Benefits Medical Information - Create New Record

Use this procedure to create a new Benefits Medical Information (0376) infotype record. Creating a new record is only necessary when the employee’s attestation information has been entered into Pay1 on payroll processing Day 3.

All updates to an employee’s benefit information should be entered in Pay1. This procedure should only be used if an employee’s attestation information in Pay1 has been updated on Day 3 of payroll processing and the information will not have the necessary time to GAP into HRMS.

For information regarding employee attestation requirements for PEBB benefits, contact Health Care Authority PEBB Program toll free at 1-800-200-1004.

Newly eligible employees, employees regaining eligibility, returning from waived status, or enrolling/changing a spouse or dependent in PEBB medical (age 13 or older) must attest on the PEBB Premium Surcharge Attestation Form.

Be sure to communicate with your payroll processor before entering retroactive changes to an employee's record.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

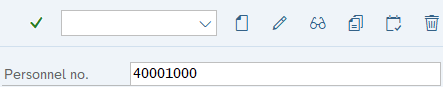

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

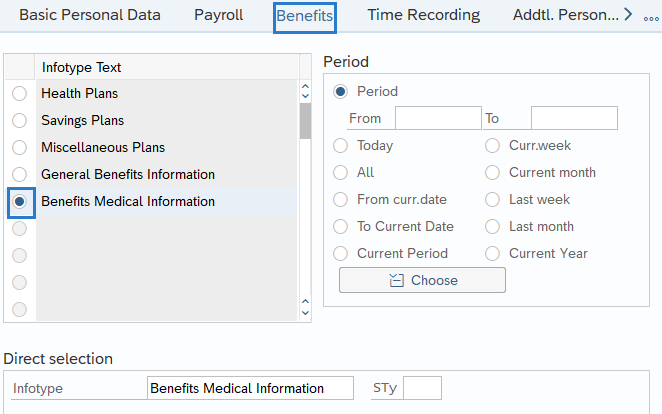

Step 4

On the Benefits tab, select the Benefits Medical Information radio button.

-

Step 5

Click the Create button.

-

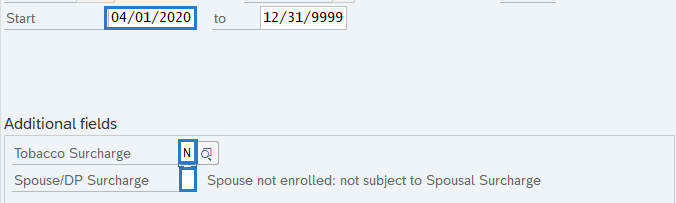

Step 6

Complete the following fields:

The following fields are mandatory:

- Start

- To

- Tobacco Surcharge

The following fields are conditional:

- Spouse/DP Surcharge

TIPS:

TIPS:The active record on the check date is the election that will process for the period.

The Start date should reflect the first working day of the month. This will allow surcharges to be effective for the 25th paycheck. You may need to manually collect the surcharge for employees for the initial 10th paycheck. Refer to eligibility tools and worksheets for more guidance and to determine if this is necessary. If a manual collection is necessary, follow the Additional Payment – Create One-Time Payment or Deduction procedure. Date the additional payment record within the current period using the appropriate corresponding wage type:

- 2578 – Tobacco Use Post Tax Adj

- 2579 – Spouse/DP HP Post tax Adj

- 2582 – Tobacco Use Pretax Adj

- 2583 – Souse/DP Pretax Adj

Also refer to the following Manual Adjustments for Healthcare Premiums procedures if manual collection is necessary:

The To date should reflect the end date of 12/31/9999.

Tobacco Surcharge options are:

- Y-Attested: subject to Tobacco Surcharge

- N-Attested: not subject to Tobacco Surcharge

- D-Not attested: subject to Tobacco Surcharge

Spouse/DP Surcharge options are:

- Blank-Spouse not enrolled: not subject to Spousal Surcharge

- Y-Attested: subject to Spousal Surcharge

- N-Attested: not subject to Spousal Surcharge

- D-Not attested: subject to Spousal Surcharge

The Spouse/DP Surcharge field is not mandatory if coverage was waived for a spouse or dependent.

-

Step 7

Click the Enter button to validate the information.

-

Step 8

Click the Save button.