Payroll Simulation – Correct a Payroll Redline

Use this report procedure to identify and correct a payroll redline after executing a payroll simulation (pay sim). If a redline is not corrected, the employee will not process or store payroll and will not receive a paycheck for the period.

Use this report procedure to view a payroll redline, make necessary corrections, and then view simulated payroll results to validate the changes. Running a pay sim allows you to view the outcome of any changes before the next stored payroll results.

This procedure shows how to read the payroll simulation results. Refer to other Payroll Simulation procedures for information on completing the report selection screen or other specific tasks.

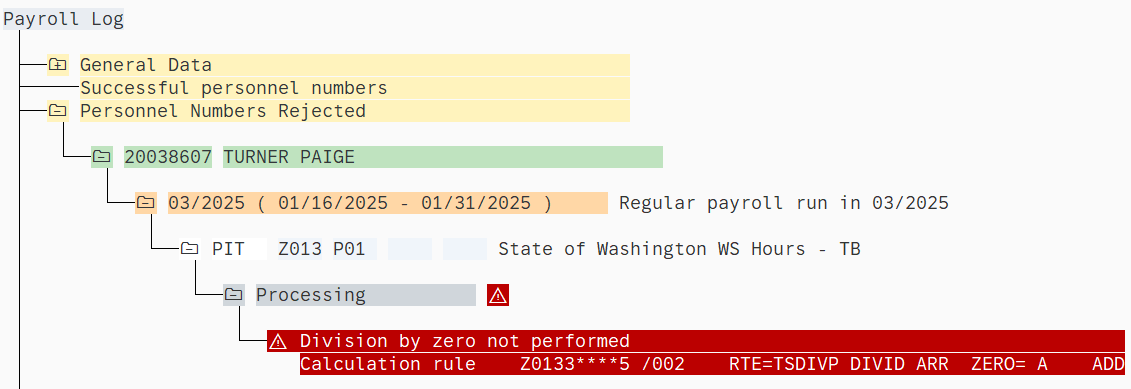

A payroll redline is an error that stops payroll calculation for an employee. Payroll redline errors are displayed in red in payroll simulation results.

Payroll redlines can be caused by a wide range of issues and because of changes within any HRMS module. If there are multiple payroll redlines, only the first one will be displayed. The steps in this procedure may need to be repeated if there are multiple redlines. Be sure to work closely with processors from other functional areas to resolve all redlines before the final payroll.

Payroll redlines will stop payroll calculation for an employee before the RPCIPE and ALAS errors are checked. An employee may still have RPCIPE or ALAS errors even after all redlines are corrected.

The Payroll Simulation report generates a simulation for the payroll results as they will process within the final payroll run if no further adjustments are made to an employee’s master data. Be sure to work closely with processors from other functional areas as needed to resolve the error.

The HRMS Processor Guide recommends running this report at minimum, on Payroll Days 1, 2, and multiple times on day 3, however processors can use this report at any time to check for redline errors and validate master data changes for payroll purposes.

Hourly employees must have submitted time for the selected pay period for this report to have accurate results.

Complete the steps for Payroll Simulation – Execute a Payroll Simulation.

Navigate to the payroll redline if one is present.

Tips:

Tips:A payroll redline is easily noticeable since the payroll simulation will cease processing and return a red error message indicating a problem is present.

If you encounter a redline while running multiple periods, navigate to the last listed period. You will find the redline error in the opened Processing folder.

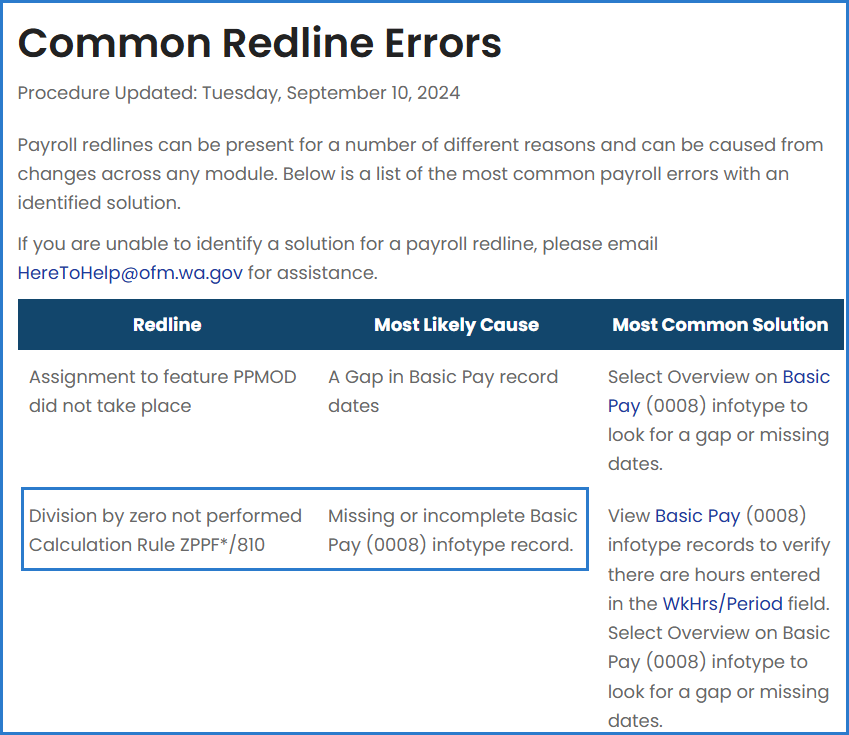

Open the Common Redline Errors list to find the redline and identify the most likely cause of the error.

Tips:

Tips:In this example, the most likely cause of the redline error, Division by zero not performed Calculation Rule ZPPF*/810, is a missing or incomplete Basic Pay (0008) infotype record.

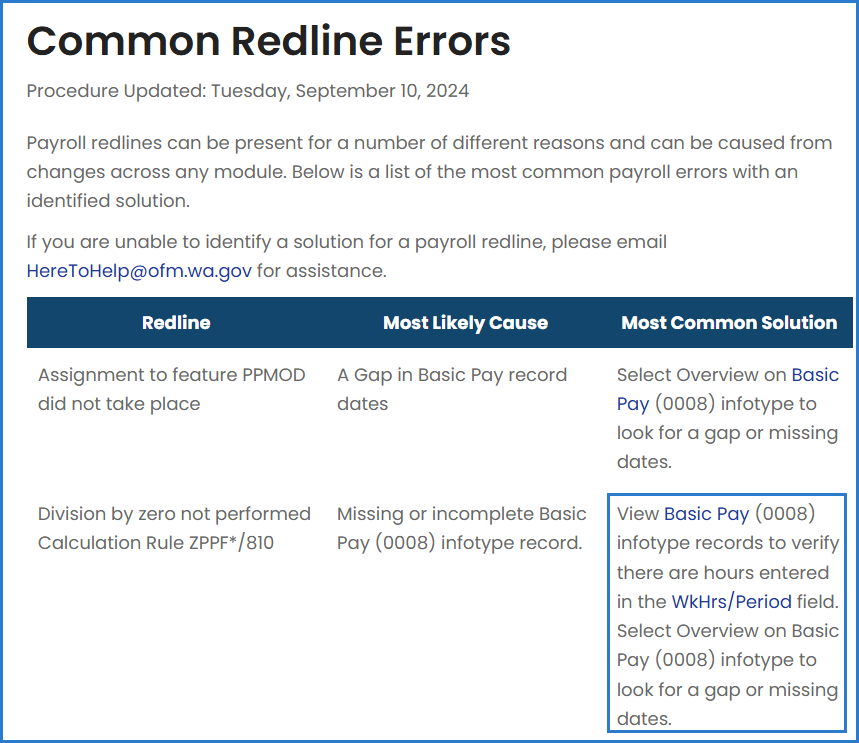

Review the Most Common Solution to the redline error.

Compare the employee’s master data with the Most Common Solution to identify the solution.

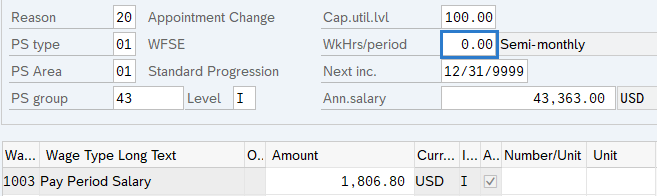

Complete the necessary edits to master data.

Tips:

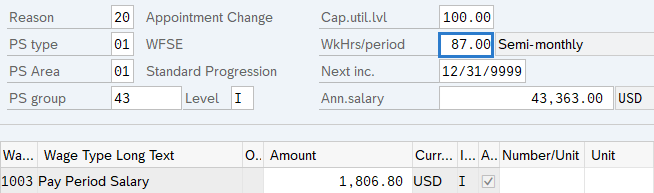

Tips:In this example, the employee was missing data in the Wk Hrs/period field. The processor entered the appropriate number of semi-monthly hours to correct the master data, as indicated in the Most Common Solution section.

Redline corrections may require hand-offs to other roles such as personnel administration processor, benefits processor, or time processor. This process will depend on your role and your agency’s structure.

Re-run the payroll simulation following steps 1 to 3 to make sure the error has been corrected.

Tips:

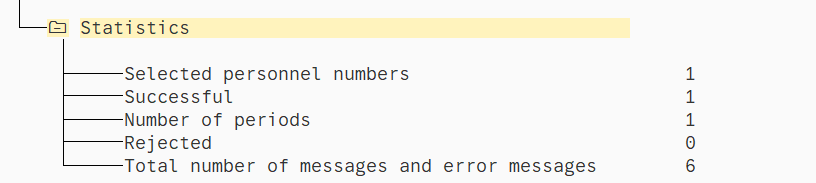

Tips:If you do not see a redline after executing the payroll simulation, you have successfully corrected the error.

Please follow these best practices during payroll cutoff to check for payroll redlines, RPCIPE, and ALAS errors.

Days 1, 2, and 3 mornings:

- Agencies should view their spool files for payroll redlines using transaction SP01.

Day 3 afternoon:

- Check the Payroll Cutoff Errors page at approximately 12:30 p.m. and 3:30 p.m. for your agency's errors. Employees on these lists will be locked out of final payroll processing if errors are left uncorrected.

- The Day 3 afternoon run is the last chance to view errors, so agencies should work from the Day 3 – Afternoon list to correct all errors. The Day 3 afternoon run begins at approximately 3:00 p.m. and errors are posted at approximately 3:30 p.m. Processors have until 8:00 p.m. on Payroll Day 3 to correct errors prior to being locked out of HRMS for final payroll processing.

- If you need assistance to correct a problem, send a ticket to HeretoHelp@ofm.wa.gov so that OFM can assist you as soon as possible. Often the support team is working through a heavy volume of tickets for Days 2 and 3, so it can be difficult for us to resolve late requests.

Example Scenarios

Below are examples of running the Payroll Simulation. It is not a comprehensive list of every scenario.

Example 1 - Run a simulation for a single employee.

In this scenario, it is Payroll Day 3 of Pay Period 3 (1/16/2025 – 1/31/2025). As a payroll processor, I am going to run a simulation after entering payroll for a single employee (personnel number 00279205) to ensure all information is complete and accurate.

Example 2 - Confirm there are no additional errors.

In this scenario, I have fixed a redline error while entering payroll for a single employee (personnel number 00279205). As a payroll processor, I am now going to run a simulation to make sure there are no additional errors.

Example 3 - Run a simulation after entering payroll for an entire agency.

In this scenario, it is Payroll Day 3. As a payroll processor, I am going to run a simulation for pay period 4 (2/01/2025 – 2/15/2025) to ensure all information is complete and accurate.