Idaho Tax Filing Report

Use this report to view Idaho tax information from stored payroll results for a selected quarter, period, or multiple periods. This report will display tax withholding amounts and wages for employees subject to Idaho taxes.

This report provides stored payroll results for Idaho state income and unemployment (UI) taxes. The information in the report can be used to help agencies complete their Idaho tax filings/reporting.

The HRMS Processor Guide recommends running this report each pay period on Day 1 to ensure Idaho taxes are processing as expected, and each quarter to assist with applicable state and local tax entity reporting requirements.

See Additional Steps for Out-of-State Employees for more information on setting up an out-of-state employee.

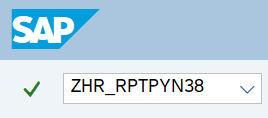

Enter transaction code ZHR_RPTPYN38 in the command field and click the Enter button.

- Tips:

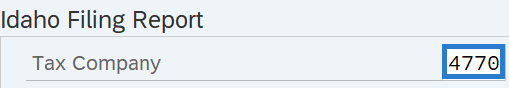

Enter an appropriate tax company. For agencies with more than one tax company, the report will display tax company results for both the agency and any subagencies.

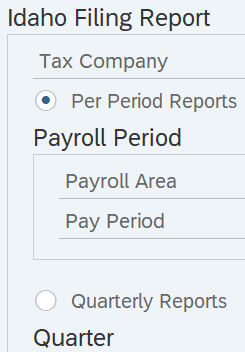

Select the appropriate radio button:

- Per Period Reports

- Quarterly Reports

Tips:

Tips:The radio buttons will determine the time period of the data that will display in the results.

The radio buttons will default to Per Period Reports but can be changed to a different selection.

Use the Per Period Reports selection to select one or more pay periods. If you selected Per Period Reports, proceed to Step 4 and then skip Step 5.

Use the Quarterly Reports selection to select one full quarter. If you selected Quarterly Reports, skip to Step 5.

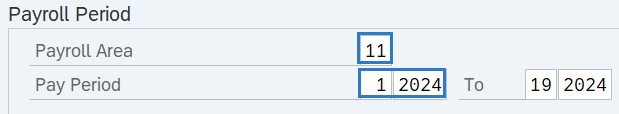

For Per Period Reports, complete the following fields:

- Payroll Area

- Pay Period

The following field is optional:

- Pay Period To

Tips:

Tips:Per Period Reports will display results for a selected period or range of periods.

The state of Washington only uses Payroll Area 11 – Semi-Monthly.

The Pay Period field will default to the current pay period but can be changed to a different selection.

You can view results from multiple pay periods by entering a period in the To field. These pay periods must be within the same year.

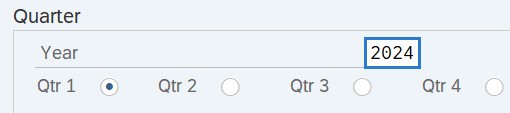

For Quarterly Reports, complete the following field:

- Tax Year

Select one of the following radio buttons:

- Qtr 1

- Qtr 2

- Qtr 3

- Qtr 4

Tips:

Tips:Quarterly Reports will display results for the selected tax quarter.

The selection will default to Qtr 1 but can be changed to a different quarter.

Previously saved layout variants may be added to the ALV Parameters section.

Tips:

Tips:The following statewide layout variants are available:

- /MAIN (Payroll Period Layout)

- /MAIN R (Payroll Period Range)

- /QTR (Quarterly Report)

An ALV variant name is not required. Leaving this field blank will result in a default layout (/MAIN) for this report.

Click the Execute button.

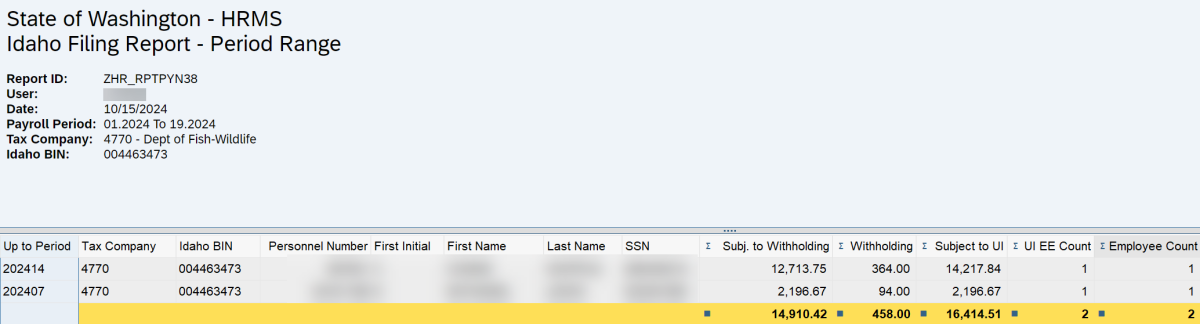

Sample report results:

Tips:

Tips:Columns included in the report results depend on your default layout for this report. The report layout can be changed, saved, or a previously saved layout can be selected.

The full column names will display when hovering the cursor over the column headings.