Garnishments - Standard Processing - Update Balance

Use this procedure to adjust the garnishment amount being deducted from an employee’s pay on the Garnishment Order (0195) infotype. Perform this procedure when the agency is notified that the garnishment amount for an existing garnishment has changed.

Before you begin, if you have questions on administering a garnishment, please contact the Public Records and Constituent Services Unit at the Attorney General’s Office:

(360) 753-9673

publicrecords@atg.wa.gov

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

Step 4

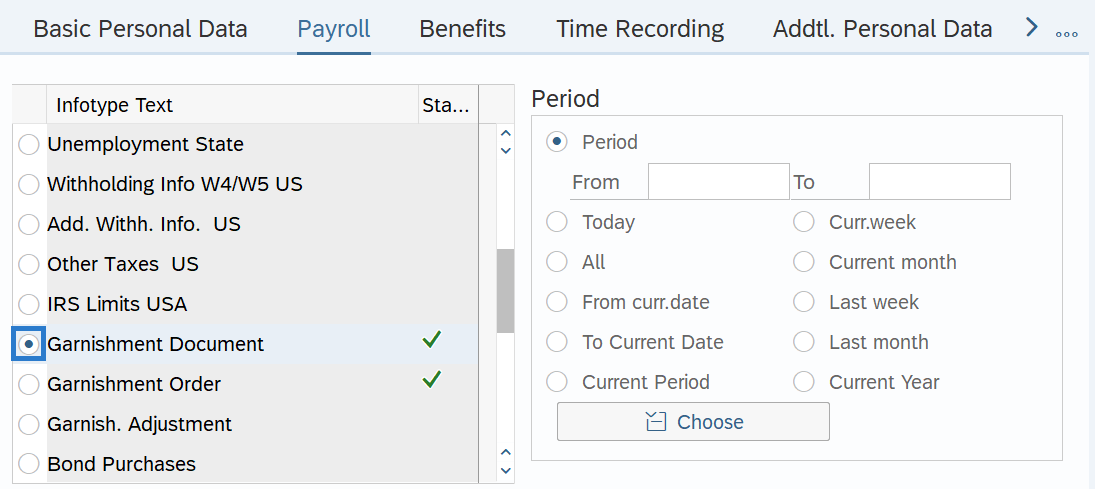

On the Payroll tab, select the Garnishment Document radio button.

-

Step 5

Click the Overview button.

-

Step 6

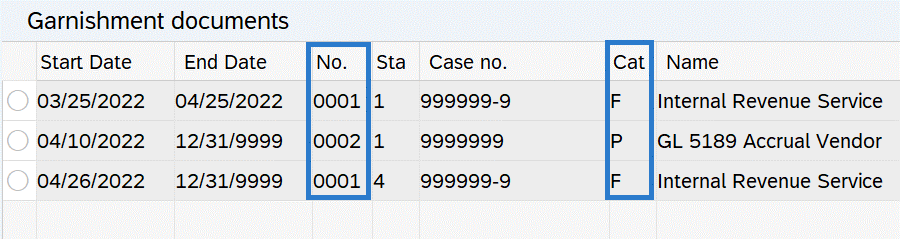

Identify the correct garnishment No. and Category.

TIPS:

TIPS:HRMS automatically assigns a sequencing number as a new document is created. This sequencing number links the Garnishment Document (0194) to the Garnishment Order (0195). If an employee has multiple garnishments, you can identify the correct garnishment within the Garnishment Document (0194) overview looking at the No. and Category columns.

-

Step 7

Click the Back button to return to the Payroll tab.

-

Step 8

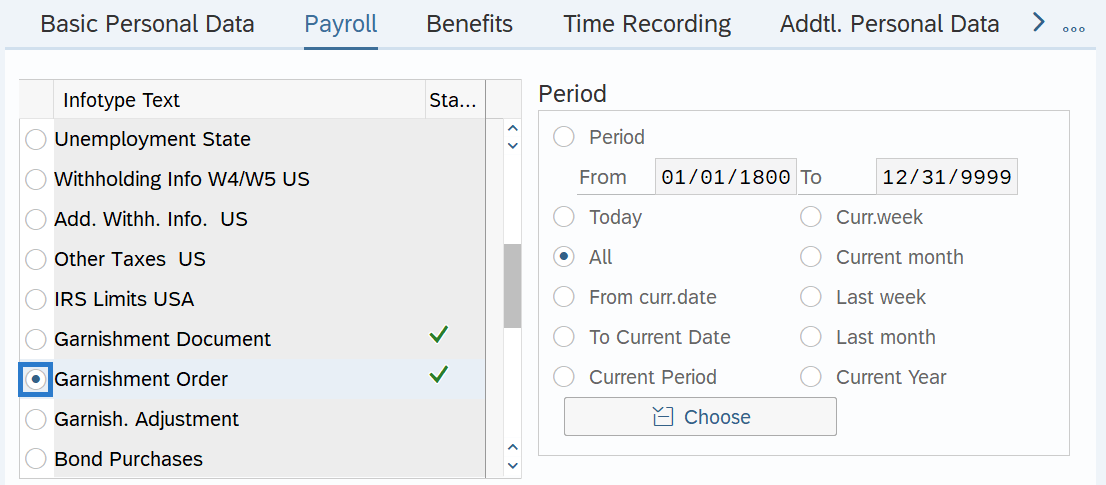

On the Payroll tab, select the Garnishment Order radio button.

-

Step 9

Click the Overview button.

-

Step 10

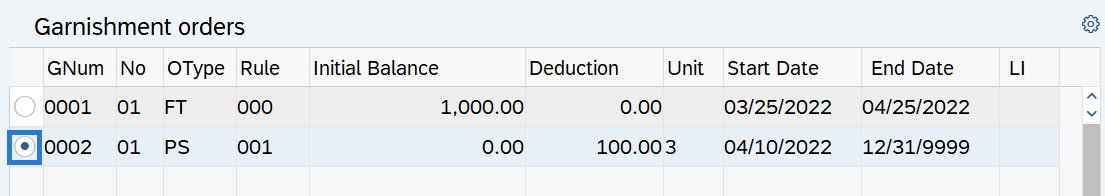

Select the radio button to the left of the Garnishment Order to be adjusted.

TIPS:

TIPS:To find the corresponding Garnishment Order (0195) you will want to look at the GNum column.

-

Step 11

Click the Copy button.

-

Step 12

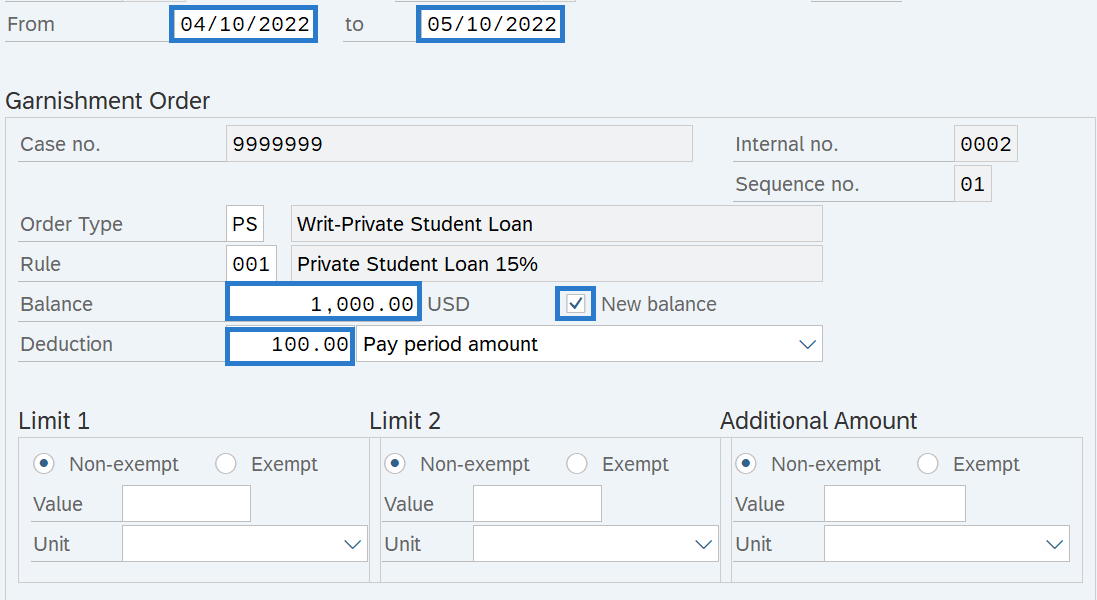

Complete the following fields:

The following fields are mandatory:

- From

- To

- Balance

- Deduction Value

- Deduction Rule

The following field is conditional:

- New balance

TIPS:

TIPS:The From date should reflect the actual pay check date the garnishment adjustment is to begin for the employee. If you are uncertain of the check date, refer to the Payroll Calendar.

The Balance is the balance of the garnishment. If the amount of the garnishment has changed, enter that amount.

In the screen shot above, we are entering an adjusted balance.

If the New Balance box is not selected and a new balance is entered, HRMS will consider the change as the new initial balance and will take the processing history into account.

Deduction specifies the regular deduction to be taken from the employee's wages and the basis for how the payment will be garnished.

When entering a percentage, always select "Percent of net" so that the disposable earnings calculation is used in determining the garnishment amount.

The To date should reflect the last check date the garnishment is to be processed.

-

Step 13

Click the Enter button to validate the information.

-

Step 14

Click the Save button.

TIPS:By running a payroll simulation, you can verify that the correct dollar amount will be deducted from the employee’s pay. Look for the following wage type associated with the garnishment types in the payroll results table:

3005 Court Payment/Creditor