Overpayment - Transition Overpayment from Previous Year

Use the following procedure to adjust active repayment plans that started in a previous year and continue into the next year.

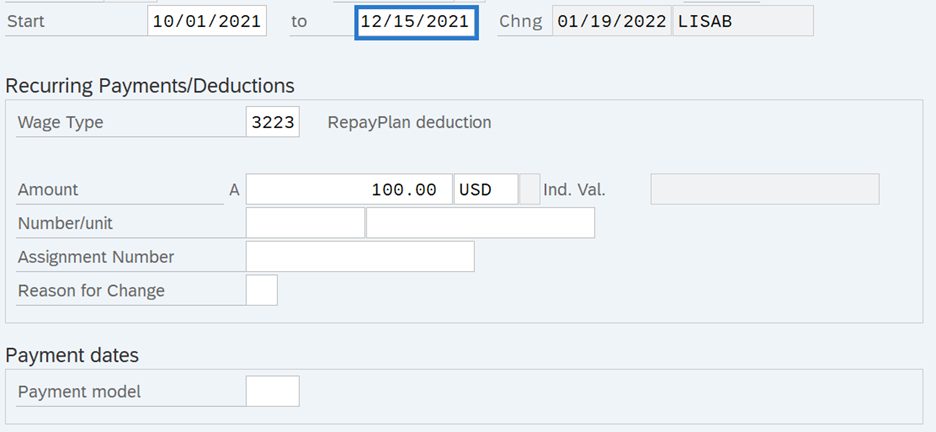

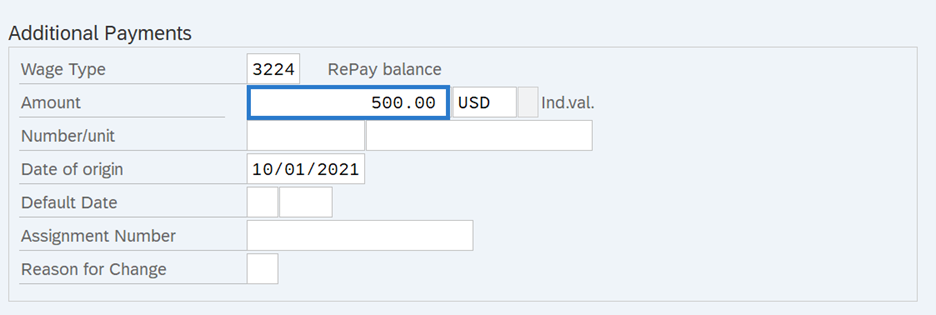

Employees who have active Recurring Payments/Deductions (0014) infotype using wage type 3223 and a remaining balance on Additional Payments (0015) infotype using wage type 3224 must have master data adjustments from gross recovery to net recovery.

In the following scenario you have identified an employee who has an active overpayment from the current processing year. The employee’s original gross overpayment totaled $900.00. The employee has agreed to repay their overpayment with $100.00 payments each pay period. The repayment plan began processing October 1st and the following payments have processed:

- October 1st (period 20) - $100

- October 16th (period 21) - $100

- November 1st (period 22) - $100

- November 16th (period 23) - $100

- December 1st (period 24) - $100

Payments in the current year total $500.00, and since the employee still owes $400.00, we must stop collecting the overpayment using wage types 3223 and 3224 (gross) and continue the remaining collection with wage types 3101 and 3111 (net).

-

Step 1

Using the Wage Type Reporter report (PC00_M99_CWTR), locate any employees with an existing wage type 3223 and wage type 3224. Note: wage type 3223 is the payment and WT3224 is the declining balance. Retain your list of employees to use in the next step.

-

Step 2

Using the Display Payroll Results Table report (PC_PAYRESULT), locate each employee’s Results Table for Period 24 and record the amounts displayed as 3224 (RePay balan) and 3225 (Repay Total).

On the results table:

- WT3224 will reflect the remaining balance, and

- WT3225 will reflect the total payments made to date.

-

Step 3

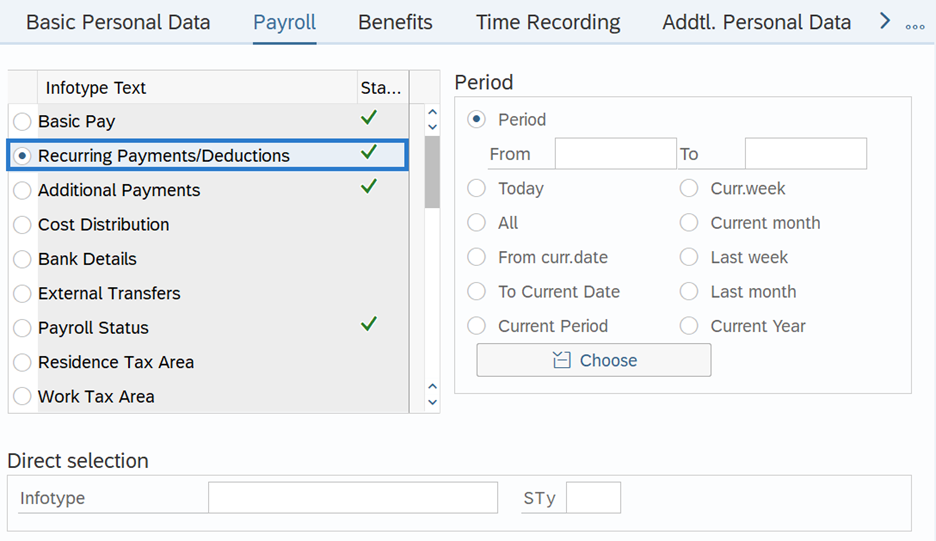

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 4

Complete the following fields:

- Personnel no.

-

Step 5

Click Enter to populate the employee information.

-

Step 6

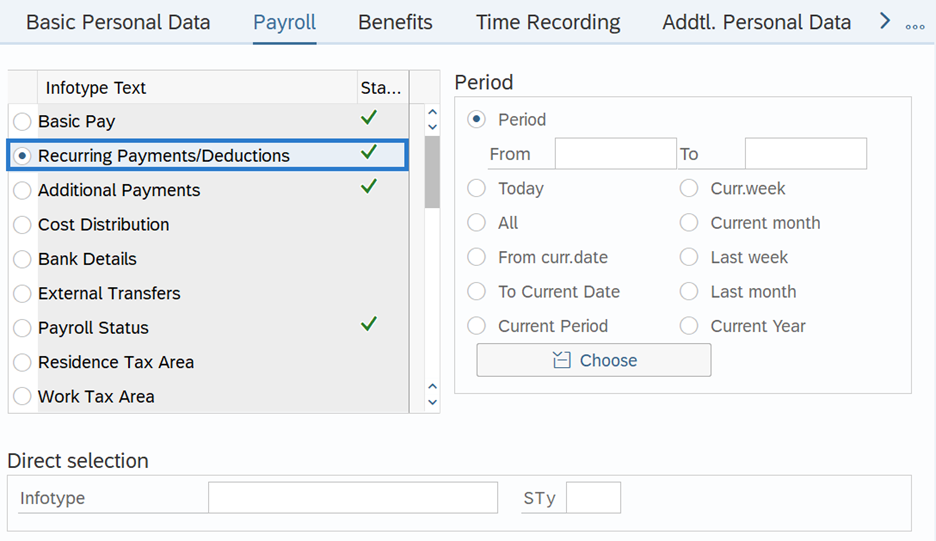

On the Payroll tab, select the Recurring Payments/Deductions radio button.

-

Step 7

Click the Overview button.

-

Step 8

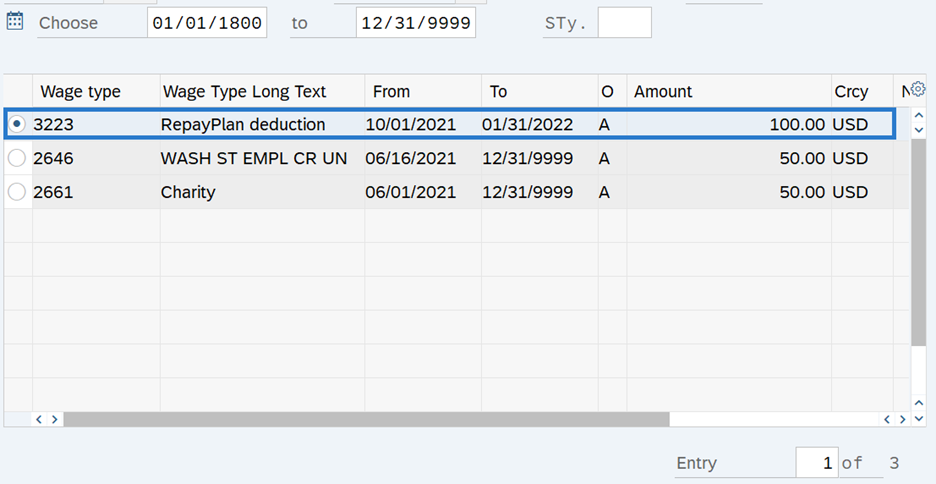

Click the radio to the left of the record you wish to update.

TIPS:

TIPS:This should be the active wage type 3223 (RepayPlan deduction) entry detailing the payment amounts.

If the employee had an odd amount in their original overpayment, there may be multiple 3223 entries for the same overpayment.

-

Step 9

Click the Change button.

-

Step 10

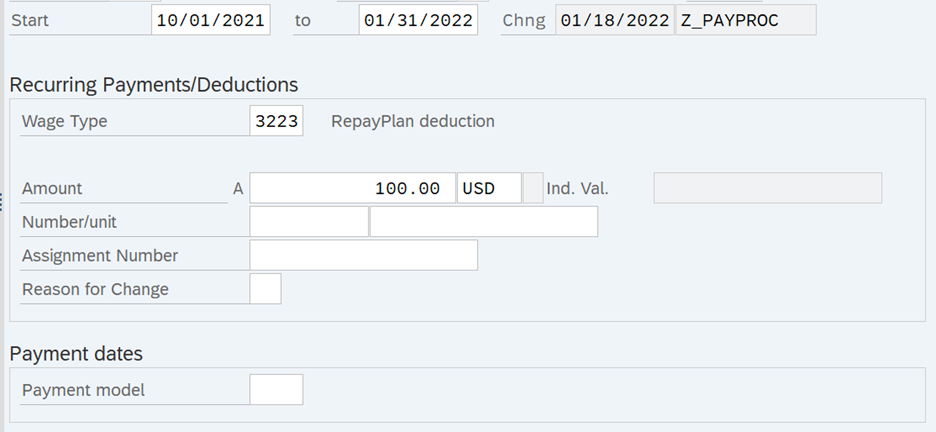

Complete the following fields:

The following fields are mandatory:

- Date of Origin

TIPS:

TIPS:End date should be 12/15 of the current calendar year.

-

Step 11

Click the Enter button to validate the information.

-

Step 12

Click the Save button.

TIPS:Most recovery wage types found in Recurring Payments/Deductions (0014) will result in a dynamic action to create an Additional Payments (0015) infotype record for the balance of the overpayment.

-

Step 13

On the Additional Payments screen, complete the following fields:

The following fields are mandatory:

- Amount

TIPS:

TIPS:Update the Amount to the amount previously identified within wage type 3225 using Display Payroll Results Table. Do not change the date.

-

Step 14

Manually calculate the remaining balance amount from wage type 3224 that was recorded in PREPARATION STEP TWO from the payroll results table and calculate the net amount to be repaid in the next calendar year. This amount is required for the next step.

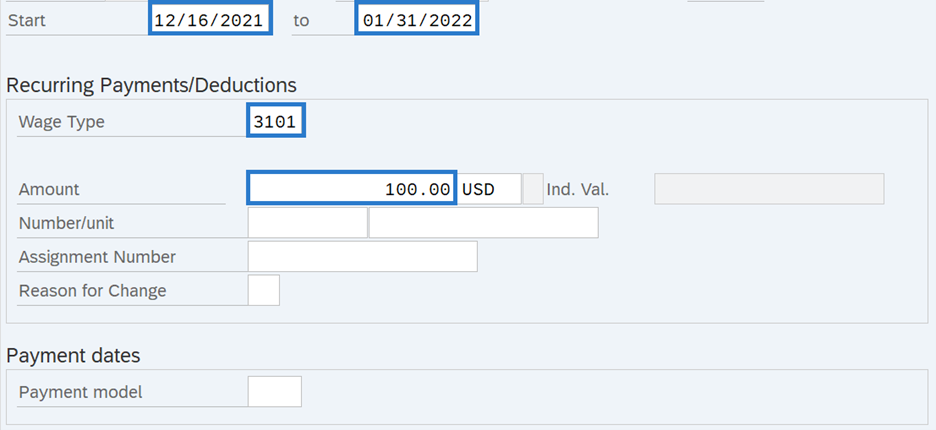

TIPS:In order to transition this overpayment from collecting a gross amount, and begin collecting a net amount, the remaining net amount due must be set up in Recurring Payments/Deductions (0014) infotype record using wage type 3101 (DB: Agency Reimbursement) with an Additional Payments (0015) infotype record using wage type 3111 (Agency Reim Bal).

The start date should be 12/16 in the current calendar year. Unlike the wage types 3223/3224, the declining balance will function as designed for wage types 3101/3111 so there is no need to be period specific with the deduction and balance amounts. Amounts entered with wage type 3101 are posted to GL1324.

-

Step 15

Go back to the Maintain HR Master Data screen.

On the Payroll tab, select the Recurring Payments/Deductions radio button.

-

Step 16

Click the Create button.

-

Step 17

Complete the following fields:

The following fields are mandatory:

- Start

- To

- Wage Type

- Amount

The following fields are optional:

- Payment Model

TIPS:- The Start date must be 12/16 of the current year.

- The To date is the end date of the Repayment Plan.

- The Wage Type is 3101 (DB: Agency Reimbursement).

Choose from one of the following Payment Model codes based on the agreement with the employee:

- WA01: Every Pay Period - Half Amount

- WA02: 25th Pay Period - Full Amount

- WA03: 10th Pay Period – Full Amount

- WA04: Every Pay Period – Full Amount

Do not use Payment Model codes other than those listed above.

-

Step 18

Click the Enter button to validate the information.

-

Step 19

Click the Save button.

TIPS:Most recovery wage types found in Recurring Payments/Deductions (0014) will result in a dynamic action to create an Additional Payments (0015) infotype record for the balance of the overpayment.

-

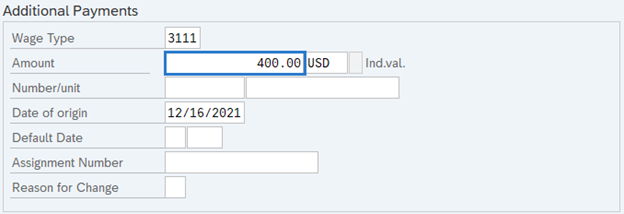

Step 20

Complete the Additional Payments (0015) infotype.

The following fields are mandatory:

- Wage Type

- Amount

TIPS:During the dynamic action, the Date of Origin will default to the Start Date used on the Recurring Payments/Deductions (0014) infotype.

The Wage Type automatically populates.

The Amount should reflect the remaining balance of the overpayment collection.

-

Step 21

Click the Enter button to validate the information.

-

Step 22

Click the Save button.

TIPS:To verify your results:

Run a Payroll Simulation (PC_M10_CALC_SIMU) for period 1 of the current year:

Review the results table from the pay simulation for period 24 and verify that there is:

- A 3223 deduction,

- A 3225 repay total, and

- No 3224 balance.

These items will validate that the prior year overpayment using wage types 3223/3224 have been properly ended.

After payroll stores the evening of Day 0, using the Payroll Results Table (PC_PAYRESULT), review the results table from period 01 to validate the correct amount is being deducted with wage type 3101. You should also see a WT3111-Agency Reim Bal and a WT3121-Agency Reimb Total.