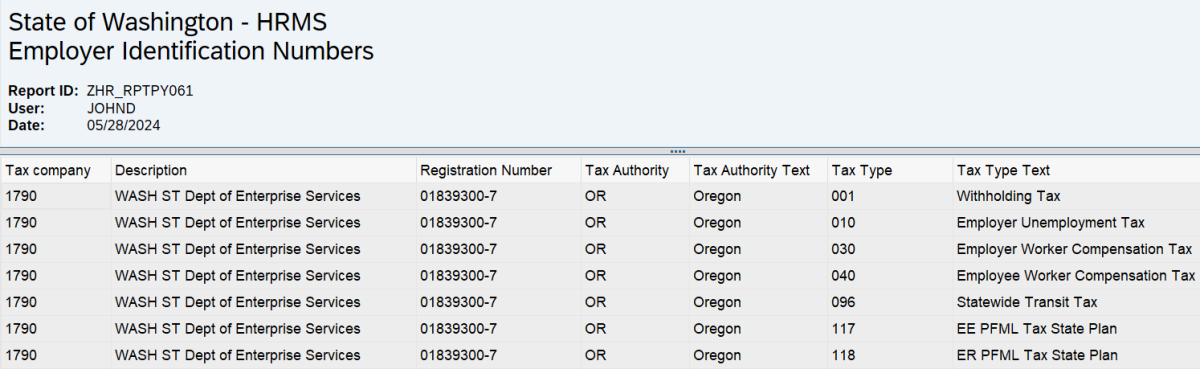

Federal / State / Local Employer Identification Numbers

Use this report to view Federal, State, and Local Employer Identification Numbers (EIN) for any tax company.

This report displays Federal, State, and Local Employer Identification Numbers (EIN) that have been configured in HRMS. Having EINs assigned to tax companies in HRMS is necessary:

- Prior to beginning system automated tax collection. (Note: HRMS is configured to process federal, Idaho, Oregon, and Washington taxes.)

- When manually collecting out-of-state taxes and the agency would like to have the state’s tax information listed on the employee’s form W-2.

Refer to the Out-of-State Tax Processing in HRMS resource for more information on configuring EINs in HRMS.

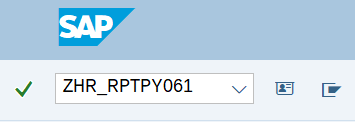

Enter transaction code ZHR_RPTPY061 in the command field and click the Enter button.

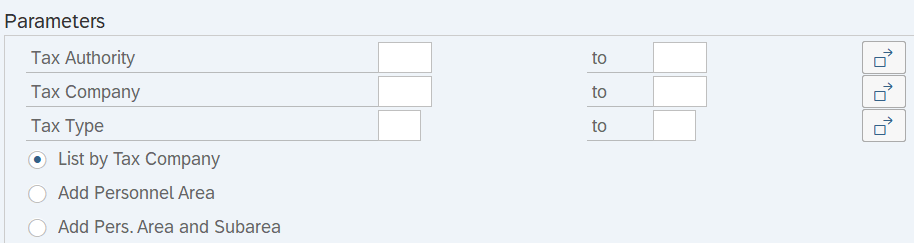

Complete the Parameters section.

The following fields are optional:

Select one of the following radio buttons:

- List by Tax Company

- Add Personnel Area

- Add Pers. Area and Subarea

Tips:

Tips:The Parameters section will assist in getting only the information needed. A selection is not required for each field.

If the Tax Authority, Tax Company, and Tax Type fields are left blank, the report will return all EINs for all tax companies, tax authorities, and tax types in HRMS. It is recommended to use the Tax Company selection field to restrict your report results to only your tax companies.

The radio button selection defaults to List by Tax Company and is the recommended selection value but can be changed to a different selection to include additional fields in the report results.

- List by Tax Company: Choose this selection to return EINs by tax company in the report results.

- Add Personnel Area: Choose this selection to also include Personnel Area information in the report results.

- Add Pers. Area and Subarea: Choose this selection to also include Personnel Area and Personnel Subarea information in the report results.

Previously saved layout variants may be added to the ALV section.

Tips:

Tips:An ALV Variant name is not required. Leaving this field blank will result in the default layout for this report.