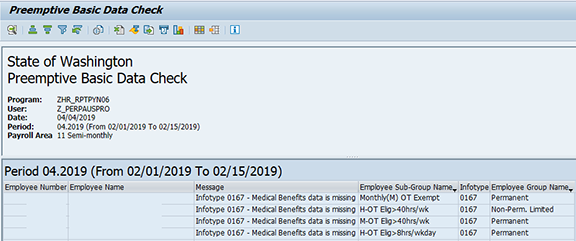

Preemptive Basic Data Check Report

Use this report to identify employees with missing infotype records in order to eliminate errors due to missing master data during payroll processing. Run this report during payroll processing Days 0-3.

This report will display missing infotype data for multiple functional areas, such as Personnel Administration, Payroll, and Benefits. All roles will see all missing infotype data, so work together to clean-up data or errors as needed.

Enter transaction code ZHR_RPTPYN06 in the command field and click the Enter button.

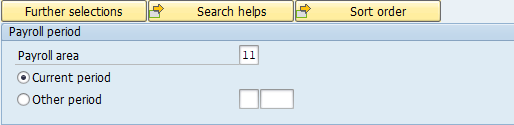

Complete the Payroll Period section.

The following field is mandatory:

- Payroll Area

Select one of the following radio buttons:

- Current period

- Other period

Tips:

Tips:The Payroll period section will determine the time period of the report results.

This section defaults to the Current period but can be changed to a different date.

When selecting the Other period radio button, enter a payroll period.

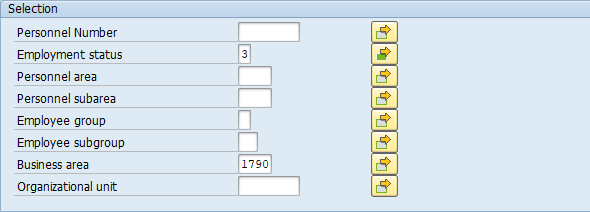

Complete the Selection section.

The following fields are optional:

- Personnel Number

- Employment Status

- Personnel Area

- Personnel Subarea

- Employee Group

- Employee Subgroup

- Business Area

- Organizational Unit

Tips:

Tips:The Selection section will assist in getting only the information needed. A selection is not required for each field.

Leaving the Employment status field blank will bring Withdrawn (0) employees into your reports results. Use this selection field to restrict your report results to only Active (3) and/or Inactive (1) employees.

Additional fields can be added to the Selection section using the Further selections button.

Complete the Infotypes Selection section.

The following Infotypes will default to selected:

- Infotype 0001 – Organizational Assignment

- Infotype 0002 – Personal Data

- Infotype 0006 – Addresses

- Infotype 0007 – Planned Working Time

- Infotype 0008 – Basic Pay

- Infotype 0009 – Bank Details

- Infotype 0027 – Cost Distribution

- Infotype 0041 – Date Specifications

- Infotype 0103 – Bond Purchase

- Infotype 0167 – Health Plans

- Infotype 0169 – Savings Plan

- Infotype 0171 – General Benefits Info

- Infotype 0207 – Residence Tax Area

- Infotype 0209 – Unemployment State

- Infotype 0210 – Withholding Info W4/W5 US

- Infotype 0234 – Add'l Withholding Info. US

- Infotype 0235 – Other Taxes

The following fields are optional for selection, but do not default:

- Infotype 0208 – Work Tax Area

- Out of State Infotype 0207 – Residence Tax Area

- Out of State Infotype 0208 – Work Tax Area

- Out of State Infotype 0209 – Unemployment State

The following field is not used by the state of Washington:

- Infotype 0168 – Insurance Benefits

Tips:Checking or unchecking the Infotypes in the Infotypes Selection section will assist in getting only the information needed. By default, all Infotypes are selected.

Consider using the buttons in the standard toolbar when selecting infotypes:

- Click the Select All button to select all infotypes.

- Click the Select OOS button to select the checkboxes directly related to out-of-state employee processing: Out of State Infotype 0207 – Residence Tax Area, Out of State Infotype 0208 – Work Tax Area, and Out of State Infotype 0209 – Unemployment State. See additional tips below for more information on the use of the Out-of-State checkboxes.

- Click the Clear All button to deselect all infotypes.

Some infotypes included in the Infotypes Selection section are not used by the state of Washington or certain agencies. If your agency does not use infotypes on this list, it is recommended to deselect them. The most common infotypes that are not used are:

- 0168 – Insurance Benefits is not used by the state of Washington.

- 0208 – Work Tax Area is only used when processing employees who are working in Oregon or Idaho.

- 0235 – Other Taxes US is only used when specific tax exemptions are present.

Use the three Out-of-State Infotype checkboxes to identify employees who have out-of-state tax areas or tax authorities entered on any of those three infotype records and the employee’s tax company is not set up to process out-of-state taxes. This might occur upon transferring an employee living or working out-of-state from an agency that was set up to process out-of-state taxes to an agency that is not set up. If the gaining agency is not set up to process out-of-state taxes, then follow the Additional Steps for Out-of-State Employees – End Out-of-State Employee procedure to end the automated out-of-state tax processing.

Deleting a Cost Distribution (0027) record for an employee will exclude the employee from returning data even when Infotype 0027 – Cost Distribution is selected in the Infotypes Selection section.

- Tips:

Columns included in the report results depend on your default layout for this report. The report layout can be changed or a previously saved layout can be selected.

The message in the above report results indicates medical benefits data is missing. The employee may not be entitled to medical benefits so missing medical benefits may be ok. This is simply a warning to double check.

The following table maps each field to the infotype.