Manual Adjustments for Healthcare Premiums - New Hire or Rehire - On or after the 2nd Working day of the Month

Use this procedure to assist with manual adjustments for healthcare premiums for employees who are newly hired or rehired on or after the 2nd working day of the month and are eligible for medical benefits the first of the month following their month of hire.

This procedure is for employees who are newly hired or rehired on or after the 2nd working day of the month and are eligible for medical benefits following their month of hire. Example: an employee is hired on March 2, 2022 and they are eligible for medical benefits on April 1, 2022.

When a New Hire or Rehire who is eligible for health coverage starts on the second working day of the month, additional steps may be necessary to allow payroll to process health care premiums for the (10th) pay date.

At the beginning of this procedure, you will identify whether the employee’s Medical and Dental records have arrived from HCA via the Health Benefits GAP file into HRMS. If the employee’s records arrive prior to their initial payroll processing, no action will be required by the processor. If the employee’s records do not arrive prior to their initial payroll processing, the processor will take the outlined steps in the following period to ensure the system is capable of processing the missed benefits via a forced retro.

-

Step 1

Enter transaction code PA20 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel Number

-

Step 3

Click Enter to populate the employee information.

-

Step 4

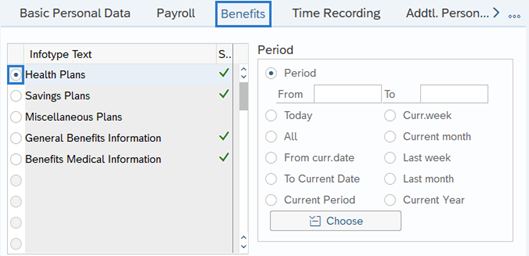

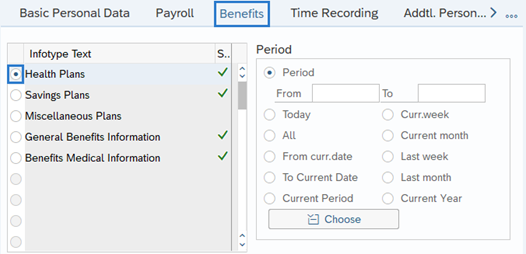

On the Benefits tab, select the Health Plans radio button.

-

Step 5

Click the Overview button.

-

Step 6

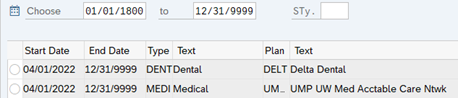

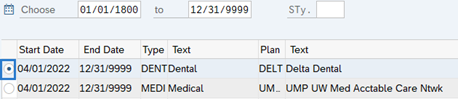

Determine if the employee has active Medical and Dental records:

If the Medical and Dental records have arrived in HRMS on or prior to Day 3 of payroll processing for the 10th pay date in the first month of eligibility:

- No action is needed, healthcare premiums will process appropriately – Click the back button and exit the transaction.

TIPS:

TIPS:An active record ends on 12/31/9999.

Using the same example listed above (hired on March 2, benefits eligible beginning April 1), if the medical and dental records have arrived in HRMS by April 6th for the April 10th pay date then no adjustments are needed and healthcare premiums will process appropriately.

Stop:If there are not active Medical and Dental records, that means the records have not arrived in HRMS prior to payroll processing for the 10th pay date in the first month of eligibility. In this scenario, adjustments will be necessary on the 25th paycheck to collect the full month’s health premiums. Continue to Step 7 of this procedure after the records have arrived in HRMS from HCA.

-

Step 7

After payroll for the 10th paycheck has completed processing and the medical and dental records arrive in HRMS, enter transaction code PA30 in the command field and click the Enter button.

-

Step 8

Complete the following field:

- Personnel Number

-

Step 9

Click Enter to populate the employee information.

-

Step 10

On the Benefits tab, select the Health Plans radio button.

-

Step 11

Click the Overview button.

-

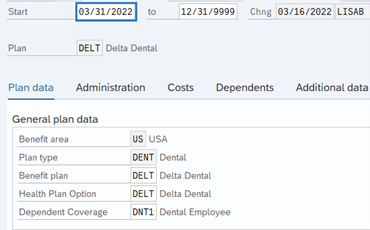

Step 12

Select the active Dental record radio button:

TIPS:

TIPS:An active record ends on 12/31/9999.

-

Step 13

Click the Change button.

-

Step 14

Complete the following fields:

The following fields are mandatory:

- Start

TIPS:

TIPS:Update the start date to reflect the last day of the previous month (the month of hire). Example: if the employee's first day was March 2, 2022, set the Start date of the record to March 31, 2022.

This action will force HRMS to retroactively calculate health benefits in the prior pay period and correct processing of those records and premiums. The retroactivity will recalculate health benefits for the 10th pay date for the first month of eligibility.

-

Step 15

Click the Enter button to validate the information.

-

Step 16

Click the Save button.