Garnishments - Standard Processing - Create Garnishment

Use this procedure to create a garnishment on the Garnishment Document (0194) and Garnishment Order (0195) infotypes. Perform this procedure when a garnishment document is received by the agency.

If you received a writ of garnishment, refer to the Garnishments - Writ Processing - Create Writ procedure instead.

Refer to the Statewide Administrative & Accounting Manual 25.60 - Garnishment and Wage Assignments and the OFM Statewide Accounting Garnishments & Overpayments resources for more information.

Before you begin, if you have questions on administering a garnishment, please contact the Public Records and Constituent Services Unit at the Attorney General’s Office:

(360) 753-9673

publicrecords@atg.wa.gov

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

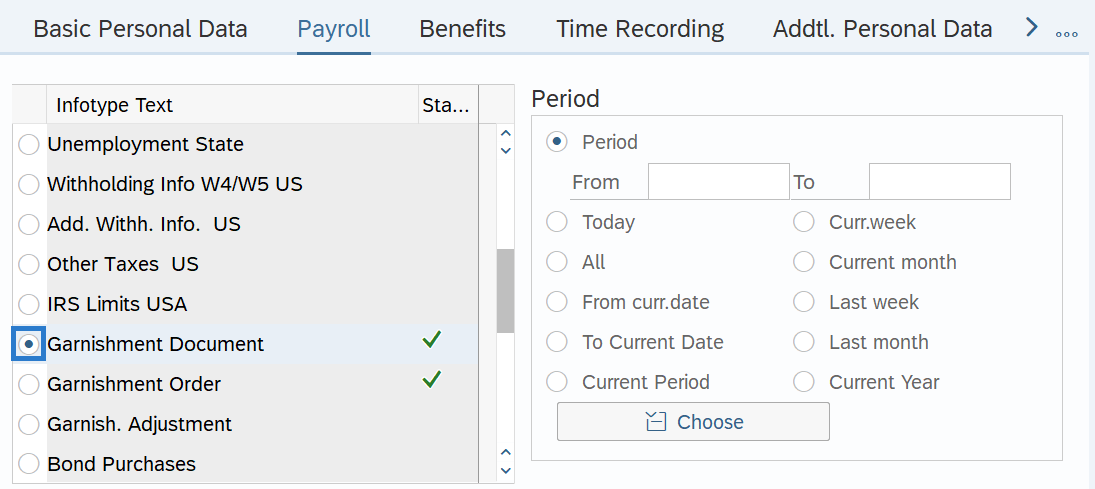

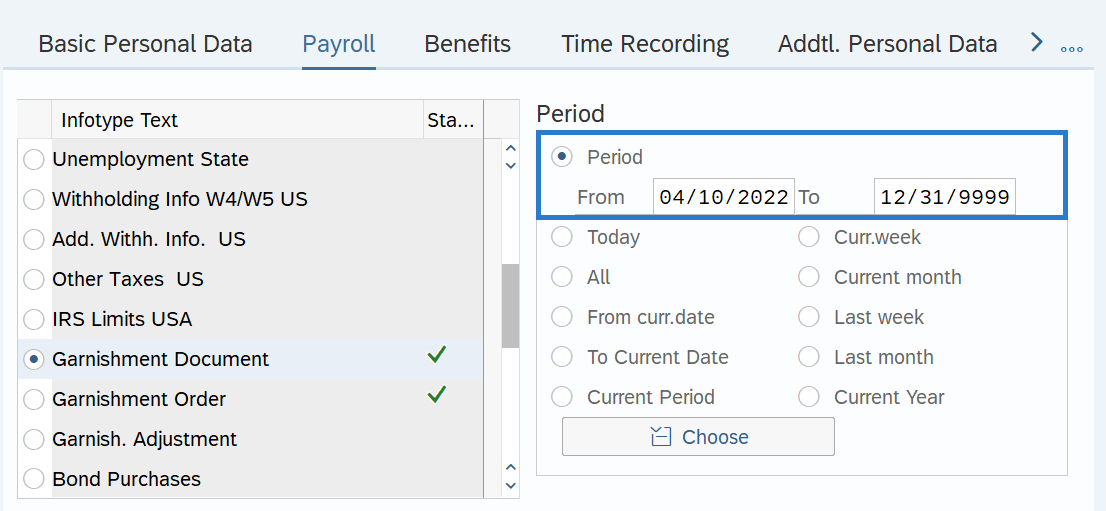

Step 4

On the Payroll tab, select the Garnishment Document radio button.

-

Step 5

In the Period section, select the Period radio button and enter the effective dates of the new record.

TIPS:

TIPS:The From date should reflect the actual check date the garnishment is to begin for the employee. If you are uncertain of the check date, refer to the Payroll Calendar.

Garnishments will not process retroactively for a prior pay period.

The To date should reflect 12/31/9999.

-

Step 6

Click the Create button.

-

Step 7

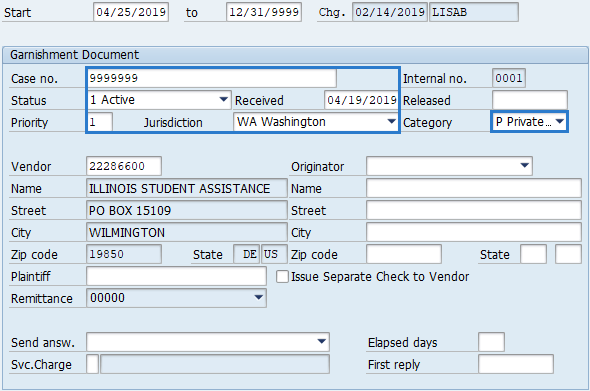

Complete the following fields:

The following fields are mandatory:

- Case no.

- Status

- Received

- Priority

- Jurisdiction

- Category

- Vendor

The following field is optional:

- Service Charge

TIPS:

TIPS:The Case no. is the ID number of the garnishment document case.

The Status of the garnishment document should be Active. Assuming that sufficient wages are available and that processing of this garnishment is not disrupted by garnishments of higher priority, wages are withheld and remitted to the vendor.

The Received date should reflect the date the garnishment document is entered in HRMS. This date does not correspond to the date that the garnishment legally takes effect.

Priority establishes the order in which a garnishment will be deducted from payroll. The highest priority is 001, while the lowest possible priority is 999. If an employee is subject to multiple garnishment documents of equal priority, the system will process these documents in the order that they were entered into the system; the garnishment with the earliest Received date will be processed first.

Jurisdiction will default to WA - Washington state.

Category is determined by garnishment type:

If garnishment type is Then select Category Mandatory Wage Assignments which includes other court orders C - Creditor-Court Federal Delinquent Tax Levy F - Federal Tax Student Loan G - Federal Non-Tax Federal Tax Notice of Payment Arrangement N - Fed Tax Notification Private Student Loan P - Private Student Loan Child Support S - Support State Delinquent Tax T - State Tax Voluntary Wage Assignment V - Voluntary Assignment DSHS no longer processes other state child support orders on behalf of any other state. Each state administering child support orders must be established individually as a garnishment vendor within HRMS. Many states have completed these requirements and are available as a garnishment vendor.

To search a garnishment vendor, click in the Vendor field and select the matchcode button. Once the search box opens, follow Steps 3 through 6 within in the HRMS Search – UFI Matchcode user procedure to identify the correct garnishment vendor. If you have received a garnishment order from a vendor that is not found in the garnishment vendor search, your agency should notify the requestor that they must Register as a Washington State Statewide Vendor. Ensure that your request indicates the vendor should be available in HRMS upon completion. Once registration is complete with OFM’s Statewide Vendor/Payee Services, the Payee Services office will request the creation of a new garnishment vendor within HRMS.

Select a Service Charge rule if a processing fee is to be collected as part of garnishment type Creditor-Court (C ) or Support (S). HRMS will determine if there are enough monies to collect the fee.

-

Step 8

Click the Enter button to validate the information.

-

Step 9

Click the save button.

TIPS:This is a dynamic action. Once the Garnishment Document (0194) infotype is saved, the Garnishment Order (0195) infotype will appear.

-

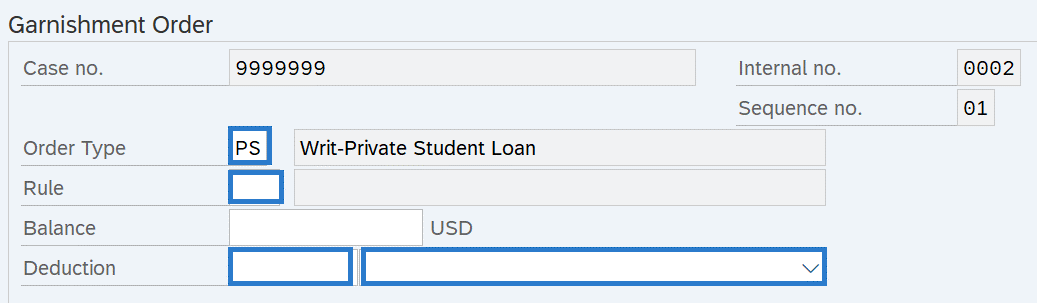

Step 10

Complete the Garnishment Order (0195) infotype:

The following field will default:

- Order Type

The following fields are mandatory:

- Rule

- Deduction Value

- Deduction Rule

The following field is optional:

- Balance

TIPS:

TIPS:Deduction specifies the regular deduction to be taken from the employee wages and the basis for how the payment will be garnished.

When entering a percentage always select "Percent of net" so that the disposable earning calculation is used in determining the garnishment amount.

The amount of the deduction for Federal Tax Levy is determined by the marital status and dependent information on the levy form rather than their W-4 filing status.

-

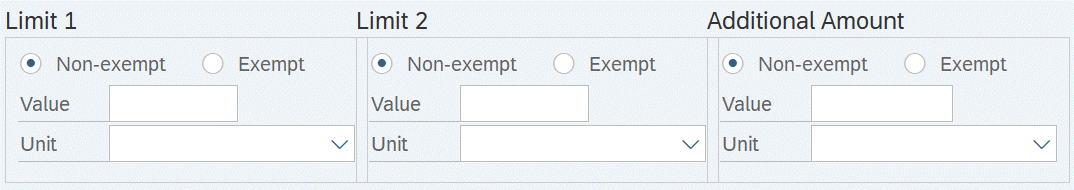

Step 11

The following fields are optional:

- Value

- Unit

Click Exempt if applicable.

TIPS:

TIPS:You can establish a ceiling override for the Non-exempt or Exempt amount by specifying a value and basis of deduction.

- Value can be an amount or a percentage, depending upon the value selected in the Unit field.

- Unit specifies a basis of deduction and is used in conjunction with the amount or percentage found in the Value field.

The exempt value is used to ensure the federal limit is followed and can also be used if the garnishment places a limit higher than the federal limit for exempt earnings.

For IRS Tax Levies, refer to the Table for Figuring Amount Exempt from Levy on Wages, Salary and Other Income. If the IRS allows for exempt amounts above the amount in the table, you must enter the total of the table amount plus the additional exemptions in the Additional Amount field to override the calculated amount. Run a Payroll Simulation and look for wage type 3030 Levy to verify the deduction amount.

-

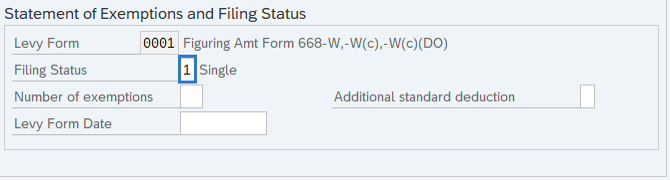

Step 12

If applicable, complete the Statement of Exemptions and Filing Status.

The following fields are mandatory:

- Filing Status

The following fields are optional:

- Number of exemptions

- Levy Form Date

- Additional standard deduction

TIPS:

TIPS:The marital status and dependent information must reflect what is on the levy form rather than their W-4 filing status.

The Levy Form Date field is used to determine the non-exempt amount for levies, which change every year.

- If the levy specifies that you should use the most up-to-date table, leave the field blank.

- If you want to use a form for a fixed year, enter a date from the year in which the table was valid.

Additional standard deduction is claimed on parts 3, 4 and 5 of the levy.

-

Step 13

Click the Enter button to validate the information.

-

Step 14

Click the Save button.