Other Taxes US - Change Existing Record

Use this procedure to make a correction to or end an employee’s Other Taxes US (0235) infotype record.

Certain groups of employees may be exempt from some taxes because they don't meet the definition of employee, the nature of the work they do, or their work is considered non-localized.

Some groups of employees are systematically exempted from the tax(es). Others may require an Other Taxes US (0235) record be created to exempt them from these taxes processing through payroll.

Tax types are applied to employees based on the tax area and tax authorities entered on their Residence Tax Area (0207), Work Tax Area (0208), and Unemployment State (0209) infotype records. Refer to the HRMS Data Definitions Resource Guide for more information about each tax type, including their definitions and which infotype controls it.

HRMS is only configured to process Oregon and Idaho taxes (in addition to Washington and Federal taxes). Refer to Additional Steps for Out-of-State Employees for more information.

Taxes exempted from this infotype include:

Exemptions from Federal (FED) taxes

Exemptions from Idaho (ID) taxes

Exemptions from Oregon (OR) taxes

Exemptions from Washington (WA) taxes

If exemptions are needed for Federal, Idaho, or Oregon income tax withholding, refer to the Withholding Info W4/W5 US - Create New Record procedure instead.

An Other Taxes US record cannot be changed to a different Subtype (STy: Fed, ID, OR, WA). If there is no existing record with the same Subtype, use the Other Taxes US – Create New Record user procedure to create a record with the correct Subtype.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

Step 4

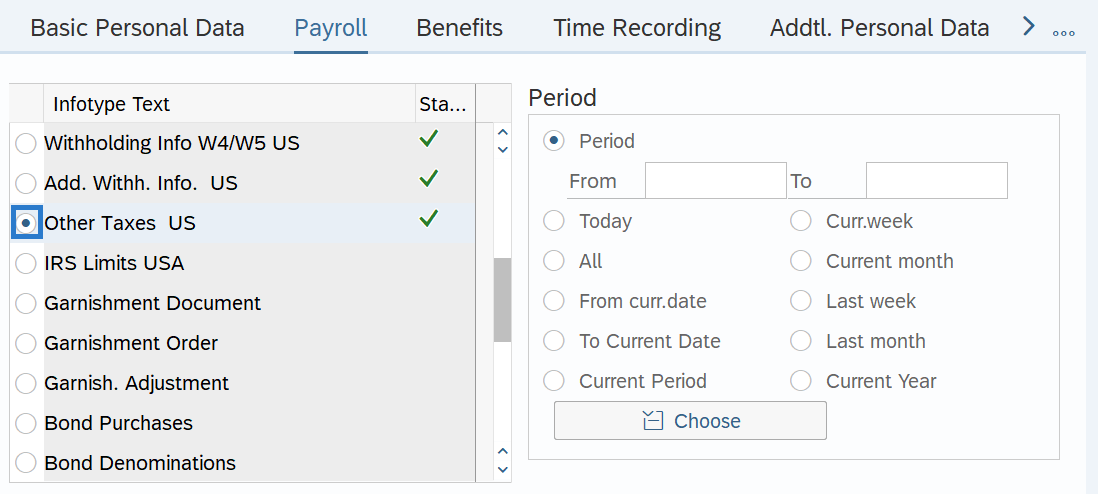

On the Payroll tab, select the Other Taxes US radio button.

-

Step 5

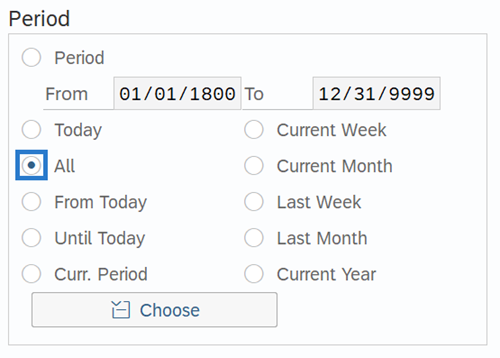

In the Time period section, select All.

-

Step 6

Click the Overview button.

-

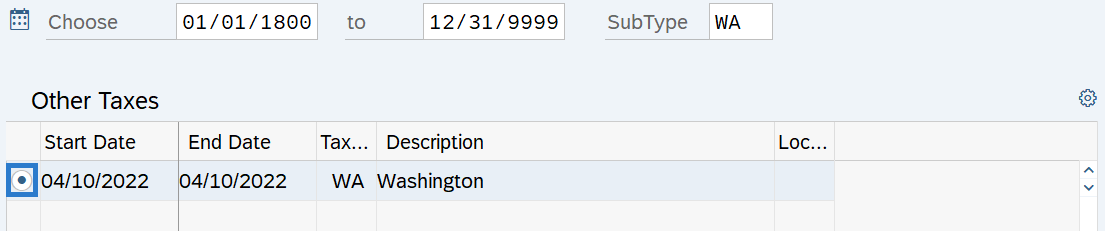

Step 7

Select the record you wish to correct or end.

-

Step 8

Click the Change button.

TIPS:Using the Change button overwrites the existing record and should only be used when making corrections.

-

Step 9

Enter necessary changes to the record:

TIPS:

TIPS:In most cases, the Start and To dates should not be changed. Changing the Start or To dates will delete the record being updated.

If updates are made to the Start and To dates outside of delimiting a record in the current or future periods, HRMS will not retroactively collect taxes from an employee, but will refund an employee and correctly adjust the employer amounts (both collect or refund). Do not make retroactive changes across business areas or calendar years.

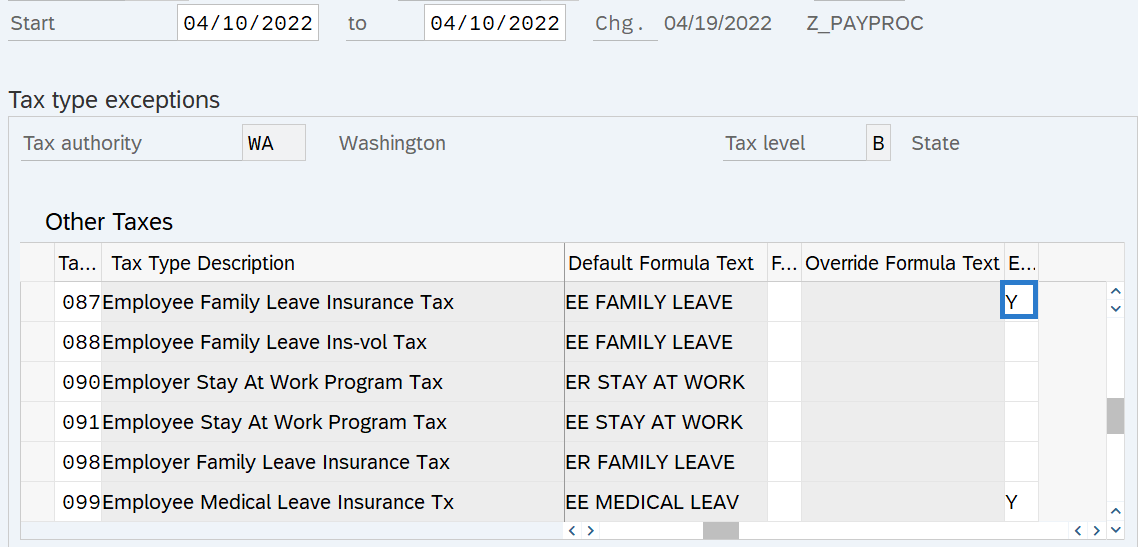

Exemption selections are as follows:

- Blank - Not exempt

- R - Exempt, reportable: use for an employee that is exempt from taxation, but whose earnings are reportable.

- Y - Exempt, not reportable: use for an employee that is both exempt from certain taxes and whose earnings should not be reported, such as a foreign national.

Refer to the tax type data definitions for information on which tax types the state of Washington uses, definitions, applicable exemption statuses, and more.

When exempting an employee from a certain tax, be sure to exempt all applicable tax types as there my be multiple. For example, if you are exempting an employee from Washington's Paid Family and Medical Leave program, there are three tax types.

Employees who have received an ESD approved exemption to the WA Cares / LTSS premiums, should have their Exempt status set to R – Exempt, reportable.

Other employees who are not liable for WA Cares / LTSS premiums, should have their Exempt status set to Y – Exempt, not reportable.

For more information on LTSS premiums and exemptions, see the Employer Long Term Services and Supports FAQ and the Employer LTSS & PFML IT0235 Decision Matrix on the Payroll Resource webpage.

It is strongly recommended to record the reason for exemption using Maintain Text. Follow the Maintain Text - Create Infotype Text user procedure if needed.

-

Step 10

Click the Enter button to validate the information.

-

Step 11

Click the Save button.

TIPS:Be aware that most exemptions should be delimited in the event of a Separation or Transfer to a new agency, as many exemptions do not follow the employee.

One exception is employees with an ESD approved exemption to the WA Cares Fund / LTSS program. Refer to the Employer Long Term Services and Supports FAQ, Question 14 for which ESD approved exemptions should remain active upon transfer or separation.