Withholding Info W4/W5 US - Create New Record

Use this procedure to create a new Withholding Info W4/W5 US (0210) infotype record for an employee. Creating a new record is necessary when the employee does not have an active infotype record, when the employee has an existing infotype record but you do not want to copy over the existing data fields, or when an out-of-state employee provides you with an Idaho or Oregon W4 form and they do not have an active Idaho or Oregon record to copy.

In order to process payroll, employees must have an active federal Withholding Info W4/W5 US (0210) infotype record.

Please note per the Education Jobs and Medicare Assistance Act the W5 has not been used since 2010.

Tax overrides from Add. Withh. Info. US (0234) infotype will appear in Withholding Info W4/W5 US (0210) records. Federal, Idaho, and Oregon tax overrides cannot be maintained directly in Withholding Info W4/W5 US (0210). Refer to the Add. Withh. Info. US procedures.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

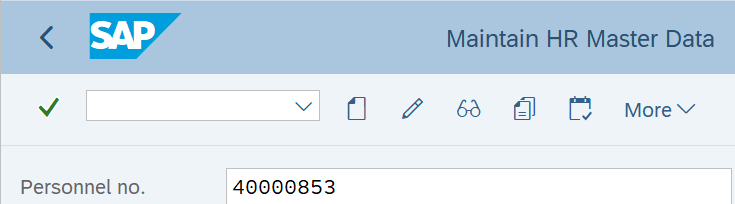

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

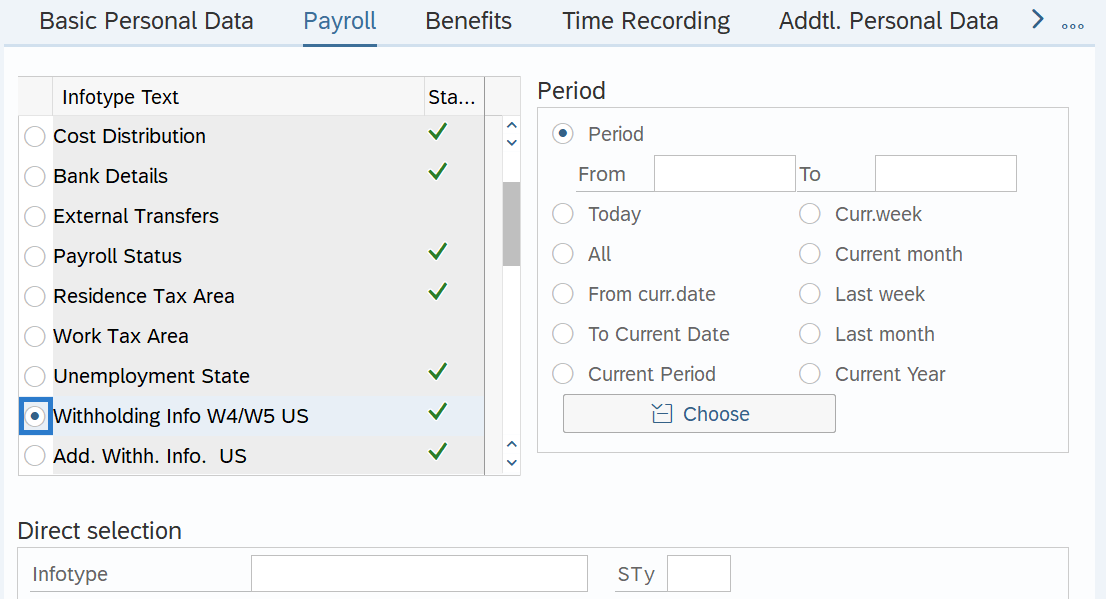

Step 4

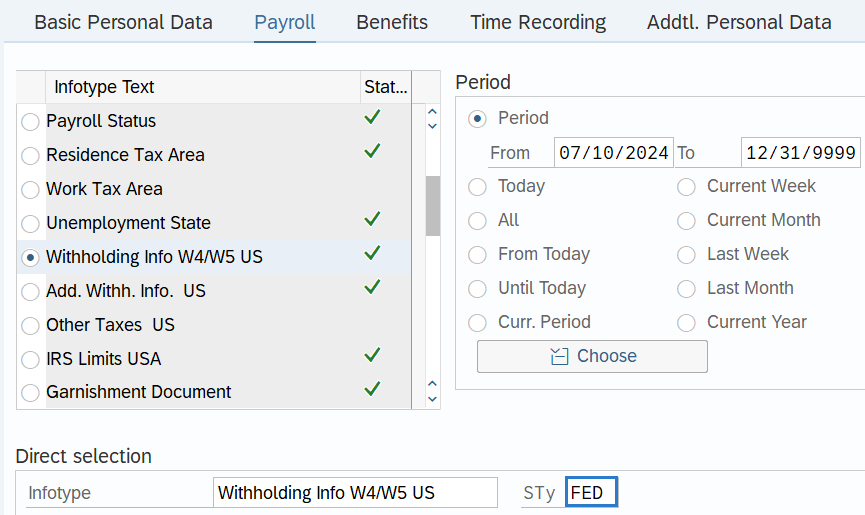

On the Payroll tab, select the Withholding Info W4/W5 US radio button.

-

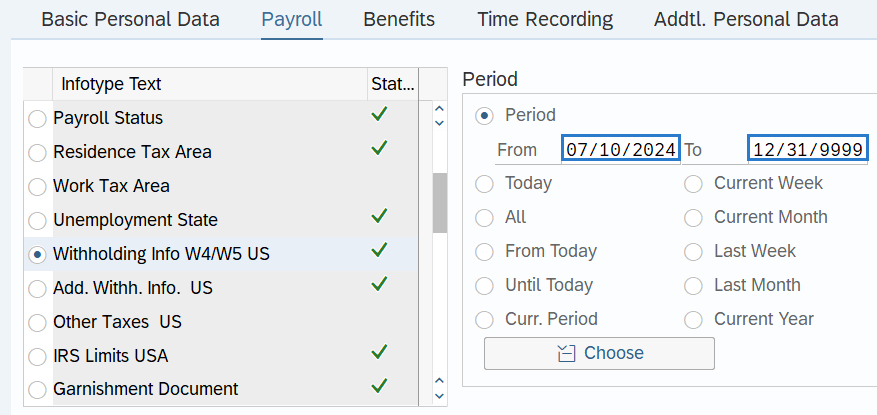

Step 5

In the Time period section, select the Period radio button and enter the effective dates of the Withholding Info W4/W5 US record.

TIPS:

TIPS:The From date should reflect the actual check date the Form W-4 is effective OR the New Hire start date for a new employee. If you are uncertain of the check date, refer to the Payroll Calendar.

The To date should reflect the end date of the elections. For example:

- If you are creating an exemption and the exemption is ongoing, use 12/31/9999 as the end date.

- If the exemption is to end, use the day before the check date in which the exemption ends as the end date.

When making a retroactive change in accordance with the specific check date, use the day after the last check date. For example, if the change you are making affects the April 10th check date, enter a start date of March 26th.

HRMS will not retroactively collect taxes from an employee, but will refund an employee and correctly adjust the employer amounts (both collect or refund). Do not make retroactive changes across business areas or calendar years.

-

Step 6

In the Direct Selection Infotype STy, enter the appropriate :

- FED

- ID

- OR

TIPS:

TIPS:Use Fed (Federal) for IRS Form W-4 Employee Withholding Certificates.

Use ID (Idaho) for Idaho Form ID W-4 Employee Withholding Allowance Certificates.

Use OR (Oregon) for OR-W-4 Oregon Withholding Statement and Exemption Certificates.

If the employee didn't provide an Oregon or Idaho form W-4, HRMS will withhold amounts based on their Federal Withholding Info W4/W5 US (0210) record. It is strongly recommended that employees submit an Oregon or Idaho W-4 to ensure withholding amounts are correct.

-

Step 7

Click the Create button.

TIPS:If you entered FED in the Direct Selection, move on to Step 8 and then skip steps 9 and 10.

If you entered ID in the Direct Selection Infotype STy, go to Step 9 and skip steps 8 and 10.

If you entered OR in the Direct Selection Infotype STy, skip to Step 10.

-

Step 8

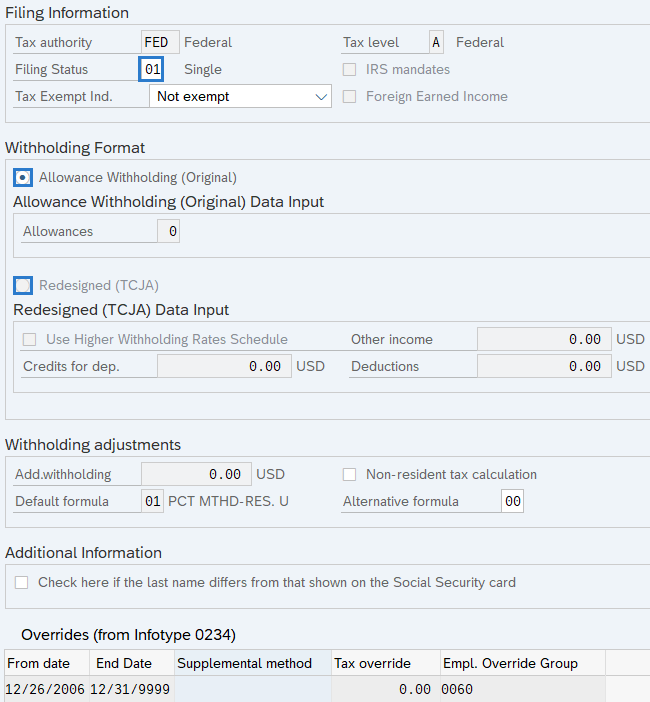

For Federal, complete the following fields:

The following fields are mandatory:

- Start

- Filing Status

- Withholding Format:

- Allowance Withholding; or

- Redesigned (TCJA)

The following fields are optional:

- Tax Exempt Ind.

- Allowances

- Use Higher Withholding Rates Schedule

- Credits for dep.

- Other income

- Deductions

- Add.withholding

- Non-resident tax calculation

TIPS:

TIPS:Use Allowance Withholding (Original) if the employee’s form is dated prior to January 2020. Use Redesigned (TCJA) if the employee’s form is dated January 2020 to current.

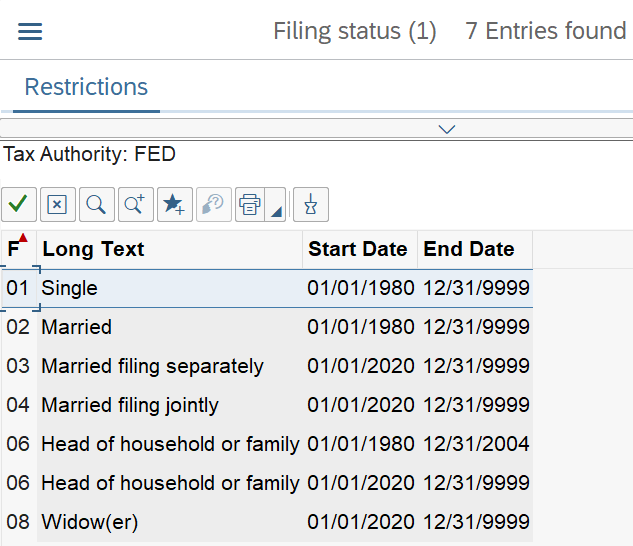

Filing Status should contain the box checked in Step 1(c) of the Form W-4:

- Single or Married filing separately:

- 01 or 03

- Married filing jointly (or Qualifying widow(er))

- 04 or 08

- Head of household

- 06

- NOTE: Do not use 02 as it is for employees that have an active Form W-4 from 2019 or earlier.

- Single or Married filing separately:

The Use Higher Withholding Rates Schedule indicator should be checked if the employee has checked the box in Step 2 of the Form W-4.

Credits for dep. should reflect the total amount in Step 3 of the Form W-4

The Tax Exempt Ind. field determines if the employee is exempt from taxation. The field will default to not exempt.

Using the Tax Exemption indicator “Y” will make the wages exempt from taxation and not reportable to the IRS.

- Example for this indicator: Payments processed for deceased employees.

Using the Tax Exemption indicator “R” will make the wages exempt from taxation and earnings reportable to the IRS.

- Example for this indicator: Employees who submit a W-4 with the filing status of “exempt.” Employees claiming except from withholding will write the word ‘Exempt’ in the space under Step 4(c) of the Form W-4.

Add.withholding should contain the amount in Step 4(c) of the Form W-4.

The Non-resident tax calculation indicator should be selected for an employee designated as a non-resident for payroll tax calculation purposes. See Publication 515, Withholding of Tax on Nonresident Aliens and Foreign Entities.

Other income should contain the amount in Step 4(a) of the Form W-4.

Deductions should contain the amount in Step 4(b) of the Form W-4.

-

Step 9

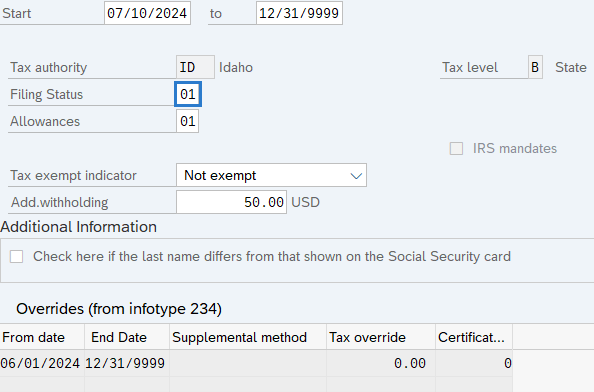

For Idaho, complete the following fields:

The following fields will default:

- Start

The following fields are mandatory:

- Filing Status

The following fields are conditional:

- Allowances

- Add. Withholding

- Tax exempt indicator

TIPS:

TIPS:The start date will default based off your entry in Step 5. You may update this field if necessary.

Filing Status should contain the Withholding Status selection of the Form ID W4:

- 01 - Single

- 02 - Married

- 15 - Married, but withhold at Single Rate

Allowances should contain the Total Number of Idaho Allowances listed in box 1 of the Form ID W-4, if entered.

Add. Withholding should contain the Additional Amount listed in box 2 of the Form ID W-4, if entered.

Enter the appropriate Tax Exempt Indicator if the employee wrote “Exempt” on line 1 of the Form ID W-4.

The state of Idaho does not currently use any other selections that are available on the Withholding Info W4/W5 US (0210) infotype.

-

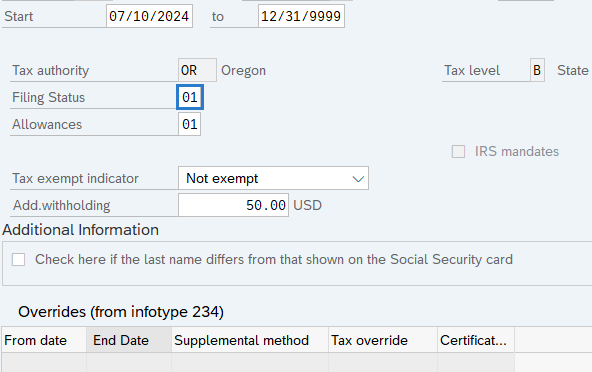

Step 10

For Oregon, complete the following fields:

The following fields will default:

- Start

The following fields are mandatory:

- Filing Status

The following fields are conditional:

- Allowances

- Add. Withholding

- Tax Exempt Indicator

TIPS:

TIPS:The start date will default based off your entry in Step 5. You may update this field if necessary.

Filing Status should contain the selection in box 1 of the Form OR W-4:

- 01 - Single

- 02 - Married

- 15 - Married, but withhold at Single Rate

Allowances should contain the Total Number of Oregon Allowances listed in box 2 of the Form OR W-4, if entered.

Add. Withholding should contain the Additional Amount listed in box 3 of the Form OR W-4, if entered.

Enter the appropriate Tax Exempt Indicator if exemption is indicated in box 4 of the Form OR W-4.

The state of Oregon does not currently use any other selections that are available on the Withholding Info W4/W5 US (0210) infotype.

-

Step 11

Click the Enter button to validate the information.

-

Step 12

Click the Save button.