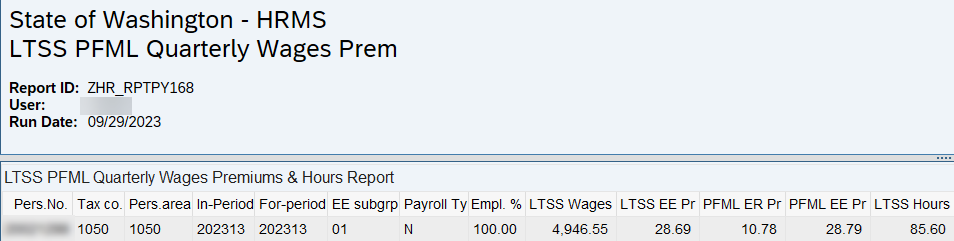

LTSS PFML Quarterly Wages Premiums & Hours Report

Use this report to identify your agency’s state of Washington Long-Term Services and Supports (LTSS or WaCares) and Paid Family Medical Leave (PFML) premiums, wages, hours and exemptions reported by the Office of Financial Management (OFM) to the Employment Security Department (ESD).

PFML Employer costs are also available on the following reports:

- Payroll Posting Report (ZHR_RPTPY126)

- Wage Type Reporter (PC00_M99_CWTR)

The report does not retain historical data. Once a new quarter is generated, the previous quarter will no longer be available. You will need to download and save a report you wish to retain before it is replaced with the new quarter data. New reports are generated on the day following the last day of the quarter (for example, the Quarter 1 report will be available until the Quarter 2 report is generated on July 1).

Beginning with the October 2023 quarterly report to ESD, OFM reports the wages and hours from technical wage type /7B3 RE EE WA Cares Fund LTC T. Prior to October 2023, technical wage type /787 EE Family Leave Insurance was used.

Since only one wage type amount and hours will be sent to ESD (wage type /7B3) for both LTSS and PFML, it is extremely important that agencies accurately code any PFML and LTSS exemptions in HRMS. Refer to the following resources to assist:

This report includes tax wage types for Washington LTSS/PFML only; employees localized to another state are not included. Agencies are responsible for all required reporting of out-of-state employees. Refer to Additional Steps for Out-of-State Employees for more information.

The HRMS Processor Guide recommends running this report quartlery to identify the premiums, wages, and hours that have been reported to ESD for the PFML and LTSS programs, and to save a copy of the report for your records.

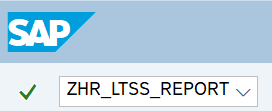

Enter transaction code ZHR_LTSS_REPORT in the command field and click the Enter button.

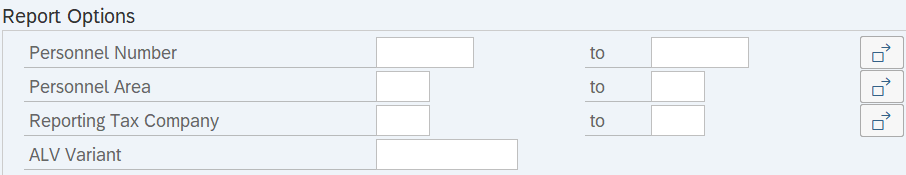

Complete the Report Options section.

The following fields are optional:

- Personnel Number

- Personnel Area

- Reporting Tax Company

- ALV Variant

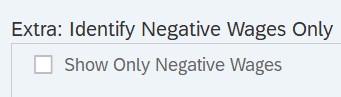

The following check box is conditional:

- Show Only Negative Wages

Tips:

Tips:The Report Options section will assist in getting only the information needed. A selection is not required for each field.

Select the Show Only Negative Wages box to identify which employees will be left off the file due to wages totaling less than zero for the whole quarter.

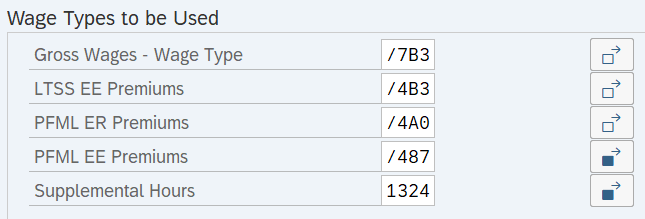

Complete the Wage Types to be Used section.

The following fields will default:

- Gross Wages – Wage Type: /7B3

- LTSS EE Premiums: /4B3

- PFML ER Premiums: /4A0

- PFML EE Premiums: /487 and /499

- Supplemental Hours: 1324, 1372, 1373, 1374, 1375, 1376, 1377, 1378, and 1383

Tips:

Tips:The following selection fields are mandatory; however, processors may update or add to the default wage types:

- Gross Wages – Wage Type: This selection defaults to provide the taxable LTSS wages (/7B3) used for reporting to the ESD. The selection can be updated to report EE Family Leave Insurance (/787), in addition to or instead of /7B3.

- Supplemental Hours: This selection defaults to provide the Supplemental Leave Hours needed to calculate LTSS wages. Supplemental Leave Hours are defined by the following wage types: 1324, 1372, 1373, 1374, 1375, 1376, 1377, 1378, and 1383.

The following selection fields are mandatory and cannot be updated or removed prior to executing the report:

- LTSS EE Premiums: This selection provides the employee premium amount for LTSS (/4B3).

- PFML ER Premiums: This selection provides the employer premium amount for PFML (/4A0).

- PFML EE Premiums: This selection provides the combined employee premium for PFML (/487 and /499).

Click the Execute button.

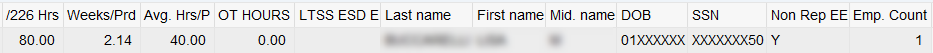

Sample report results: