Out-of-State Tax Authority Locator

Use this report to identify the tax area and tax authorities that may be applicable to an out-of-state employee based on where they are living and/or working. This information will be used to create the employee’s Residence Tax Area (0207) and Work Tax Area (0208) infotype records.

Washington, Oregon, and Idaho are the only states with tax areas configured in HRMS. For employees who reside and/or work outside of Washington, Oregon, or Idaho, the tax areas should remain as WA and any out-of-state taxes will need to be calculated and collected manually.

See Additional Steps for Out-of-State Employees for more information on setting up an out-of-state employee.

Work with your agency’s personnel administration processor to verify that the employee’s Permanent residence and Out-of-State Work Location records are accurate in the Addresses (0006) infotype.

Agencies will not be able to save an Oregon or Idaho residence or work tax area unless they have completed the Additional Steps for Out-of-State Employees – Set-up Tax ID Number for Out-of-State Tax Processing procedure first. This report will identify whether the tax company is set up for the suggested tax area(s).

The Out-of-State Tax Authority Locator Report will suggest tax areas or tax authorities based on the addresses used. It is the employer’s responsibility to identify and assign the correct taxes to an employee based on the tax entities’ rules. If you are not sure whether a particular tax applies to a particular employee, then work with your legal counsel.

Enter transaction code ZHR_TAXFINDER in the command field and click the Enter button.

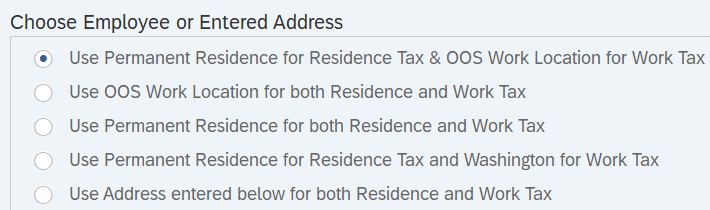

Complete the Choose Employee or Entered Address section.

Select one of the following radio buttons:

- Use Permanent Residence for Residence Tax & OOS Work Location for Work Tax

- Use OOS Work Location for both Residence and Work Tax

- Use Permanent Residence for both Residence and Work Tax

- Use Permanent Residence for Residence Tax and Washington for Work Tax

- Use Address entered below for both Residence and Work Tax

Tips:

Tips:The Choose Employee or Entered Address section will determine the addresses that are used to look up possible tax areas and displayed in the results.

The radio button will default to Use Permanent Residence for Residence Tax & OOS Work Location for Work Tax but can be changed to a different selection.

Select one of the following radio buttons depending on which address(es) you would like to use for the employee’s residence and work location:

- Use Permanent Residence for Residence Tax & OOS Work Location for Work Tax: Choose this selection to return tax authority information based off the employee’s Permanent Residence and Out of State (OOS) Work location records within the Addresses (0006) infotype.

- Choose this selection if an employee’s Permanent residence and Out-of-State Work Location are correct within the Addresses infotype and you want to use those addresses for the residence and work tax lookup.

- Use OOS Work Location for both Residence and Work Tax: Choose this selection to return tax authority information based off the employee’s Out of State Work Location record within the Addresses (0006) infotype.

- Choose this selection if you want to ignore the employee’s current Permanent residence address and use their current Out of State Work Location address for both residence and work tax lookup.

- Use Permanent Residence for both Residence and Work Tax: Choose this selection to return tax authority information based off the employee’s Permanent Residence record within the Addresses (0006) infotype.

- Choose this selection if you want to ignore the OOS Work Location address and use their current Permanent residence address for both residence and work tax lookup.

- Note: When using this selection, the system may not be able to accurately identify the work tax area in Oregon transit districts that rely on the county and/or zip code, since the employee’s Permanent residence address record doesn’t include the actual Oregon county. Consider using one of the other selection options as appropriate.

- Use Permanent Residence for Residence Tax and Washington for Work Tax: Choose this selection to return tax authority information based off the employee’s Permanent residence record within the Addresses (0006) infotype and automatically uses Washington for work tax.

- Choose this selection if the employee's permanent residence is outside of the state of Washington and the employee’s work location is in the state of Washington.

- Note: the employee will not have an OOS Work Location address record if they work exclusively in Washington.

- Use Address entered below for both Residence and Work Tax: Choose this selection to return tax authority information based off the address you manually enter in the Address section below.

- Choose this selection if the personnel administration processor has not yet updated the employee’s address records.

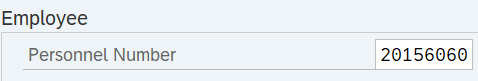

Complete the Employee section.

The following field is conditional:

- Personnel Number

Tips:

Tips:Enter the employee’s Personnel Number if you selected one of the following radio buttons:

- Use Permanent Residence for Residence Tax & OOS Work Location for Work Tax

- Use OOS Work Location for both Residence and Work Tax

- Use Permanent Residence for both Residence and Work Tax

- Use Permanent Residence for Residence Tax and Washington for Work Tax

Do not enter a Personnel Number if you selected Use Address entered below for both Residence and Work Tax.

Only one personnel number can be entered. If you have multiple employees, you will need to execute this report for each one individually.

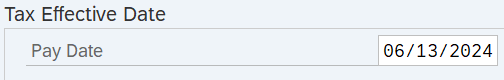

Complete the Tax Effective Date section.

The following field is conditional:

- Pay Date

Tips:

Tips:The Tax Effective Date section will determine the effective date of your report results.

The Pay Date will default to Today but can be changed to a different date.

Enter the check date for the out-of-state work or residence location if you selected one of the following radio buttons:

- Use Permanent Residence for Residence Tax & OOS Work Location for Work Tax

- Use OOS Work Location for both Residence and Work Tax

- Use Permanent Residence for both Residence and Work Tax

- Use Permanent Residence for Residence Tax and Washington for Work Tax

If you are uncertain of the check date, refer to the Payroll Calendar.

If you selected Use Address entered below for both Residence and Work Tax, you do not need to adjust the Pay Date field.

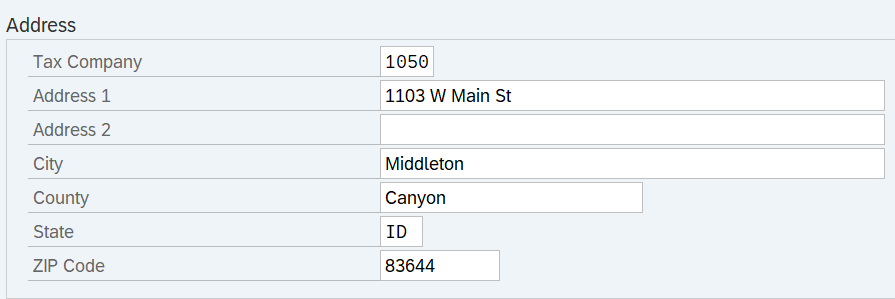

Complete the Address section only if you selected Use Address entered below for both Residence and Work Tax.

Tips:

Tips:Use the Address section if the personnel administration processor has not yet updated the employee’s address(es).

The Tax Company, Address, City, State and Zip Code fields are required.

The County field is recommended but not required. However, if a county is not entered, the system may not be able to accurately identify the work tax area in Oregon transit districts that rely on the county.

It is strongly recommended that you use the USPS Address Lookup Tool to ensure the address is entered correctly. Otherwise, the report will return an error message.

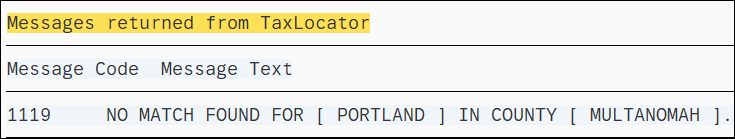

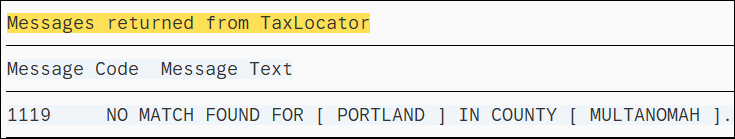

For example, this error message presented because the county of Multnomah was misspelled.

Click the Execute button.

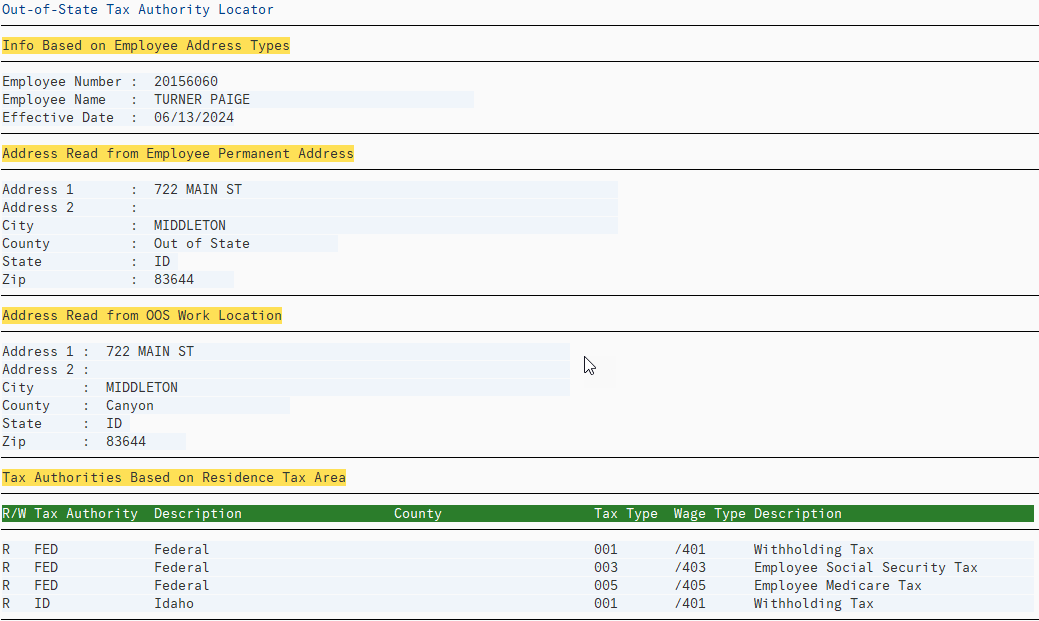

Sample report results:

Tips:

Tips:The report will return the following information:

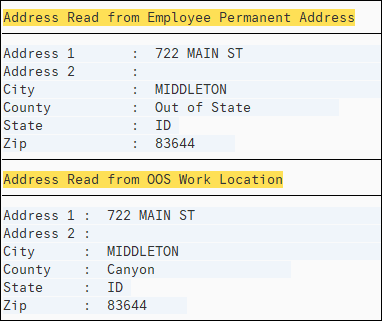

Address Read from Employee Present Address section displays the employee’s Permanent residence address. Address Read from OOS Work Location section displays the employee’s Out-of-State Work Location address(es).

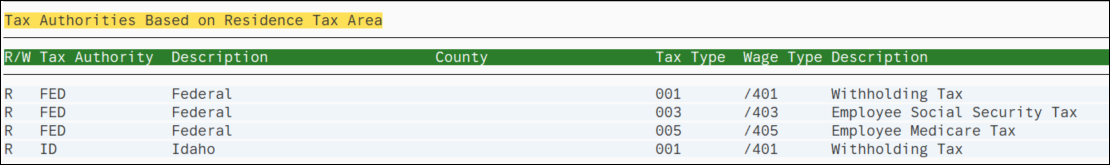

Tax Authorities Based on Residence Tax Area section displays tax authorities and tax types that might be applicable based on the employee’s Permanent residence address. The last tax authority listed will typically align with the tax area that should be entered on the employee’s Residence Tax Area (0207) record. One exception is if only Federal (FED) tax authorities are returned, then select the State of Washington (WA) as the residence tax area.

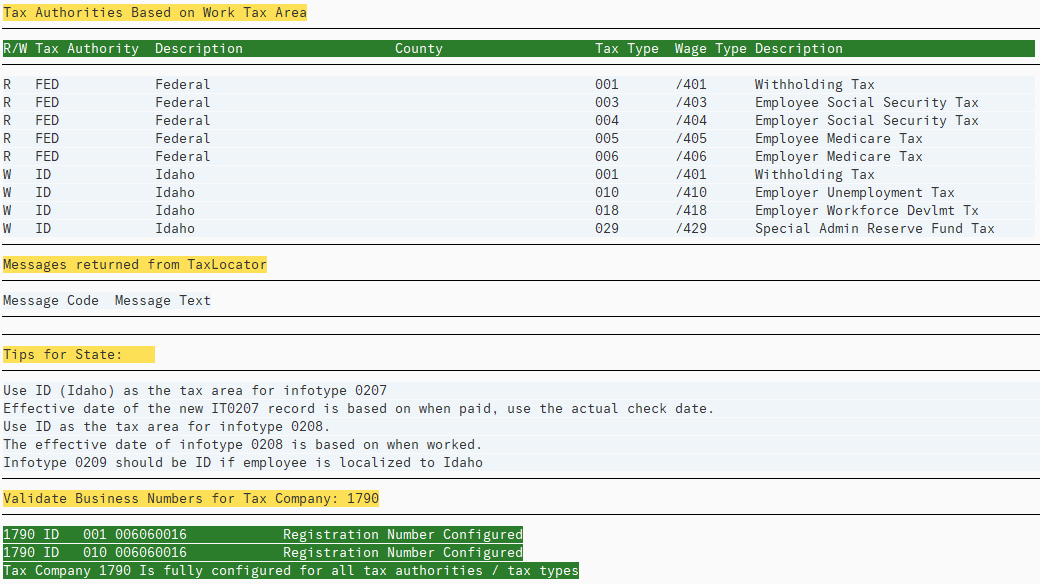

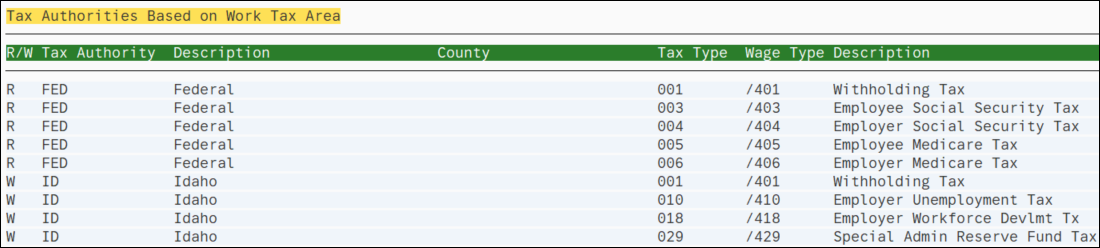

Tax Authorities Based on Work Tax Area section displays tax authorities and tax types that might be applicable based on the employee’s Out-of-State Work Location address(es). This section will also include tax authorities that may apply if the work is localized to that address’s state, however, localization is entered on Unemployment State (0209) and may be different than what’s suggested here.

The last tax authority listed will typically align with the tax area that should be entered on the employee’s Work Tax Area (0208) record.

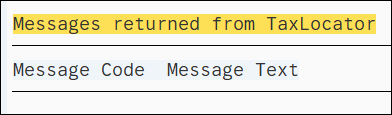

Messages returned from TaxLocator section will display an error message if the employee’s address was not entered correctly. For example, this error message presented because the county of Multnomah was misspelled.

This section will be blank if the address is correct and there are no messages.

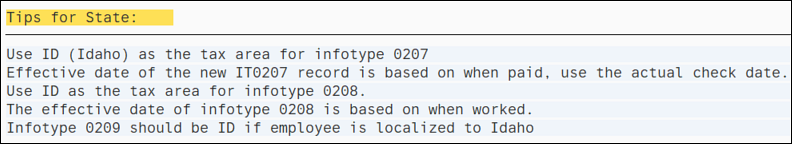

Tips for State section provides important information about what tax areas and tax authorities apply to an employee, as well as suggested effective date guidance. This information should be used to create the employee’s Residence Tax Area (0207) and Work Tax Area (0208) infotype records.

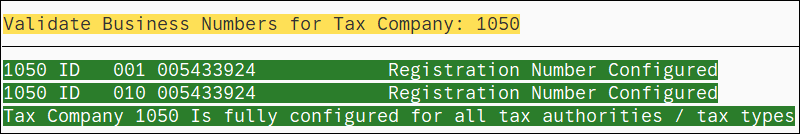

Validate Business Numbers for Tax Company section information will be highlighted in green if the tax company is set up for the suggested tax authorities and tax types.

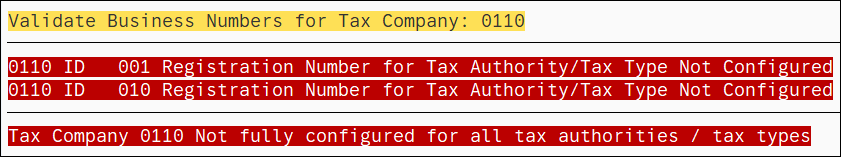

The information will be highlighted in red if the tax company is not fully configured. See Additional Steps for Out-of-State Employees – Set-up Tax ID Number for Out-of-State Tax Processing for more information.

Example Scenarios

Below are examples of running the Out-of-State Tax Authority Locator report. This is not a comprehensive list of every scenario.

Scenario 1 - Look up employee residence and work address for suggested tax area(s).

In this scenario, an employee who lives in Oregon, but who previously was working in the state of Washington, was approved to work from home. My agency’s personnel administration processor has not yet created an Out-of-State Work Location record. As a payroll processor, I am going to run the Out-of-State Tax Authority Locator report to validate the tax area(s) that will apply to this employee after they begin working from home. I can use the Permanent residence address to find both their residence and work tax areas.

On the report selection screen:

Example 2 - Lookup employee residence address for suggested tax area.

In this scenario, my agency just hired a new employee who lives in Oregon but commutes to Washington daily for work. As a payroll processor, I'm going to run the Out-of-State Tax Authority Locator report to confirm the employee’s residence tax area.

On the report selection screen: