Unemployment State - Change Existing Record

Use this procedure to make a correction to an employee’s Unemployment State (0209) infotype record. This infotype is used to identify the tax authority applicable to the employee based on where their work is localized.

In order to process payroll, employees must have an active Unemployment State (0209) infotype record.

The tax authority entered here determines which tax types are assigned to an employee based on where their work is localized. Refer to the Out-of-State Employee Coding Guide and HRMS Data Definitions Resource Guide for more information on which taxes are controlled by this infotype.

The Unemployment State (0209) is used in combination with the Residence Tax Area (0207) and Work Tax Area (0208) infotype records to determine all applicable tax types for the employee.

See Additional Steps for Out-of-State Employees for more information on setting up an out-of-state employee.

Before setting an employee’s Unemployment State tax authority to Oregon or Idaho, your agency must be configured in HRMS to collect Oregon or Idaho taxes. Agencies will not be able to save an Oregon or Idaho tax authority unless they have completed the Additional Steps for Out-of-State Employees – Set Up Tax Company for Out-of-State Tax Processing procedure first.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

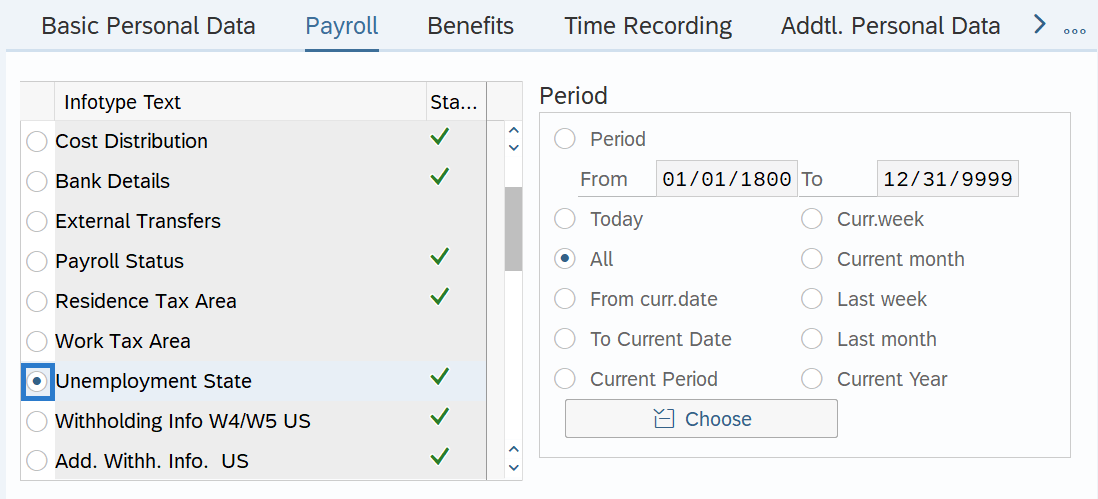

Step 4

On the Payroll tab, select the Unemployment State radio button.

-

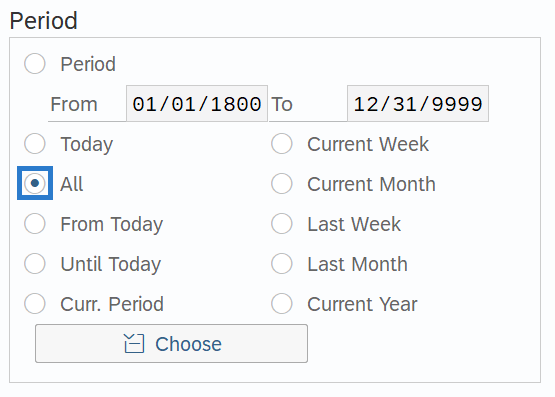

Step 5

In the Time period section, select All.

-

Step 6

Click the Overview button.

-

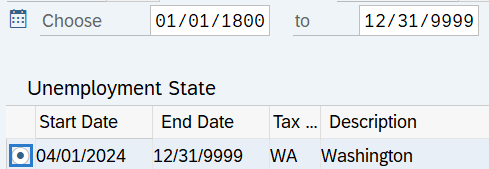

Step 7

Select the radio button record you wish to correct.

-

Step 8

Click the Change button.

TIPS:Using the Change button overwrites the existing record and should only be used when making corrections.

-

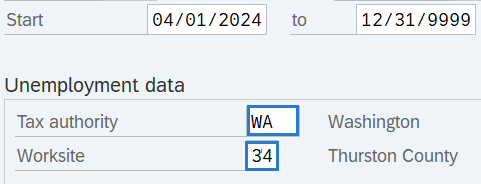

Step 9

Enter the necessary changes to the record.

TIPS:

TIPS:In most cases, the Start and To dates should not be changed. Changing the Start or To dates will delete the record being updated.

If updates are made to the Start and To dates, HRMS will not retroactively collect taxes from an employee, but will refund an employee and correctly adjust the employer amounts (both collect or refund). Do not make retroactive changes across business areas or calendar years.

Washington, Oregon, and Idaho are the only Unemployment State tax authorities configured in HRMS. For employees whose work is localized outside of Washington, Oregon, and Idaho, the tax authority should remain as WA and any out-of-state taxes will need to be calculated and collected manually. Setting the tax authority to Washington will turn on Washington taxes for the employee, which will likely need to be exempted if the work is not localized to Washington.

Refer to the HRMS Data Definitions Resource Guide for more information on tax authorities and tax types. Do not use Tax Authorities other than WA, OR, or ID.

For employees under the jurisdiction of Washington unemployment insurance and workers compensation programs or a state not configured in HRMS, when the Unemployment State (0209) Tax Authority is set to WA, the Worksite field should reflect the employee’s primary work location.

For employees under the jurisdiction of Oregon or Idaho unemployment insurance and workers compensation programs, when the Unemployment State (0209) Tax Authority is set to OR or ID, there is only one valid Worksite selection option for each.

Creation and maintenance of the Worksite field may require coordination with the personnel administration processor and the organizational management processor to ensure all employee and position work location address, such as UFI Code, are reflected accurately.

-

Step 10

Click the Enter button to validate the information.

-

Step 11

Click the Save button.

TIPS:When updating the employee’s Unemployment State tax authority record, it is strongly recommended to check the employee’s other tax related infotype records to determine if updates are needed anywhere else as well. Refer to the Additional Steps for Out-of-State Employees – Set Up Out-of-State Employee and Additional Steps for Out-of-State Employees – End Out-of-State Employee user procedures as needed.

If the employee is covered under Washington’s workers’ compensation program, they must have an active Add. Withh. Info. US (0234) record containing a valid Washington risk classification in the Employee Override Group field. Refer to the Add. Withh. Info. US user procedures as needed.

If the employee is exempt from any of the tax types under the selected tax authority, refer to the Other Taxes US user procedures to create or maintain exemptions.

Out-of-state Unemployment State records must be updated to return the employee back to the state of Washington by the losing agency when an employee transfers to a new agency, when an employee separates, or when an employee’s work is no longer localized to Oregon or Idaho. Follow the Additional Steps for Out-of-State Employees – End Out-of-State Employee user procedure for more information.

The only exception is if the gaining agency has communicated to the losing agency that the employee will continue working out-of-state and the gaining agency is fully configured for the applicable OOS taxes and has requested the OOS tax infotype records remain active.