Bank Details - Create New Record

Use this procedure to create an employee’s warrant or direct deposit elections on the Bank Details (0009) infotype. Creating a new record is necessary when the employee does not have an active infotype record or when the employee has an existing infotype record but you do not want to copy over the existing data fields.

The Bank Details (0009) infotype is created during the New Hire or Rehire Action using PA40 and defaults to a warrant. If you receive the Authorization for Automated Clearing House (ACH) Direct Deposit of Wages form within the same payroll period as the original entry, you may use the change (pencil) function to update the record. Refer to the Bank Details - Change Existing Record user procedure.

In order to process payroll, employees must have an active Bank Details (0009) infotype record.

Use the Corrections and Returns Report (ZHR_RPTPY151) on a daily basis for any Notifications of Changes (NOC) or Returns. Failure to monitor this report may result in Automatic Deposits not being processed accurately.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

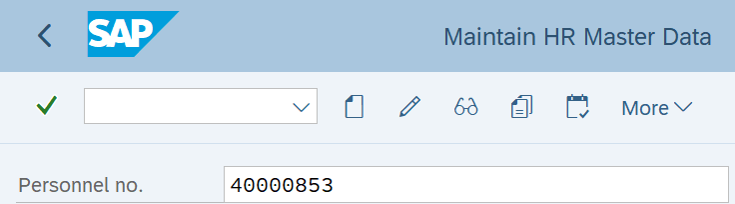

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

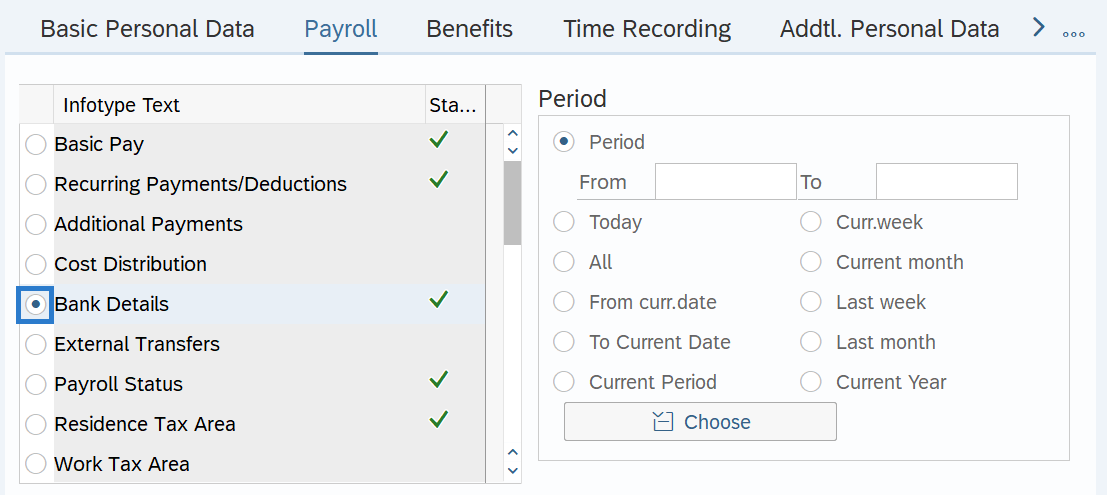

Step 4

On the Payroll tab, select the Bank Details radio button.

-

Step 5

Click the Create button.

-

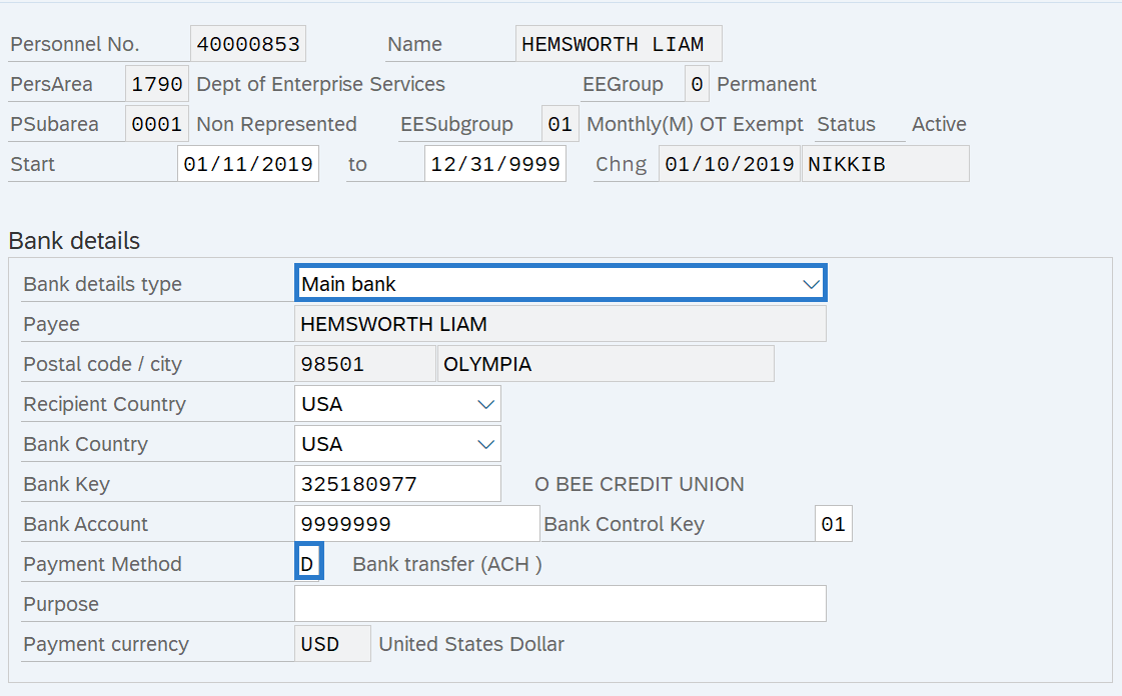

Step 6

Complete the following fields:

The following fields are mandatory:

- Start

- To

- Bank Details Type

- Payment Method

- C – Warrant

- D – Bank transfer (ACH)

If you selected D - Bank transfer (ACH), the following fields are also mandatory:

- Bank Key

- Bank Account

- Bank control key

- 01 – Checking

- 02 - Savings

TIPS:

TIPS:The record start date is typically the new hire date or a calendar day after the last pay date.

Bank Details Type must be Main Bank.

The State of Washington does not accommodate payments to multiple financial institutions.

If the Payment Method is C - Warrant, the Bank Key and Bank Account fields must be blank.

State of Washington employees may opt to utilize two direct deposit options which will deposit employee’s net funds into their desired account type using ACH (Automated Clearing House):

- Traditional checking or savings account the employee has set up directly with their financial institution, or

- The U.S. Bank Focus Card, which is a prepaid Visa® offered through the State of Washington as an alternative to receiving paper checks.

Employee’s choosing the U.S. Bank Focus Card will require assistance from agency payroll processors to setup their prepaid card. After the one-time setup process is complete, U.S. Bank issues a card in the employee’s name and mails it to the employee. Prior to the first use, employees must activate the card either by phone (877-474-0010) or by visiting U.S. Bank website. Once the card has been activated, the cardholder must contact the agency payroll office to initiate electronic deposit of payroll funds.

Refer to the State of Washington Payroll Card Program and OFM’s Focus Card FAQs for more information on Focus bank cards.

If the employee has completed the Authorization for Automated Clearing House (ACH) Direct Deposit of Wages form identifying where they would like their pay check deposited, complete the Bank Key, Bank Account, Bank control key, and Payment method fields.

For Payment Method D – Bank transfer (ACH):

- Bank Key is often referred to as the bank or financial institution’s routing or transit number.

- For Bank control key, use 01 for checking and 02 for savings accounts.

When entering or changing a Bank transfer (ACH) record, the system initiates the pre-note process. The first ACH transfer of wages will depend on when the record was keyed. A Bank transfer (ACH) record keyed 10 day prior to Payroll Day 3 will be in effect for that payroll. If the record is not keyed 10 days prior to Day 3, the system may create a warrant for that payroll.

Consider sending an EFT Employee Letter after you have created or maintained an employee's Bank Transfer (ACH) record. Refer to the EFT Employee Letter report procedure.

Important note for Bank transfer (ACH): You must monitor Corrections and Returns (ZHR_RPTPY151) Report for Notifications of Changes (NOC) or Returns (NOR) reported by the financial institution. Failure to do so may result in deposits not processing correctly.

-

Step 7

Click the Enter button to validate the information.

-

Step 8

Click the Save button.