Savings Plans - Copy and Update Record

Use this procedure to copy an existing Savings Plans (0169) infotype record and update it with necessary changes. Using the Copy action will retain the history of the previous record.

If your benefits office has received notification from DRS that an employee has been approved for an Override for Special Catch-Up Limits, a new record will arrive in HRMS via GAP. Once the new record arrives, it is the processor's responsibility to select the Start Special Catch-up Limit Override box located on the Bonus Contribution tab. This will process the Special Catch-up.

This action should not be taken in retro, so if this is missed, the dates should be adjusted to process in the current period.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

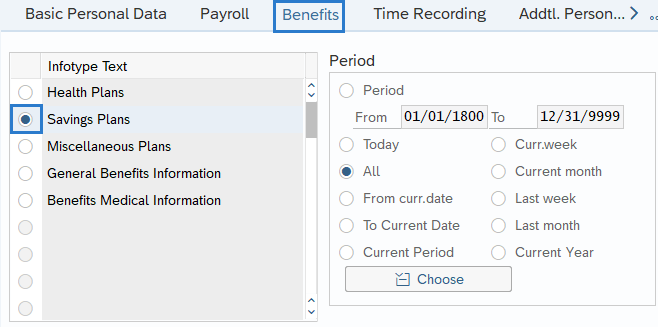

Step 4

On the Benefits tab, select the Savings Plans radio button.

-

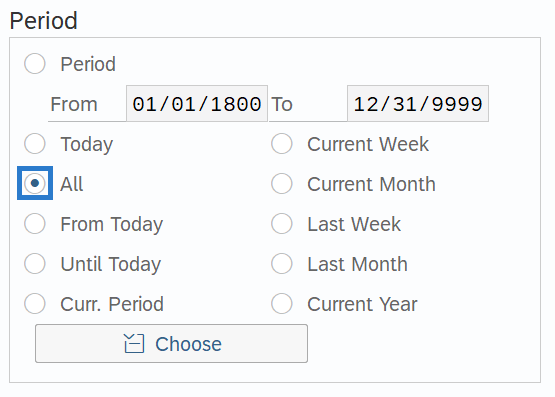

Step 5

In the Time period section, select All.

-

Step 6

Click the Overview button.

-

Step 7

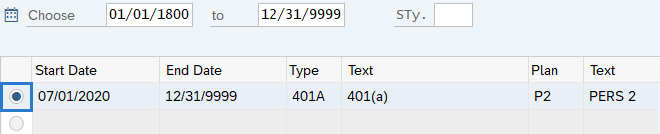

Select the radio button to the left of the record you wish to copy.

-

Step 8

Click the Copy button.

-

Step 9

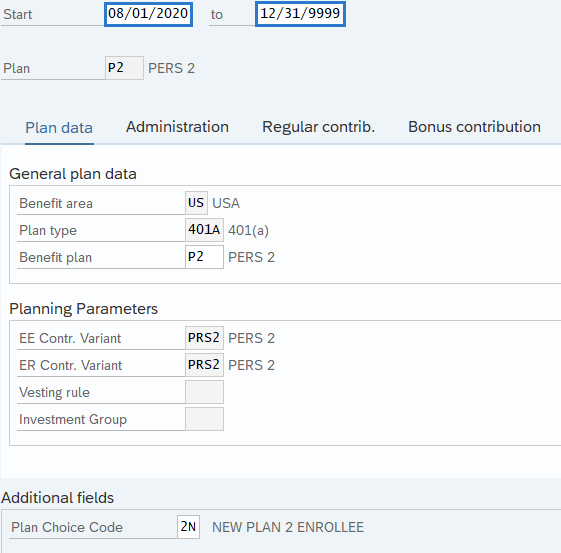

Enter the appropriate Start and To dates.

TIPS:

TIPS:When using the Copy button, the Start and To dates will populate with the dates of the existing record. Be sure to enter the new Start and To dates to keep the history of the existing record.

The Start date should reflect the first day of the period. Please contact Department of Retirement Systems for guidance prior to creating a retroactive record.

Do not correct a PERS 3 plan in retro. Department of Retirement Systems recommends correcting the Savings Plan beginning in the current period and moving forward. Please contact Department of Retirement Systems for guidance.

In most cases, the To date should reflect the end date of 12/31/9999.

-

Step 10

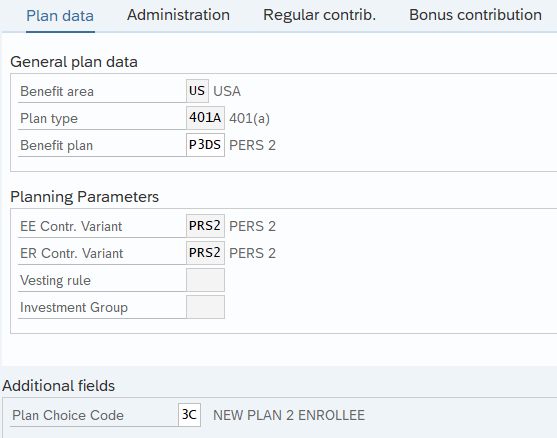

Enter the necessary changes to the record.

TIPS:

TIPS:If changing Benefit plan to PERS 3 (P3), enter the correct PERS 3 Benefit Plan from the employee’s Member Information Form and enter the correct Plan Choice Code. You will also need to change the percentage amount on the Regular Contrib. Tab.

-

Step 11

Click the Enter button to validate the information.

-

Step 12

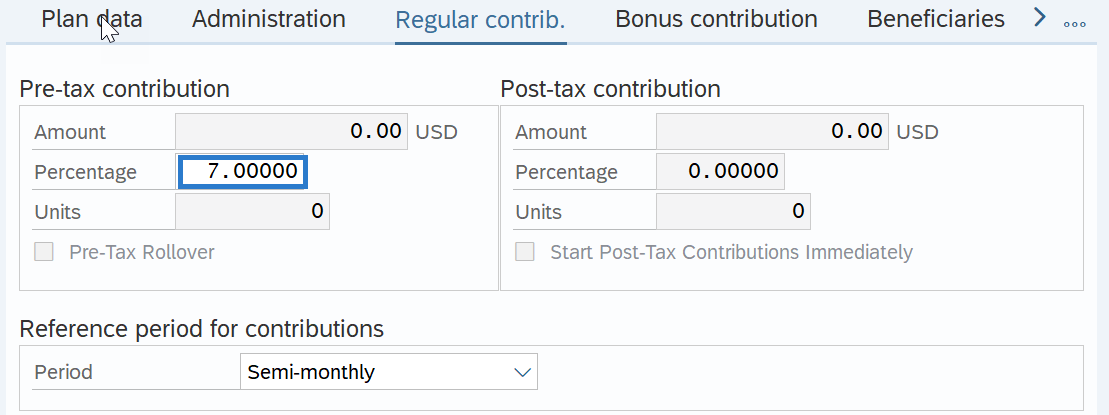

On the Regular Contrib. (Regular Contribution) tab complete the following field:

The following field is mandatory:

- Percentage

Enter the employee’s contribution percentage for their plan. If you are uncertain of the current percentage rate, click the Enter button one time to see a warning message containing the correct percentage.

-

Step 13

Click the Enter button to validate the information.

-

Step 14

Click the Save button.