Work Tax Area - Change Existing Record

Use this procedure to make a correction to or delimit an employee’s Work Tax Area (0208) infotype record. Work Tax Area is used to identify the tax area and tax authorities that are applicable to the employee based on where they are working.

The tax areas and tax authorities entered here determine which tax types are assigned to an employee for some work-based taxes. Refer to the Out-of-State Employee Coding Guide and HRMS Data Definitions Resource Guide for more information on which taxes are controlled by this infotype.

The Work Tax Area (0208) is used in combination with the Residence Tax Area (0207), and Unemployment State (0209) infotype records to determine all applicable tax types for the employee.

See Additional Steps for Out-of-State Employees for more information on setting up an out-of-state employee.

Before beginning this procedure, consider using the Out-of-State Tax Authority Locator report to verify the applicable work tax area(s) for the employee.

Before setting an employee’s work tax area to Oregon or Idaho, your agency must be set-up in HRMS to collect Oregon or Idaho taxes. Agencies will not be able to save an Oregon or Idaho tax area unless they have completed the Additional Steps for Out-of-State Employees – Set Up Tax Company for OOS Tax Processing procedure first.

When updating a Tax Area or Allocation within the Work Tax Area (0208) infotype, combined allocation percentages cannot be greater than 100%. Avoid errors due to over-allocated percentages by following this procedure to delimit any active records before attempting to create a new one.

A work tax area override can be entered in CATS. An override may be necessary when the employee works in a different tax area for a portion of a pay period and entering an allocation split on the employee’s Work Tax Area (0208) record is not desired. Refer to Additional Steps for Out-of-State Employees – CATS Work Tax Area Override user procedure for more information.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

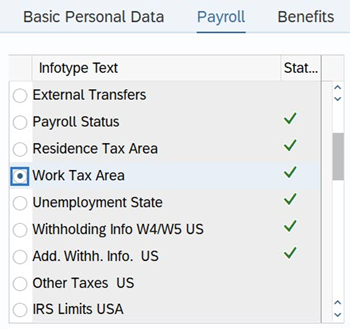

Step 4

On the Payroll tab, select the Work Tax Area radio button.

-

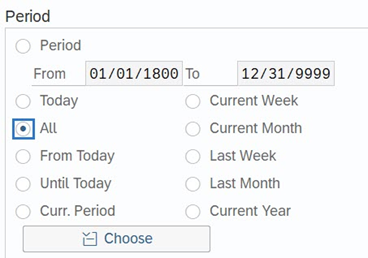

Step 5

In the Time period section, select All.

-

Step 6

Click the Overview button.

-

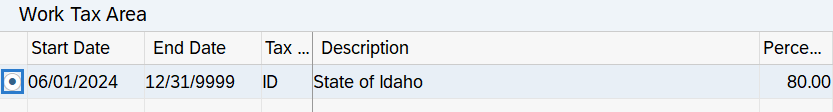

Step 7

Select the radio button to the left of the record you wish to correct.

-

Step 8

Click the Change button.

TIPS:Using the Change button overwrites the existing record and should only be used when making corrections.

-

Step 9

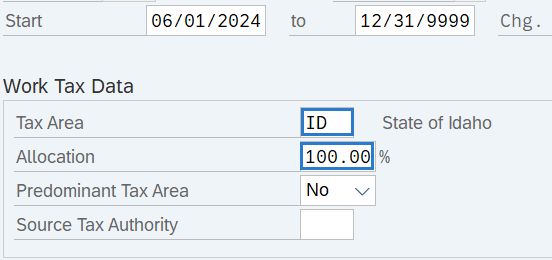

Enter the necessary changes to the record.

TIPS:

TIPS:In most cases, the Start and To dates should not be changed. Changing the Start or To dates will delete the record being updated.

If changing the To date to delimit an out of state record, the To date should be the actual effective date of separation, last day of employment with losing agency, or last day working in that tax area.

If updates are made to the Start and To dates outside of delimiting a record in the current or future periods, HRMS will not retroactively collect taxes from an employee, but will refund an employee and correctly adjust the employer amounts (both collect or refund). Do not make retroactive changes across business areas or calendar years.

The Tax Area selected will populate the corresponding Tax Authorities. For example, selecting Tax Area OR01 will bring in OR and OR01 tax authorities.

Washington, Oregon, and Idaho are the only Tax Areas configured in HRMS.

- Use Oregon or Idaho work tax areas for employees working in Oregon or Idaho.

- Use Washington work tax area for employees living in Oregon or Idaho and working in Washington.

- An active Work Tax Area (0208) infotype record is not needed for employees living and working in Washington or another state outside of Oregon or Idaho.

Refer to the HRMS Data Definitions Resource Guide for more information on tax areas, tax authorities, and tax types. For employees who work in Oregon, use tax area codes OR, OR01, OR02, OR04, OR05, or OR06 only. Do not use tax area codes OR03, OR07, OR30, and OR31, as they are not configured for use in HRMS.

If the employee is working in only one tax area, enter 100% in the Allocation field. If the employee is working in more than one tax area, manually calculate the percentage worked in this Tax Area and enter the percentage into the Allocation field. Once you have created the initial record, use the Work Tax Area – Copy and Update Record user procedure to create an additional record(s) containing the other Tax Area sites and Allocation amounts. Ensure that the employee’s Allocation equals 100% if there are multiple records.

Do not change the default for the Predominant Tax Area or enter data into the Source Tax Authority fields. These fields are used for employees working in Pennsylvania and HRMS does not support automated tax collection for the state of Pennsylvania.

-

Step 10

Click the Enter button to validate the information.

-

Step 11

Click the Save button.

TIPS:Additional pop-up windows may appear depending on what data you entered. Validate each pop-up message to ensure the data you've entered is accurate. You may need to continue clicking the Enter and Save buttons, after validating each message, until the record saves.

When updating the employee’s work tax area records, it is strongly recommended to check the employee’s other tax related infotype records to determine if updates are needed anywhere else as well. Refer to the Additional Steps for Out-of-State Employees – Set Up Out-of-State Employee and Additional Steps for Out-of-State Employees – End Out-of-State Employee user procedures if updates are needed.

If the employee is exempt from any of the tax types under the selected tax authorities, refer to the Other Taxes US user procedures to create or maintain exemptions.

Out-of-state Work Tax Area records must be delimited by the losing agency when an employee transfers to a new agency, when an employee separates, or when an employee stops working in Oregon or Idaho. Follow the Additional Steps for Out-of-State Employees – End Out of State Employee user procedure for more information.

The only exception is if the gaining agency has communicated to the losing agency that the employee will continue working out-of-state and the gaining agency is fully configured for the applicable OOS taxes and has requested the OOS tax infotype records remain active.