Garnishments - Standard Processing - Create Adjustment Refund

Use this procedure to adjust the amount being deducted from an employee’s pay for a garnishment on the Garnishment Order (0195) and Garnishment Document (0194) infotypes. Perform this procedure when a vendor has refunded the agency for overpaid garnishment funds.

A garnishment must be in Released status to reactivate for refund.

A creditor may send a garnishment refund check directly to your agency. Your agency will need to process this refund using one of the following options:

- Deposit funds into Account 035, GL 5199 and create a garnishment refund using the Additional Payment - Create one-time Payment or Deduction procedure with wage type 3100; or

- Follow the steps as outlined in this procedure.

An adjustment refund cannot take place if more than 180 days have passed since the garnishment was last active. If it is outside of the 180 day window, the refund must be processed using the Additional Payment - Create One-time Payment or Deduction procedure with Wage Type 3100.

Once the payroll process has begun for the current period, a garnishment document should not be updated. If trying to change a document after Day 0 of payroll has processed, you will need to contact the OFM Help Desk at HeretoHelp@ofm.wa.gov to request for Stored Results to be deleted.

Before you begin, if you have questions on administering a garnishment, please contact the Public Records and Constituent Services Unit at the Attorney General’s Office:

(360) 753-9673

publicrecords@atg.wa.gov

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

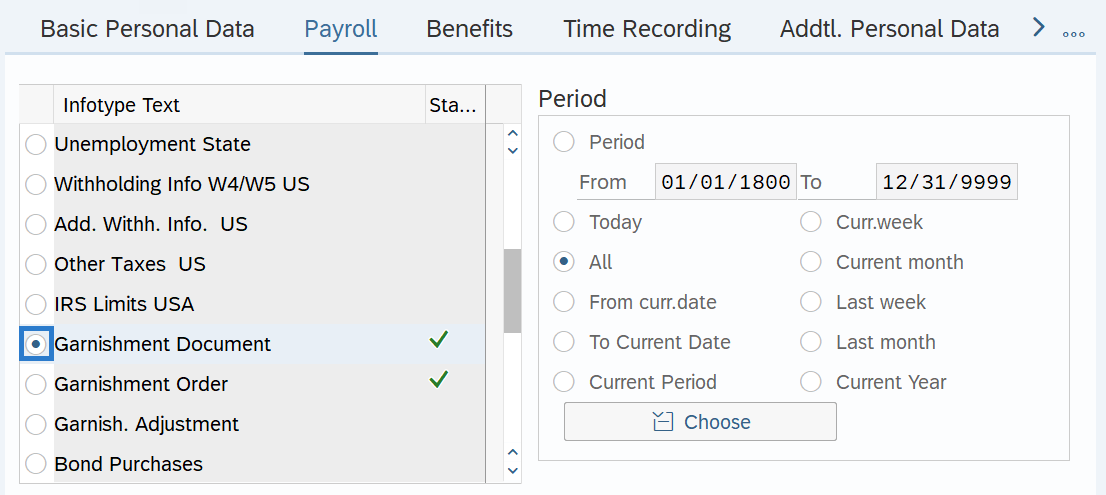

Step 4

On the Payroll tab, select the Garnishment Document radio button.

-

Step 5

Click the Overview button.

-

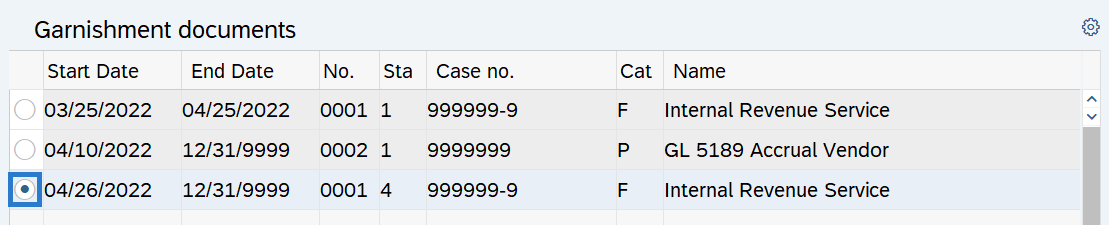

Step 6

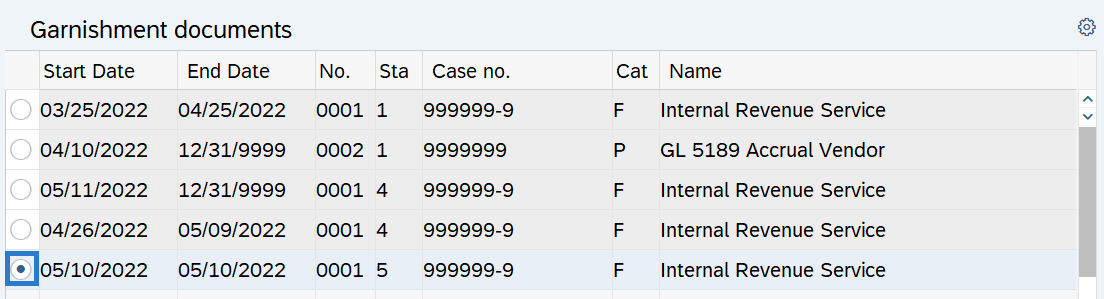

Select the radio button to the left of the garnishment you wish to reactivate for refund.

TIPS:

TIPS:To determine which garnishment is in “released” status, look in the “Sta” column of the overview. Garnishments with the following numbers listed in that column are:

- Active

- Pending

- Inactive

- Released

- Reactivated for refund

- Rejected

- Bankrupt

-

Step 7

Click the Copy button.

-

Step 8

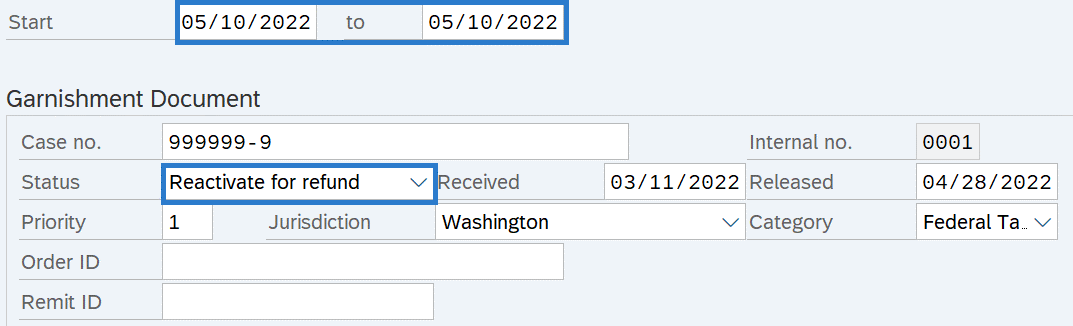

Complete the following fields:

The following fields are mandatory:

- Start

- To

- Status

TIPS:

TIPS:The Start and To date should reflect the actual check date the refund is to begin for the employee. If you are uncertain of the check date, refer to the Payroll Calendar.

The Status should be Reactivate for Refund.

-

Step 9

Click the Save button.

-

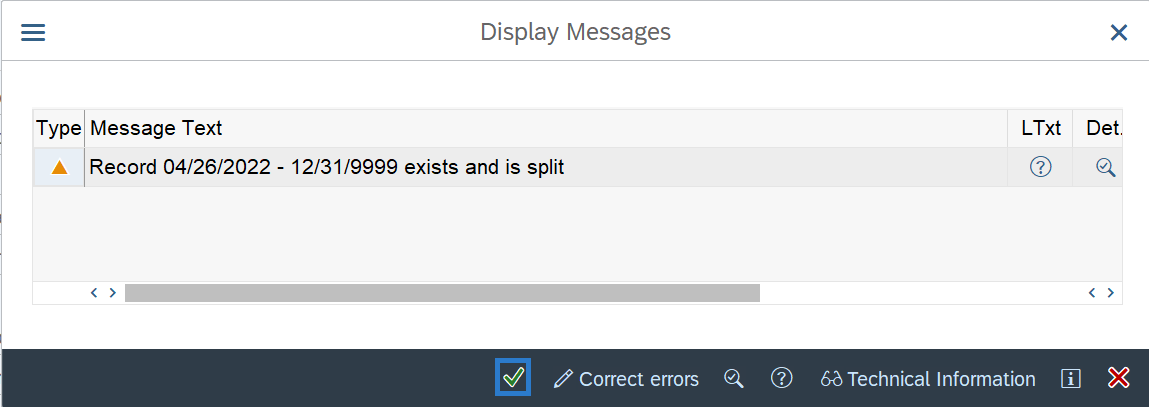

Step 10

Click Continue in the Display Messages dialog box.

TIPS:

TIPS:Once you click on continue, you will be taken to the List Garnishment Document to select the correct garnishment for the refund.

-

Step 11

Select the radio button to the left of the garnishment for the refund.

-

Step 12

Click the Change button.

-

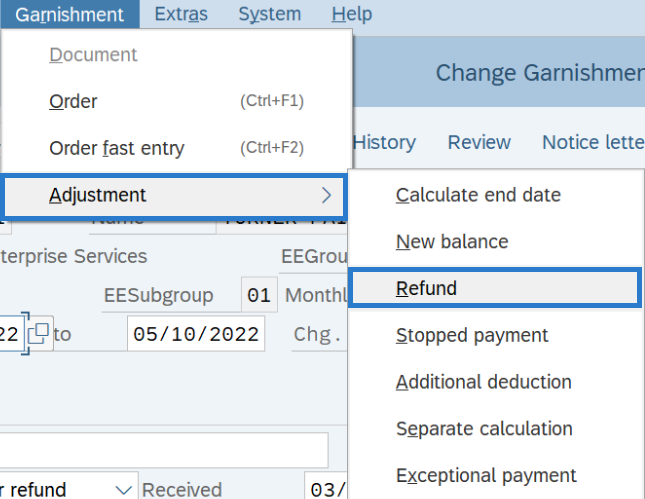

Step 13

From the Menu bar, click Garnishment/Adjustment/Refund.

-

Step 14

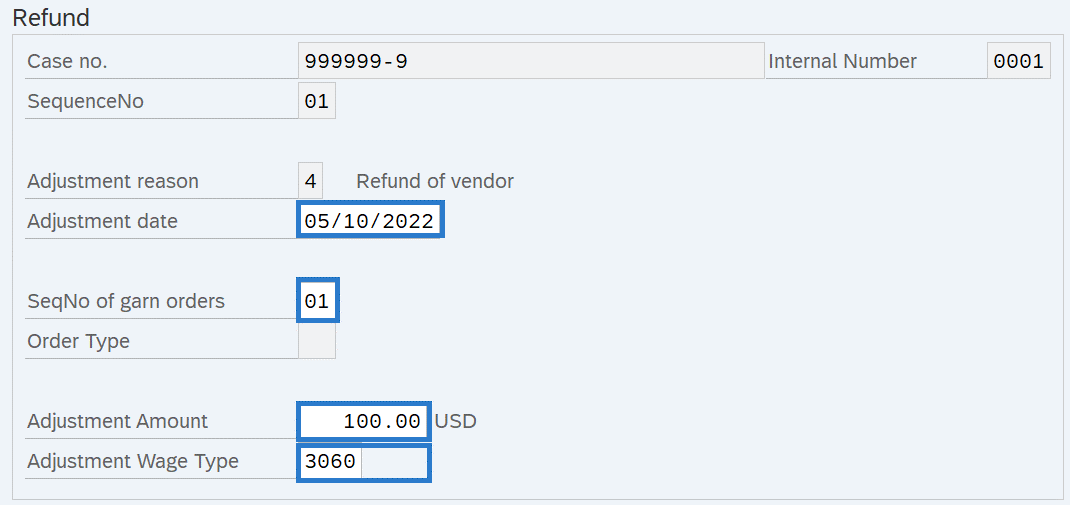

Complete the following fields:

The following fields are mandatory:

- Adjustment Date

- SeqNo of garn orders

- Adjustment Amount

- Adjustment Wage Type

TIPS:

TIPS:The Adjustment Date is the actual check date the refund is to begin for the employee. If you are uncertain of the check date, refer to the Payroll Calendar.

The SeqNo of garn orders is associated with the number of garnishment orders that exist for the employee.

The Adjustment Amount is the dollar amount of the refund to be adjusted.

The Adjustment Wage Type is the wage type representing the type of garnishment adjustment being created. Use the matchcode if you are uncertain of the adjustment wage type.

-

Step 15

Click the Enter button to validate the information.

-

Step 16

Click the Save button.