Manual Adjustments for Healthcare Premiums - Identify Premium Adjustments - Medical and Dental Amounts

Use this procedure to identify manual adjustment amounts for medical and dental premiums that may be needed for New Hire, Rehire, or Appointment Change - Transfer Different Agency actions. Medical adjustment amounts are identified on the employee’s current Health Plans (0167) infotype record.

This procedure will take you through the steps to assist in identifying the employee’s medical benefits election and determine the amount required for employee and employer healthcare premium adjustments for New Hire, Rehire, or Appointment Change - Transfer Different Agency actions.

If the employee has waived both medical and dental coverage then the Employee Costs and Provider Costs are $0 and do not require manual adjustments. For an employee who has waived medical coverage only, enter the manual adjustment Additional Payment using wage type 2575 (Health – Provider) using the Dental Record’s Provider Cost only.

-

Step 1

Enter transaction code PA20 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel Number

-

Step 3

Click Enter to populate the employee information.

-

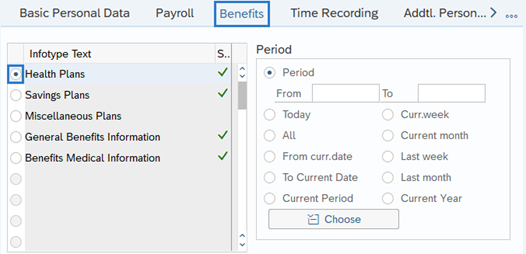

Step 4

On the Benefits tab, select the Health Plans radio button.

-

Step 5

Click the Overview button.

-

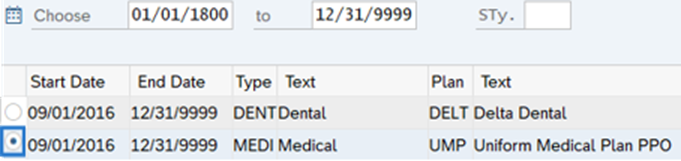

Step 6

Select the active Medical record radio button.

-

Step 7

Click the Choose button.

-

Step 8

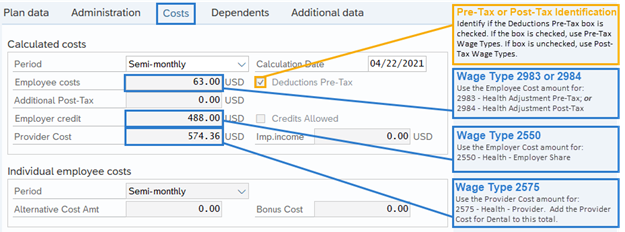

On the Costs tab, identify and record the following:

- Pre-Tax or Post-Tax designation

- Employee costs

- Employer credit

- Provider Cost

TIPS:

TIPS:You have identified and recorded the following information to assist with your manual adjustments for healthcare contributions:

Deductions Pre-Tax - This box indicates the employee’s selection for either Pre-Tax health contributions or Post-Tax health contributions. Record this status for determining which wage types are appropriate for Employee Costs and Tobacco Surcharge wage type selections.

Employee Costs – The amount identified here is the employee share of health premiums and should be used to create an Additional Payment (0015) infotype record using wage type:

- Deductions Pre-Tax box is checked: 2983 – Health Adjustment Pre-Tax, or

- Deductions Pre-Tax is unchecked: 2984 – Health Adjustment Post-Tax.

Employer Credit – The amount identified here is the Employer Cost amount (or employer share) and should be used to create an Additional Payment (0015) infotype record using wage type 2550 – Employer Cost.

Provider Cost – The amount identified here will be added to the Provider Cost amount identified and recorded in the dental record. Once you have added the Medical and Dental record amounts together, the total amount identified here should be used to create an Additional Payment (0015) infotype record using wage type 2575 – Health – Provider.

Additional Post-Tax and Imp. Income (imputed income) boxes - If there is an amount in these boxes, this indicates the employee is insuring a domestic partner or a domestic partner’s child. This will require additional Health Adjustments using the following wage types:

- Additional Post Tax – 2984

- Imp. Income – 2513

-

Step 9

Click the Back button to return to the Benefits overview.

-

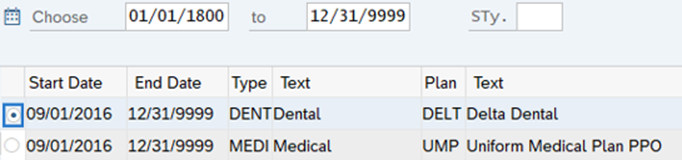

Step 10

Select the active Dental record radio button.

-

Step 11

Click the Choose button.

-

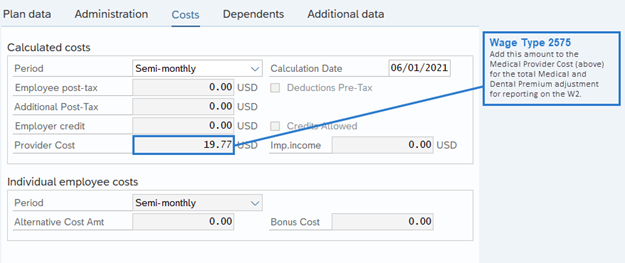

Step 12

On the Costs tab, identify and record the following:

- Provider Cost

TIPS:

TIPS:You have identified and recorded the following information to assist with your manual adjustment for health contributions:

Provider Cost – The amount identified here should be added to the Provider Cost amount identified and recorded from the Medical record. Once you have added the Medical and Dental record amounts together, the total amount identified here should be used to create an Additional Payment (0015) infotype record using wage type 2575 – Health – Provider.

-

Step 13

Click the Back button to exit.

Stop:This marks the end of the procedure to identify medical and dental adjustment amounts. Follow the Manual Adjustments for Healthcare Premiums - Identify Adjustment Amounts - Surcharge Amounts and Manual Adjustments for Healthcare Premiums - Identify Adjustment Amounts - Health Savings Account Amounts procedures to identify any remaining adjustments amounts. Then refer to the Manual Adjustments for Healthcare Premiums - New Hire or Rehire or Manual Adjustments for Healthcare Premiums - Transfer Different Agency procedures, as appropriate, to create the manual adjustment entries.