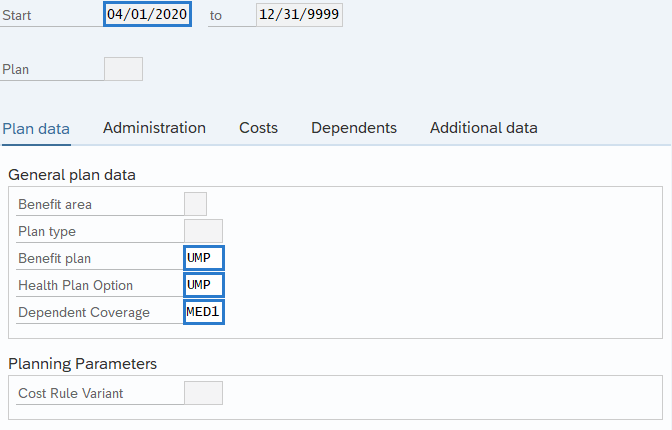

Step 6

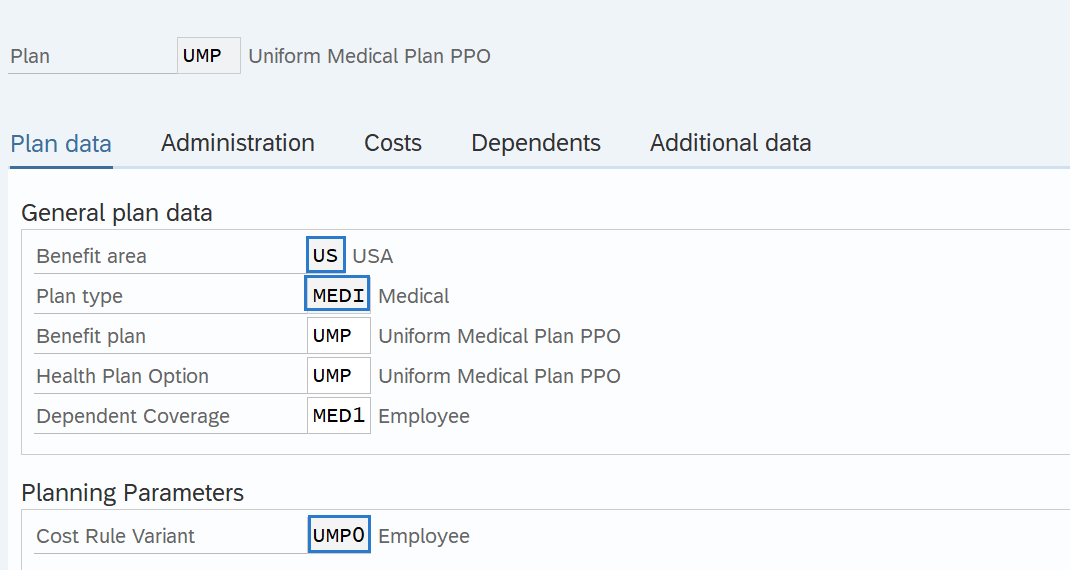

Complete the following fields on the Plan data tab:

The following fields are mandatory:

- Start

- Benefit plan

- Health Plan Option

- Dependent Coverage

TIPS:

TIPS:Start date for a new hire or rehire:

- If the employee’s hire date is on the 1st working day of the month and the employee is benefits eligible, then the start date should reflect the 1st of the month and an Additional Payment (0015) infotype record should be created to collect premiums on the 10th paycheck.

- If the employee’s hire date is on any other day of the month (not the 1st working day) and the employee is benefits eligible, then the start date should reflect the last day of the month of hire or rehire, which is also the first day prior to their eligibility date. For more information on manual adjustments, refer to the Manual Adjustments for Healthcare Premiums - Identify Premium Amounts and Manual Adjustments for Healthcare Premiums - New Hire or Rehire procedures.

Start date for an existing employee:

- If the employee is an existing employee who is newly benefits eligible, then the start date should reflect the first day prior to their eligibility date.

- If the employee is transferring into your agency and continuing benefits (Appointment Change), then do not end date this infotype. Action is required in Pay1. When transferring on the 1st of month, both agencies must create manual adjustments (losing agency - Negative last day of the month, gaining agency - Positive first day of the month). For more information on manual adjustments, refer to the Manual Adjustments for Healthcare Premiums - Identify Premium Amounts and Manual Adjustments for Healthcare Premiums - Transfer Different Agency procedures.

General plan data is entered on the Plan data tab.

An employee can only participate in one plan of each plan type at any time.

The Benefit plan is a three to four character identifier for the benefit plan.

Dependent Coverage identifies which of the employee's dependents are covered under the health plan.

-

Step 7

Click the Enter button to validate the information.

The following fields will populate based on the selections entered in the previous step:

- Benefit area

- Plan type

- Cost Rule Variant

TIPS:

TIPS:The Administration, Dependents, and Additional data tabs do not require action:

Administration - houses the type of enrollment, other available fields are not used.

Dependents - Do not use.

Additional data - Do not use.

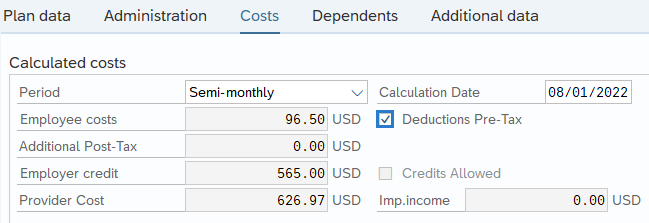

The Costs tab will default based on the chosen plan.

The Deductions Pre-Tax box will default to blank (post-tax). Check this indicator if pre-tax deductions are desired. This can be changed in retro, however you cannot cross tax years. When you save the record it will automatically default to post-tax. If you want pre-tax go back into the record after it’s saved and select the check box for pre-tax contributions.

Imputed income determines the imputed income value of a health plan. Imputed income is relevant for plans in which taxable domestic partners and taxable domestic partners' children can enroll, employer contributions for these persons must be taxed.

-

Step 8

Click the Save button.

Stop:If manual collection of premium amounts are necessary, refer to the following Manual Adjustments for Healthcare Premiums procedures: