Payroll Simulation – Read Payroll Simulation Results

Use this report procedure to view simulated payroll after a change to an employee’s master data to validate or correct the changes. Running a pay sim allows you to view the outcome of any changes before the next stored payroll results.

This report describes the key sections of a payroll simulation that should be reviewed during payroll processing. Since payroll simulations contain a lot of data, there may be sections with useful information that are not covered in this procedure.

This procedure shows how to read the payroll simulation results. Refer to other Payroll Simulation procedures for information on completing the report selection screen or other specific tasks.

Payroll processors should view the results of a payroll simulation for employees who have had master data changes that may result in a pay change or to ensure correct processing.

The Payroll Simulation report generates a simulation for the payroll results as they will process within the final payroll run if no further adjustments are made to an employee’s master data. Be sure to work closely with processors from other functional areas as needed.

The HRMS Processor Guide recommends running this report at minimum, on Payroll Days 2 and 3, however processors can use this report at any time to validate master data changes for payroll purposes.

Hourly employees must have submitted time for the selected pay period for this report to have accurate results.

Complete the steps for Payroll Simulation – Execute a Payroll Simulation.

Tips:This report describes the key sections of a payroll simulation that should be reviewed during payroll processing. Since payroll simulations contain a lot of data, there may be sections with useful information that are not covered in this procedure.

If an employee has a payroll redline, the payroll simulation will stop processing at the point of the error and the full simulation will not be available. If a payroll redline is shown in your simulation, refer to the Payroll Simulation – Correct a Payroll Redline report procedure to fix the error.

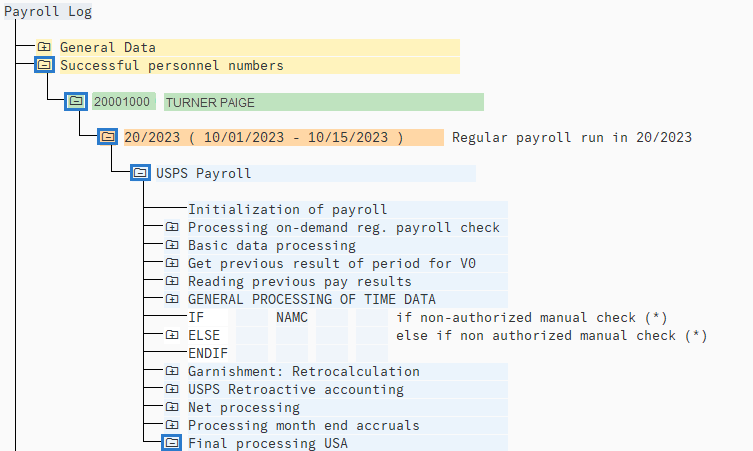

Click the folder to the left of the following selections to expand:

- Successful personnel numbers

- Personnel number and employee name

- Payroll period

- USPS payroll

- Final processing USA

Tips:

Tips:If the employee has retroactivity, multiple periods will be present under the Personnel number and employee name section. Retroactivity (also known as retro) is caused when an employee has changes in a prior period, thereby resulting in a payroll recalculation. You may select any period within the retro to view that period’s simulated payroll results.

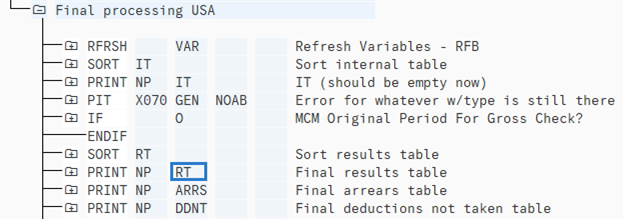

Double click on RT (Final results table) to view the simulated payroll results.

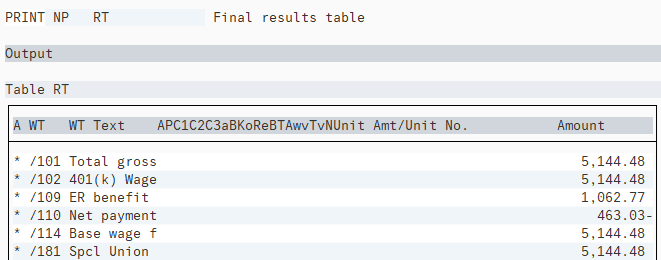

Review the employee’s simulated payroll results.

Tips:

Tips:Refer to the Payroll Simulation – Understand Payroll Wage Types procedure for detailed information on wage types that may appear in an employee’s simulated payroll results.

Click the Back button to return to the Final Processing USA results.

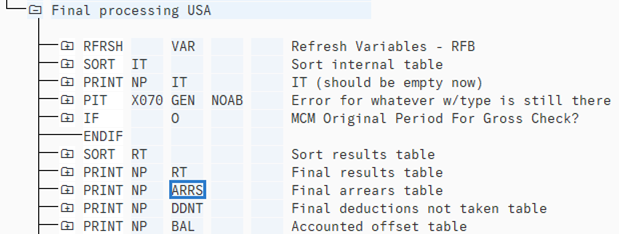

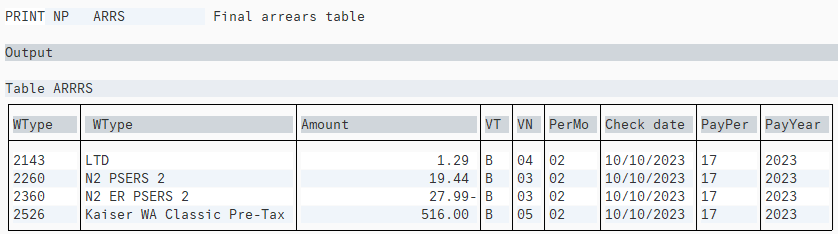

To view the Arrears (ARRS) table, double click on ARRS.

Tips:

Tips:Items that process through arrears are related to health, retirement, and/or long-term disability deductions that were unable to process due to a lack of wages in the current period. This may also occur if changes to master data caused a difference in one of these payments. Employer-related payments may also process through arrears.

Review the employee’s simulated arrears.

Tips:

Tips:The ARRS selection will be empty if the employee has sufficient wages to cover payments and is not receiving a refund in the period.

If the employee-related item in arrears is reflected as a positive number (payment) in the current period, the employee still owes this amount. The payment will process once the employee has sufficient wages for HRMS to pay the deduction.

If the employee-related item in arrears is reflected as a negative number (refund) in a previous period within the retroactivity, the employee will receive the refund regardless of the amount of wages processing in the current period.

Click the Back button to return to the Final Processing USA results.

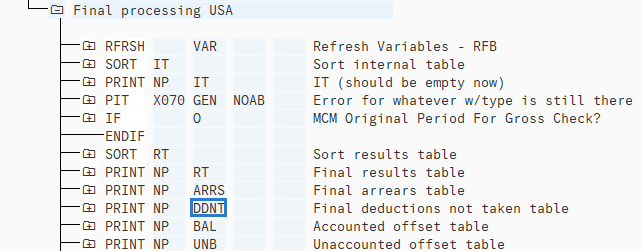

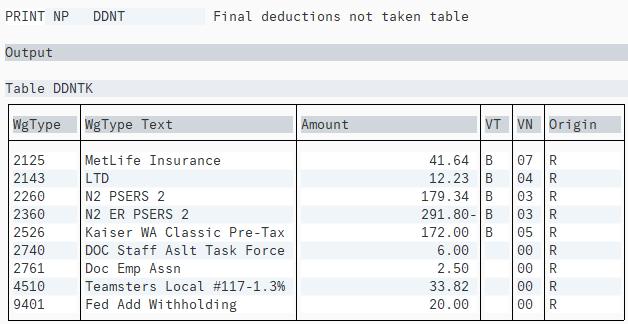

To view the Deductions Not Taken table, double click on DDNT.

Tips:

Tips:Items that process through Deductions Not Taken (DDNT) are related to mandatory or employee elected deductions that are unable to process due to a lack of wages in the period. Even though health, retirement, and/or LTD deductions are visible in both ARRS and DDNT, they will continue to process through ARRS until the employee has sufficient funds to pay them. All other DDNT items will not attempt to process in future periods, regardless of wages.

Review the employee’s simulated Deductions Not Taken (DDNT).

Tips:

Tips:The DDNT selection will be empty if the employee has sufficient wages to cover payments.

If the employee related item in DDNT is reflected as a positive number (payment) in the current period, the employee still owes this amount and HRMS will not attempt to process it in the future. This may require a manual collection using an Additional Payments (0015) infotype record.

Any items located in DDNT that are not related to health, retirement, and/or LTD will not process in retro. If an Additional Payments (0015) infotype record is later used to collect these funds, the record must be dated within the current period.

If an overpayment repayment wage type is found within the DDNT table, this will cause the employee to have a RPCIPE error once payroll begins processing. Adjustments should be made to ensure the overpayment repayment wage type is corrected and no longer visible in DDNT.

Click the Back button to return to the Final Processing USA results.

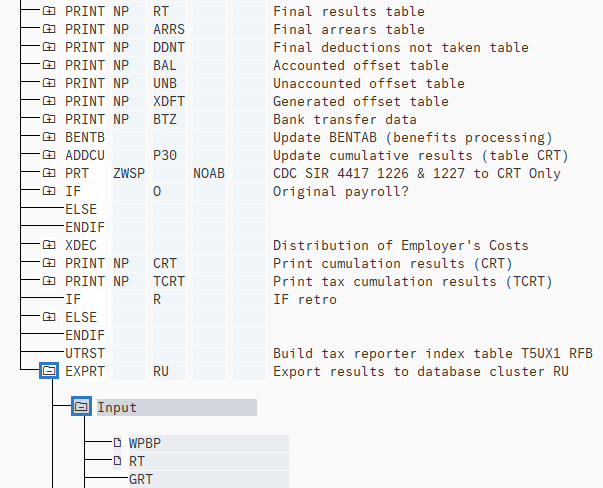

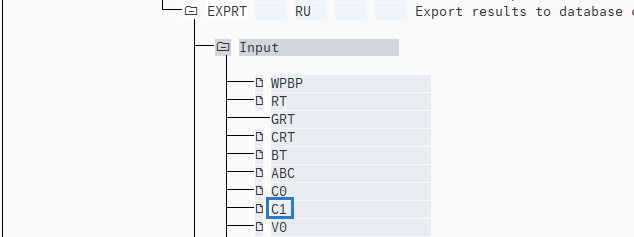

To view funding, click the folder to the left of the following selections to expand:

- EXPRT: Export results to database cluster RU

- Input

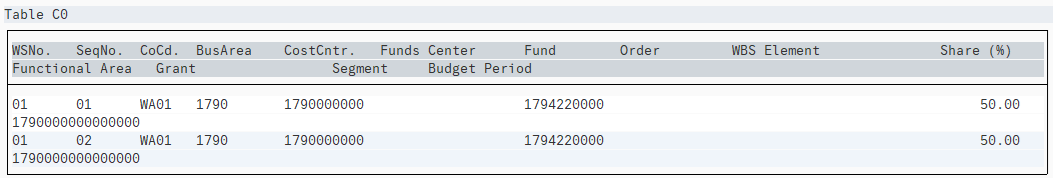

To view Position Cost Distribution, double click on C0.

Review the employee’s simulated Position Cost Distribution funding (C0).

Tips:

Tips:The funding located in the C0 table is maintained by organizational management processors in the Cost Distribuition (1018) infotype, which is located within the employee’s position. If an employee has an active Employee Cost Distribution (0027) record, the funding in the employee’s record will override the position’s cost distribution. See next steps for more information on the C1 table.

Funding must always total 100%. A RPCIPE error will occur if an employee does not have funding in every period they are currently processing or if the funding does not total 100%.

If both C0 and C1 are without funding, create a Cost Distribution (0027) infotype record to eliminate the RPCIPE error. The beginning date of the record should be the first day of the first period and the end date should be the last day of the final period within the retro.

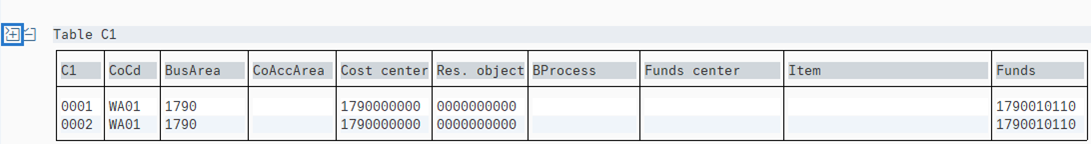

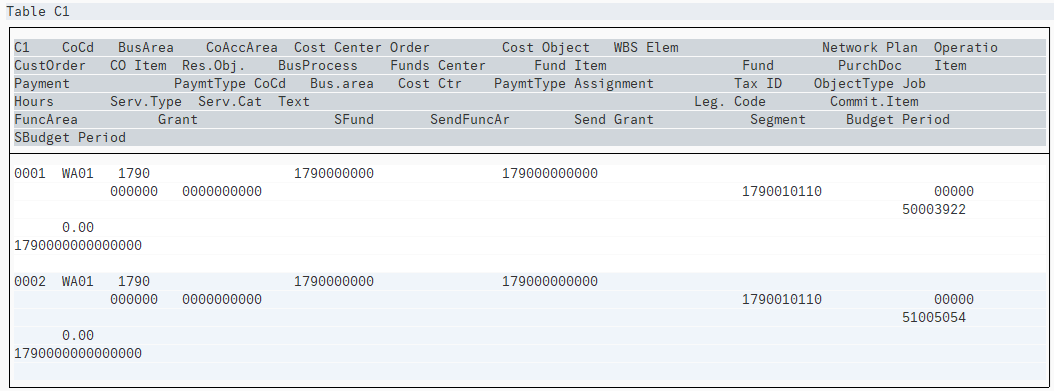

To view Employee Cost Distribution, double click on C1.

Click the folder to the left of Table C1 to expand.

Review the employee’s simulated employee Cost Distribution funding (C1).

Tips:

Tips:If an employee has an active Employee Cost Distribution (0027) record, the funding in the employee’s record will override the position’s cost distribution. Funding must always total 100%.