Garnishments - Writ Processing - Create Writ

Use this procedure to create a writ of garnishment on the Garnishment Document (0194) and Garnishment Order (0195) infotypes. Perform this procedure when a writ of garnishment document is received by the agency from the Office of Attorney General.

If you are creating a Creditor, Federal Tax, Private Student Loan, Child Support, State Tax, or Voluntary Assignment garnishment, please refer to Garnishments - Standard Processing - Create Garnishment instead.

A writ of garnishment (continuing lien on earnings) is served to capture an employee’s earnings. Earnings include wages, salary, and other compensation. If the writ does not have the caption “continuing lien on earnings,” it captures only the assets being held by the agency on the day the writ was received by the Office of the Attorney General.

Service of a writ on the Office of the Attorney General is required pursuant to RCW 6.27.040 and RCW 4.92.020. If an agency receives a writ directly, without prior service on the Office of the Attorney General, return the writ to the creditor (plaintiff) noting that it was improperly served.

Before you begin, if you have questions on administering a writ, please contact the Public Records and Constituent Services Unit at the Attorney General’s Office:

(360) 753-9673

publicrecords@atg.wa.gov

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

Step 4

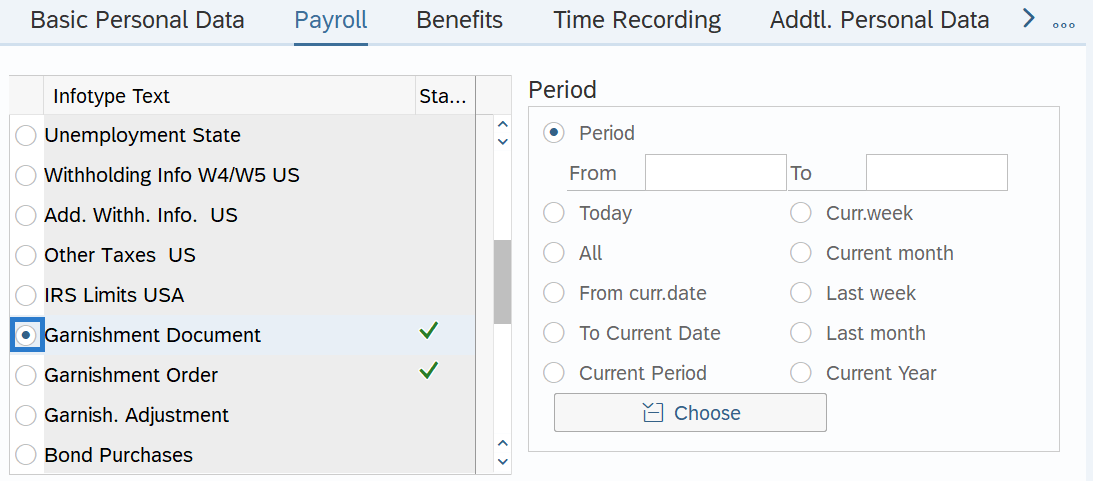

On the Payroll tab, select the Garnishment Document radio button.

-

Step 5

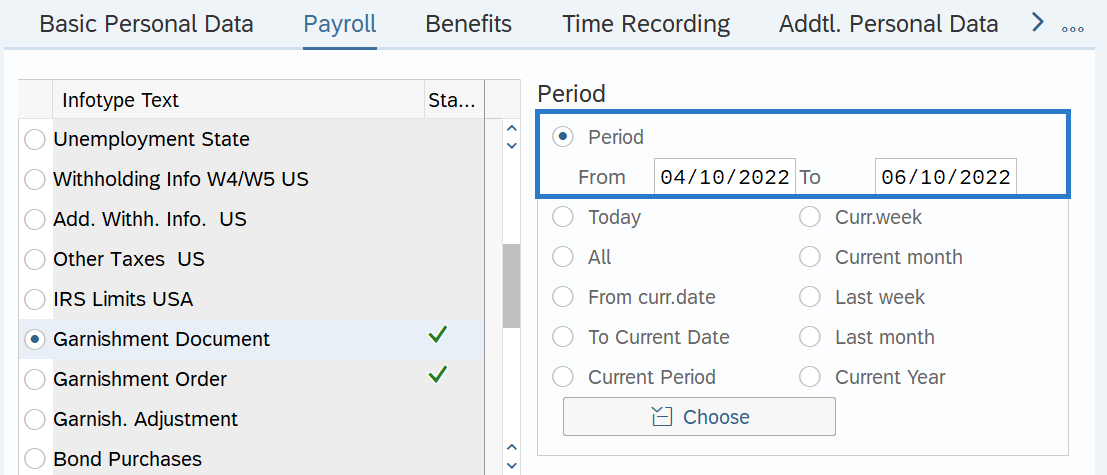

In the Time period section, select the Period radio button and enter the effective dates of the new record.

TIPS:

TIPS:The From date should reflect the actual check date the writ of garnishment is to begin for the employee. If you are uncertain of the check date, refer to the Payroll Calendar.

Garnishments will not process retroactively for a prior pay period.

The To date should reflect the last check date the writ is to be processed.

Multiple writs can be stacked based on the date the agency receives them. Typically a writ processes for 4 or 5 pay periods.

-

Step 6

Click the Create button.

-

Step 7

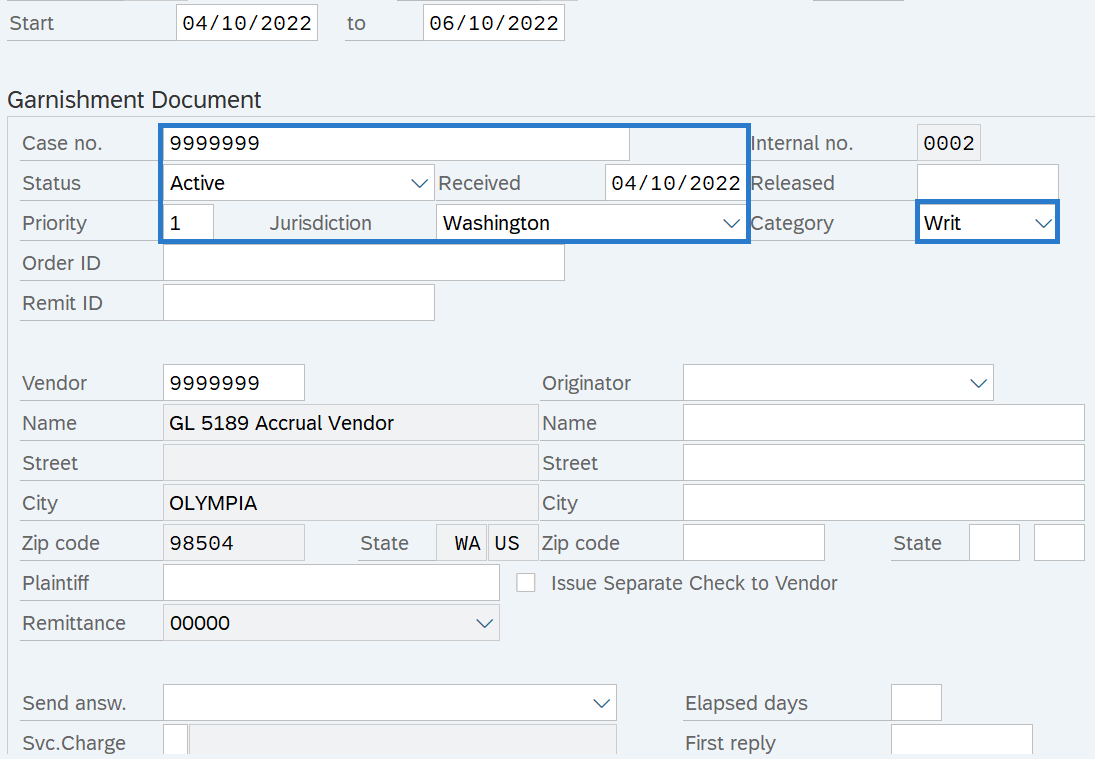

Complete the following fields:

The following fields are mandatory:

- Case no.

- Status

- Received

- Priority

- Jurisdiction

- Category

- Vendor

The following field is optional:

- Service Charge

TIPS:

TIPS:The Case no. is the ID number of the garnishment document case.

The Status of the garnishment document should be Active. Assuming that sufficient wages are available and that processing of this garnishment is not disrupted by garnishments of higher priority, wages are withheld.

The Received date should reflect the date the garnishment document is entered in HRMS. This date does not correspond to the date that the garnishment legally takes effect.

Priority establishes the order in which a garnishment will be deducted from payroll. The highest priority is 001, while the lowest possible priority is 999. If an employee is subject to multiple garnishment documents of equal priority, the system will process these documents in the order that they were entered into the system; the garnishment with the earliest Received date will be processed first.

Jurisdiction will default to WA - Washington State.

Category should be W – Writ.

The Vendor number 9999999 will automatically populate once Writ is selected as the Category. Deductions will accrue to GL 5189 to be disbursed using an A.19 vendor payment.

Select a Service Charge rule if a processing fee is to be collected as part of garnishment type Writ (W). HRMS will determine if there are enough monies to collect the fee.

For additional information on garnishments or disposable earnings calculations, you can refer to the OFM Statewide Accounting Garnishments and Overpayments resource documents.

-

Step 8

Click the Enter button to validate the information.

-

Step 9

Click the Save button.

TIPS:This is a dynamic action. Once the Garnishment Document (0194) infotype is saved, the Garnishment Order (0195) infotype will appear.

-

Step 10

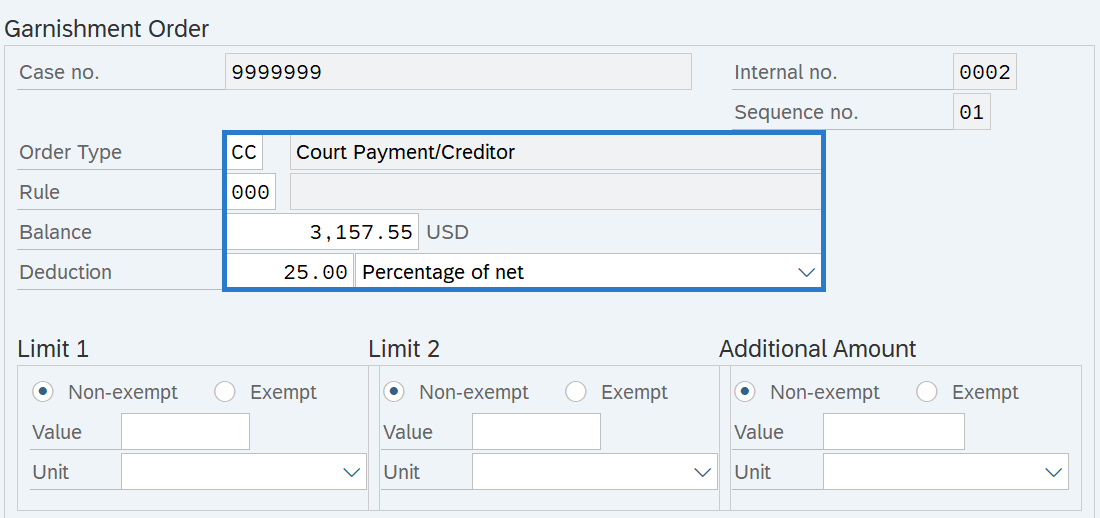

Complete the Garnishment Order (0195) infotype.

The following field will default:

- Order Type

The following fields are mandatory:

- Rule

- Balance

- Deduction Value

- Deduction Rule

TIPS:

TIPS:Order Type will default to CC - Court Payment/Creditor when processing a writ.

The Rule should be 000 Creditor when processing a writ.

A writ is the only garnishment category that requires an initial Balance amount.

Deduction specifies the regular deduction to be taken from the employee wages and the basis for how the payment will be garnished.

When entering a percentage always select “Percent of net” so that the disposable earnings calculation is used in determining the garnishment amount.

-

Step 11

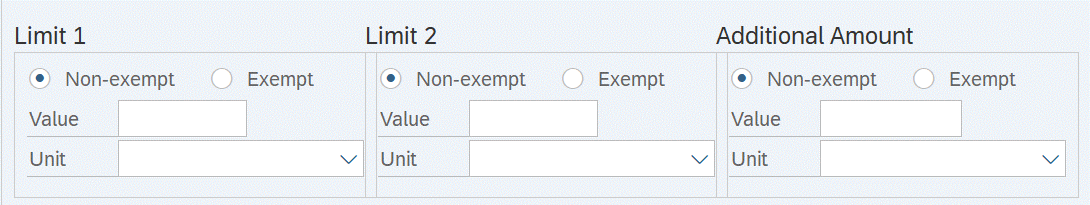

The following fields are optional:

- Value

- Unit

Click Exempt if applicable.

TIPS:

TIPS:You can establish a ceiling override for the Non-exempt or Exempt amount by specifying a value and basis of deduction.

- Value can be an amount or a percentage, depending upon the basis selected in the Unit field.

- Unit specifies a basis of deduction and is used in conjunction with the amount or percentage found in the Value field.

-

Step 12

Click the Enter button to validate the information.

-

Step 13

Click the Save button.

TIPS:Accompanying the writ should be an “Answer to Writ of Garnishment” form. This form is often called the “First Answer.” The agency must complete the First Answer form and return it to the applicable court with copies to the creditor (plaintiff) or the creditor’s attorney and the employee (defendant). Use Calculations for First Answer to Writ of Garnishment, Continuing Lien for assistance with this.

The First Answer must be mailed to the court, the creditor, and the employee within 20 calendar days after receipt of the writ by the Office of the Attorney General. Failure to answer the writ timely can result in a judgment against the agency for the entire amount of the writ as well as costs and attorney fees.