Savings Plans - Create New Record

Use this procedure to create a new Savings Plans (0169) infotype record. Creating a new record is necessary when a new employee is hired into a retirement-eligible position or when an employee is newly eligible for a retirement plan.

For a new hire employee, creating a Savings Plans (0169) infotype record is completed through the PA40 action unless you exited the action prior to completion.

If you are manually creating benefits records in PA30, ensure the employee has an active General Benefits Information (0171) infotype record prior to completing this procedure. Refer to the General Benefits Information user procedures.

Before beginning this procedure, follow the steps in Chapter 2 of the DRS ERA Employer Handbook to determine the employee’s eligibility for membership. If the employee has not previously had retirement benefits, they may have a 90-day window to choose a plan, and potentially a rate:

- PERS (P2 or P3) - 90-day window for plan (P2 and P3) and rate (P3 rate only)

- TRS (T2 or T3) - 90-day window for plan (T2 and T3) and rate (T3 rate only)

- PSERS (N2) - no 90-day window

- WSPRS (S2) - no 90-day window

For PERS and TRS plans, after 90 days, if the employee has not made a selection, they will be defaulted to PERS2/TRS2 within the ERA. No action is needed in HRMS.

If an employee chooses PERS3 or TRS3, benefits processors must create an updated Savings Plans (0169) infotype record following this user procedure.

Before creating a new Health Savings Account (HSA) record, validate that the employee is currently enrolled in a Consumer Directed Health Plan (CDHP) medical plan. If you are uncertain, contact Health Care Authority to determine or confirm eligibility.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

Step 4

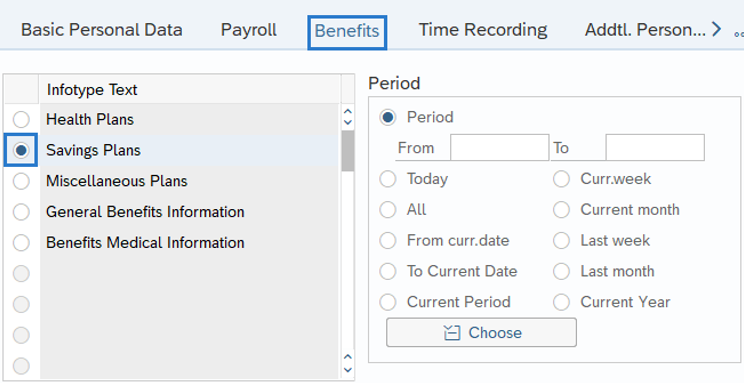

On the Benefits tab, select the Savings Plans radio button.

-

Step 5

Click the Create button.

-

Step 6

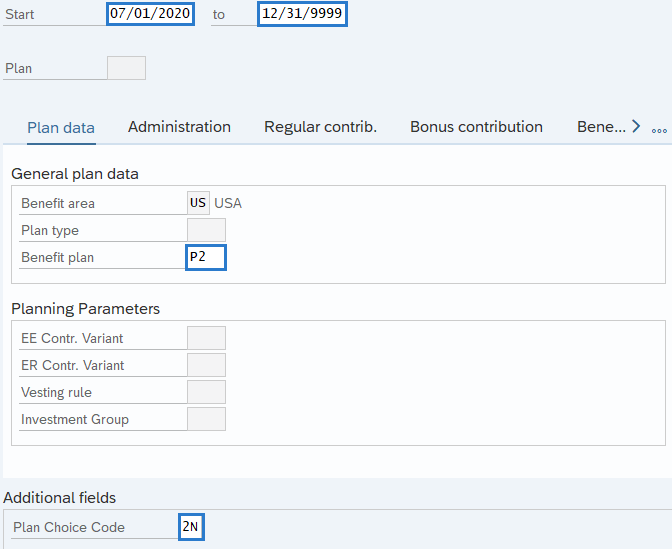

On the Plan Data tab, complete the following fields:

The following fields are mandatory:

- Start

- To

- Benefit plan

- Plan Choice Code

TIPS:

TIPS:The Start date should reflect the hire date. If the employee is transferring to your agency from a ineligible position, the Start date should reflect the first day of the period they transfer. Please contact Department of Retirement Systems for guidance prior to creating a retroactive record.

The To date should reflect the end date of 12/31/9999.

Enter the Plan Choice Code that corresponds with the ERA Member Verification Report.

Returning PERS/TRS Plan 3 members will have 90 days to select a rate and investment option or they will default to Rate Option A, Self Investment program.

-

Step 7

Click the Enter button to validate the information.

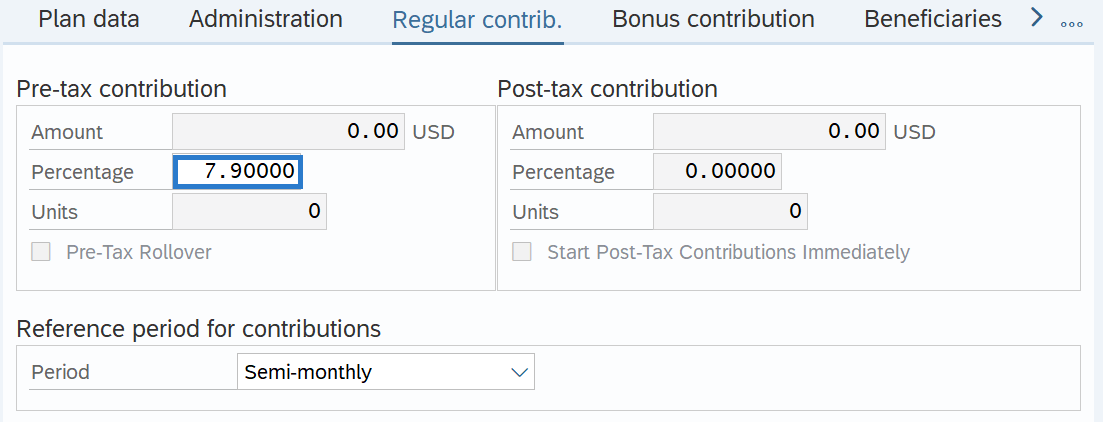

TIPS:You will be taken to the Regular Contrib. (Regular Contribution) tab.

-

Step 8

Complete the following field:

The following field is mandatory:

- Percentage

TIPS:

TIPS:Enter the employee’s contribution percentage for their plan. If you are uncertain of the current percentage rate, click the Enter button one time to see a warning message containing the correct percentage.

-

Step 9

Click the Enter button to validate the information.

-

Step 10

Click the Save button.