Employee Cost Distribution - Change Existing Record

Use this procedure to make a correction to or end an employee’s existing Cost Distribution (0027) infotype record.

If Payroll is to run on an employee who was not active in the period, a Cost Distribution record should be created effective the first day of the following period the employee was active through the last day of the period you are running.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

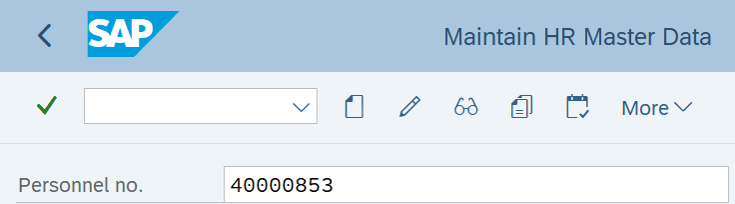

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

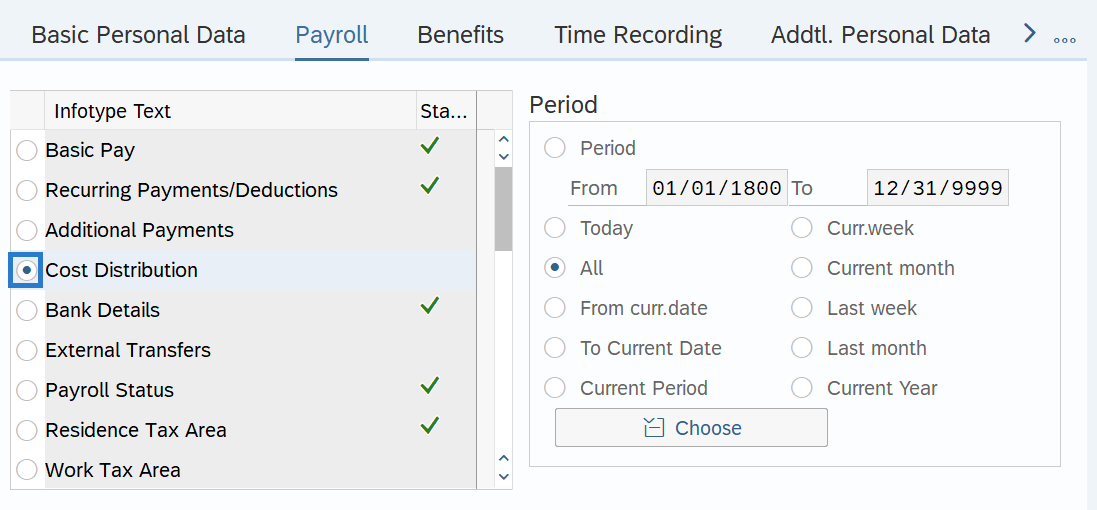

Step 4

On the Payroll tab, select the Cost Distribution radio button.

-

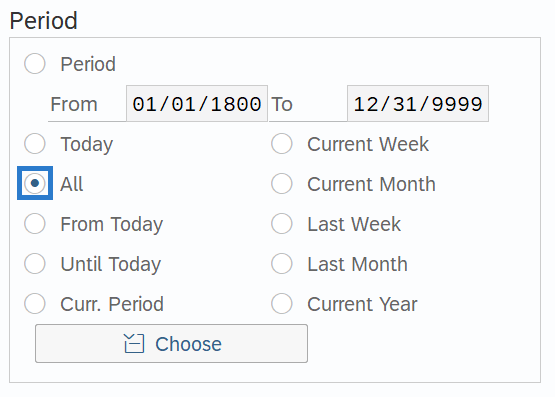

Step 5

In the Time period section, select All.

-

Step 6

Click the Overview button.

-

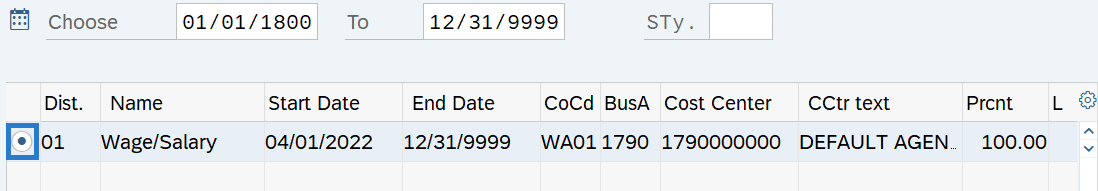

Step 7

Select the record you wish to correct or end.

-

Step 8

Click the Change button.

TIPS:Using the Change button overwrites the existing record, and should only be used when making corrections or ending the record.

-

Step 9

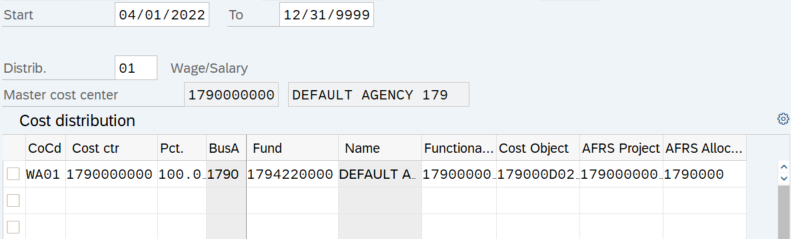

Enter necessary changes to the record.

TIPS:

TIPS:- CoCd (Company Code) will be WA01 for all agencies.

- Pct. (Percent) column should total 100%.

- If you are uncertain of a code, contact your agency Accounting Department for verification.

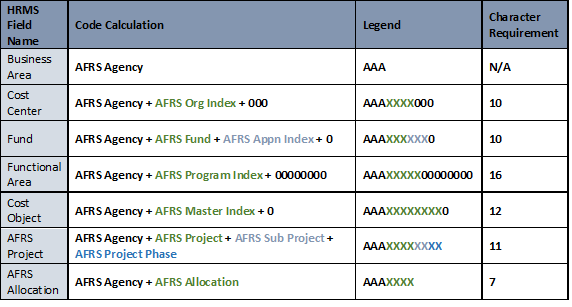

- Coding breakdown is as follows:

LEGEND:

‘A’ – Three-character business area

‘X’ – The AFRS accounting object embedded within the field

‘0’ – filler characters, usually 0 (zero)

The AFRS Master Index (referred in the table above) is an eight character AFRS account input field that agencies routinely use as an input coding reduction technique, instead of providing the full account code combination for each transaction.

When requesting an upload of a Winshuttle script for Cost Distribution (0027) infotype data, all fields and characters are required.

-

Step 10

Click the Enter button to validate the information.

-

Step 11

Click the Save button.

TIPS:Run the Payroll Simulation to Validate RPCIPE Error Corrections Report (PC00_M10_CALC_SIMU) to verify your Cost Distribution changes.