Payroll Results Adjustment – Change Existing Record

Use this procedure to make a correction to an existing Payroll Results Adjustment (0221) infotype record.

Using the change function does not allow a correction to the Check Date in the Payroll Results Adjustment (0221) infotype. If you are updating the Check Date, use the Payroll Results Adjustment (0221) – Copy and Update Record procedure to create a new record and delete the incorrect record. You should only use the Change Existing record procedure to update Payroll Results Adjustment section of the record.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

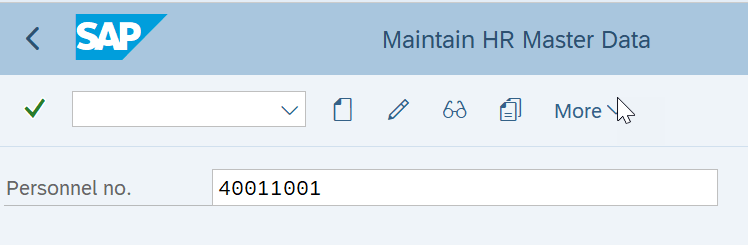

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

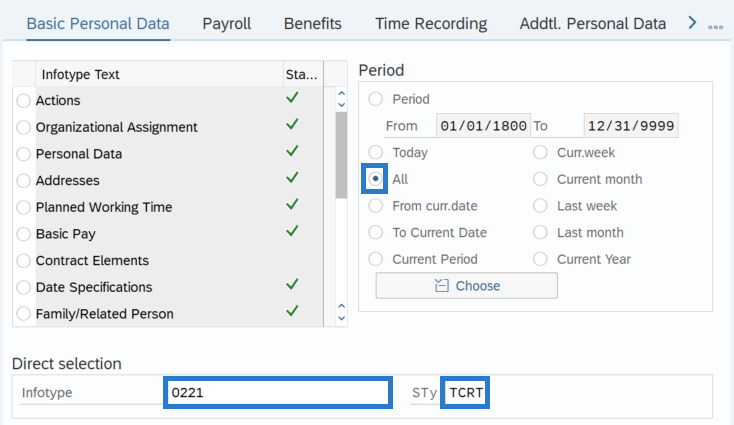

Step 4

In the Direct selection Infotype and STy fields, enter the appropriate infotype and Subytpe for your adjustment:

- 0221

- TCRT

-

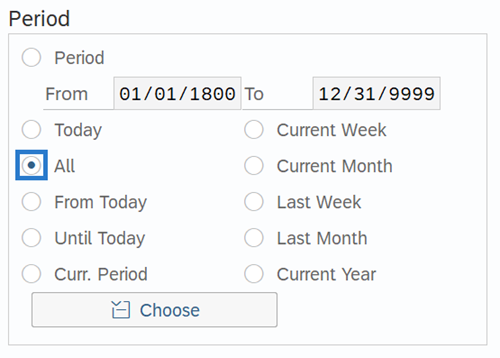

Step 5

In the Time period section, select All.

-

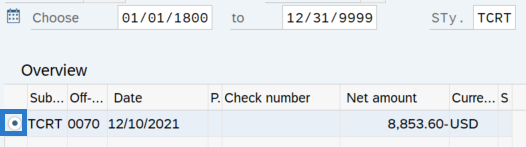

Step 6

Click the Overview button.

-

Step 7

Select the radio button to the left of the record you wish to correct.

-

Step 8

Click the Change button.

TIPS:Using the Change button overwrites the existing record and should only be used when making corrections.

-

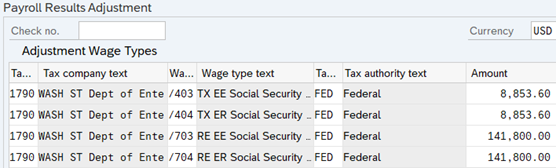

Step 9

Enter the necessary changes to the record.

-

Step 10

Click the Enter button to validate the information.

-

Step 11

Click the Save button.

TIPS:To verify the adjustments have successfully processed, run a Payroll Simulation for the employee.

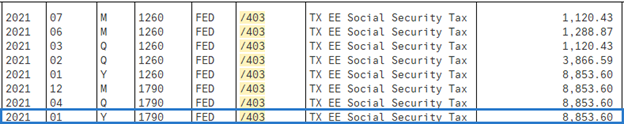

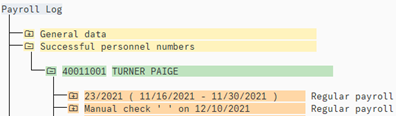

After saving a Payroll Results Adjustment record, the Payroll Simulation will reflect an additional ‘Manual check’ line item:

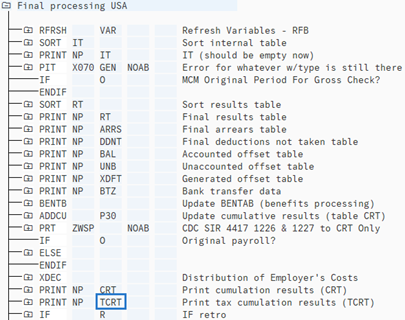

Expanding the following folders in the Manual Check section will detail the Tax Cumulated Results Table (TCRT) as shown below:

- Successful Personnel Numbers

- Personnel Number – Name

- USPS Payroll

- Final Processing USA

- TCRT (double click directly on TCRT to select)

Using Find, enter each wage type you adjusted. You will see that the gaining agency now has the amount adjusted included in the YTD totals: