Other Taxes US - Create New Record

Use this procedure to create a new Other Taxes US (0235) infotype record. Creating a new record is necessary when the employee has become exempt from certain state or federal taxes.

Certain groups of employees may be exempt from some taxes because they don't meet the definition of employee, the nature of the work they do, or their work is considered non-localized.

Some groups of employees are systematically exempted from the tax(es). Others may require an Other Taxes US (0235) record be created to exempt them from these taxes processing through payroll.

Tax types are applied to employees based on the tax area and tax authorities entered on their Residence Tax Area (0207), Work Tax Area (0208), and Unemployment State (0209) infotype records. Refer to the HRMS Data Definitions Resource Guide for more information about each tax type, including their definitions and which infotype controls it.

HRMS is only configured to process Oregon and Idaho taxes (in addition to Washington and Federal taxes). Refer to Additional Steps for Out-of-State Employees for more information.

Taxes exempted from this infotype include:

Exemptions from Federal (FED) taxes

Exemptions from Idaho (ID) taxes

Exemptions from Oregon (OR) taxes

Exemptions from Washington (WA) taxes

If exemptions are needed for Federal, Idaho, or Oregon income tax withholding, refer to the Withholding Info W4/W5 US - Create New Record procedure instead.

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

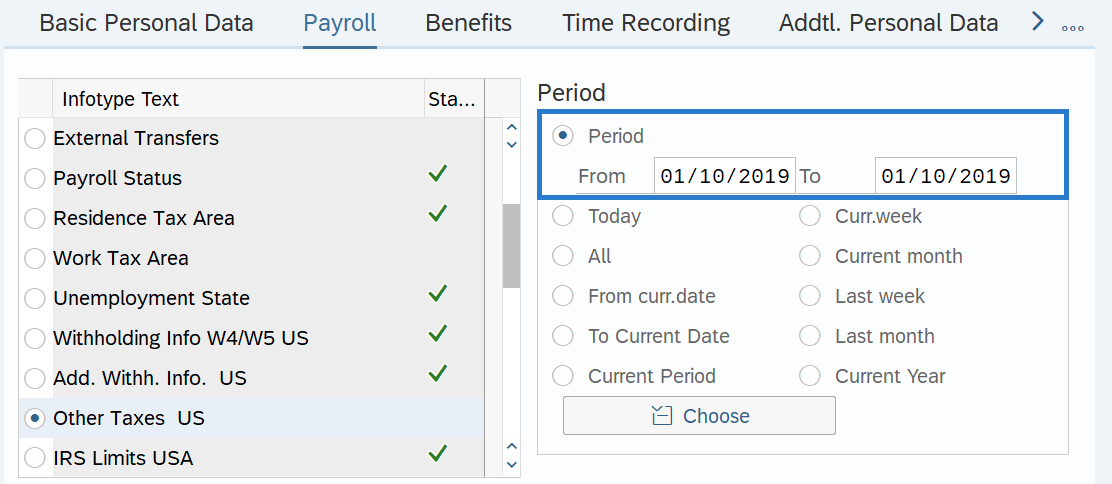

Step 4

On the Payroll tab, select the Other Taxes US radio button.

-

Step 5

In the Time period section, select the Period radio button and enter the effective dates of the new record.

TIPS:

TIPS:The From date should reflect the actual check date the exemption is to begin. If you are uncertain of the check date, refer to the Payroll Calendar.

The To date should reflect the end date of the exemption:

- If the exemption is ongoing, use 12/31/9999.

- If the exemption is to end, use the day before the check date in which the exemption ends.

When entering an ESD approved exemption to WA Cares Fund / LTSS premiums, the exemption letter will state the effective date of the exemption. The From date should be the actual check date immediately following the effective date of the exemption.

When making a retroactive change in accordance with a specific check date, use the day after the last check date. For example, if the change you are making affects the July 10 check date, enter a start date of June 26.

HRMS will not retroactively collect taxes from an employee, but will refund an employee and correctly adjust the employer amounts (both collect or refund). Do not make retroactive changes across business areas or calendar years.

For this example, the employee’s exemption will be effective for one pay period only, therefore dated with the check date for the period exempted.

-

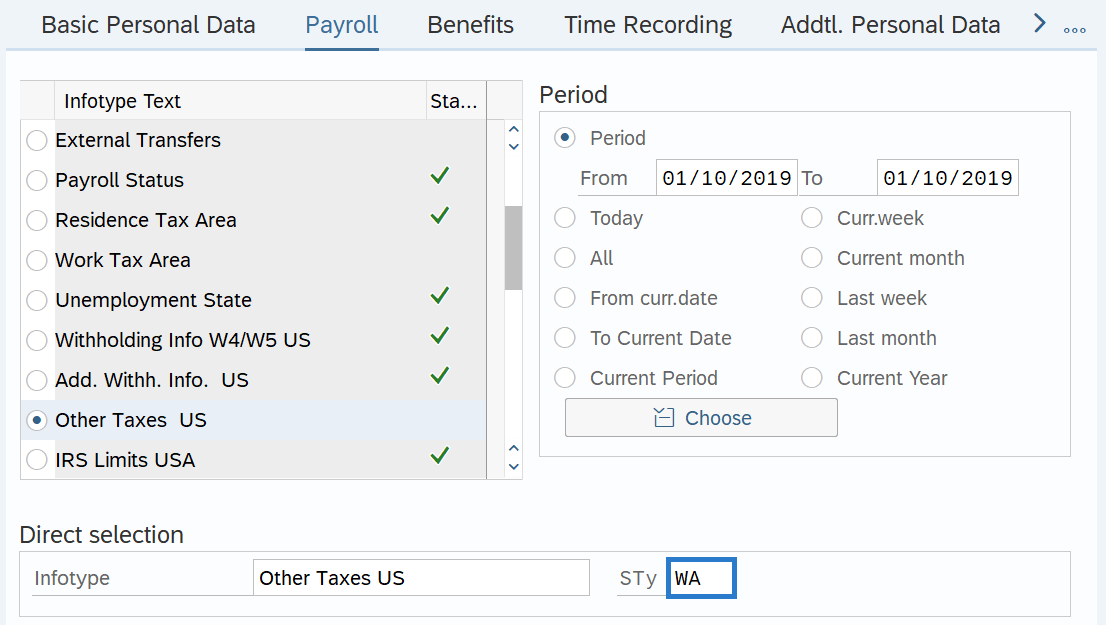

Step 6

In the Direct Selection Infotype STy, enter the appropriate Tax Authority Subtype for your exemption:

- FED - Federal

- ID - Idaho

- OR - Oregon

- WA - Washington

-

Step 7

Click the Create button.

-

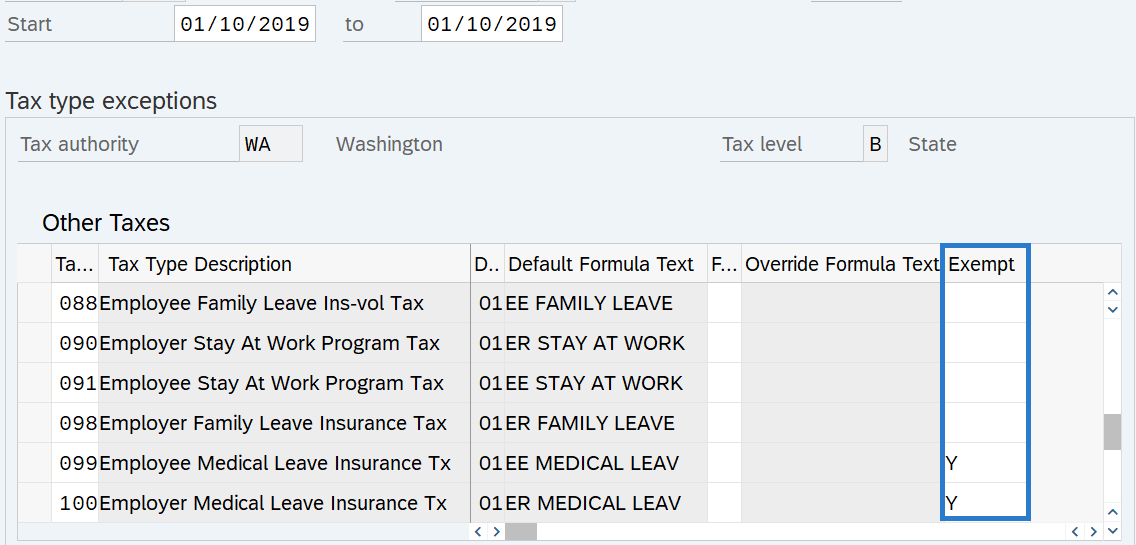

Step 8

Complete the following field:

The following field is mandatory for each tax type that should be exempted:

- Exempt

TIPS:

TIPS:Exemption selections are as follows:

- Blank - Not exempt

- R - Exempt, reportable: use for an employee that is exempt from taxation, but whose earnings are reportable.

- Y - Exempt, not reportable: use for an employee that is both exempt from certain taxes and whose earnings should not be reported, such as a foreign national.

Refer to the tax type data definitions for information on which tax types the state of Washington uses, definitions, applicable exemption statuses, and more.

When exempting an employee from a certain tax, be sure to exempt all applicable tax types as there my be multiple. For example, if you are exempting an employee from Washington's Paid Family and Medical Leave program, there are three tax types.

Employees who have received an ESD approved exemption to the WA Cares / LTSS premiums, should have their Exempt status set to R – Exempt, reportable.

Other employees who are not liable for WA Cares / LTSS premiums, should have their Exempt status set to Y – Exempt, not reportable.

For more information on LTSS premiums and exemptions, see the Employer Long Term Services and Supports FAQ and the Employer LTSS & PFML IT0235 Decision Matrix on the Payroll Resource webpage.

It is strongly recommended to record the reason for exemption using Maintain Text. Follow the Maintain Text - Create Infotype Text user procedure if needed.

-

Step 9

Click the Enter button to validate the information.

-

Step 10

Click the Save button.

TIPS:Be aware that most all exemptions should be delimited in the event of a separation or transfer to a new agency, as many exemptions do not follow the employee.

One exception is employees with an ESD approved exemption to the WA Cares Fund / LTSS program. Refer to the Employer Long Term Services and Supports FAQ, Question 14 for which ESD approved exemptions should remain active upon transfer or separation.