Garnishments - Writ Processing - Release Writ

Use this procedure to release a writ of garnishment on the Garnishment Document (0194) and Garnishment Order (0195) infotypes. Perform this procedure when a writ of garnishment release is received by the agency.

If you are releasing a Creditor, Federal Tax, Private Student Loan, Child Support, State Tax, or Voluntary Assignment garnishment, refer to the Garnishments - Standard Processing - Release Garnishment procedure instead.

Service of a writ on the Office of the Attorney General is required pursuant to RCW 6.27.040 and RCW 4.92.020. If an agency receives a writ directly, without prior service on the Office of the Attorney General, return the writ to the creditor (plaintiff) noting that it was improperly served.

Before you begin, if you have questions on administering a writ, please contact the Public Records and Constituent Services Unit at the Attorney General’s Office:

(360) 753-9673

publicrecords@atg.wa.gov

-

Step 1

Enter transaction code PA30 in the command field and click the Enter button.

-

Step 2

Complete the following field:

- Personnel no.

-

Step 3

Click Enter to populate the employee information.

-

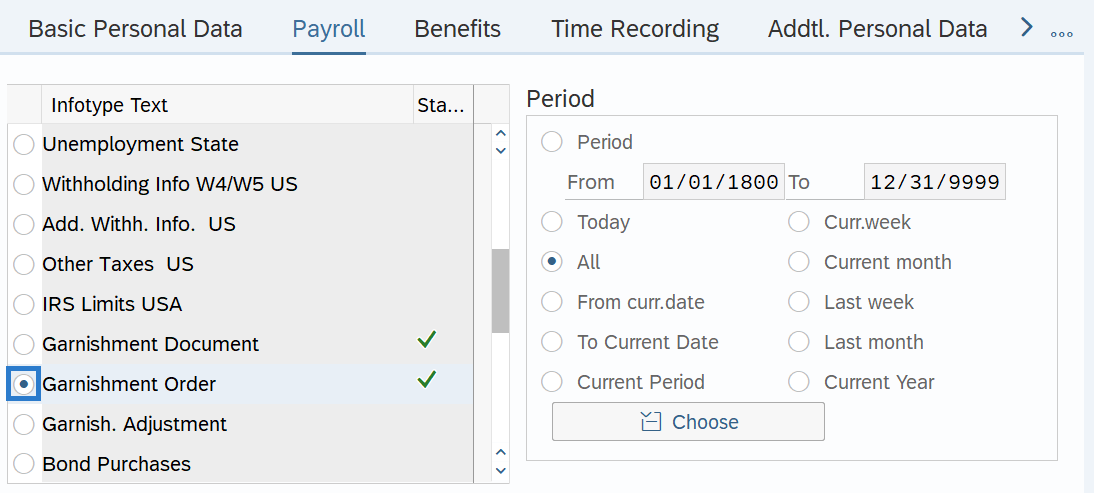

Step 4

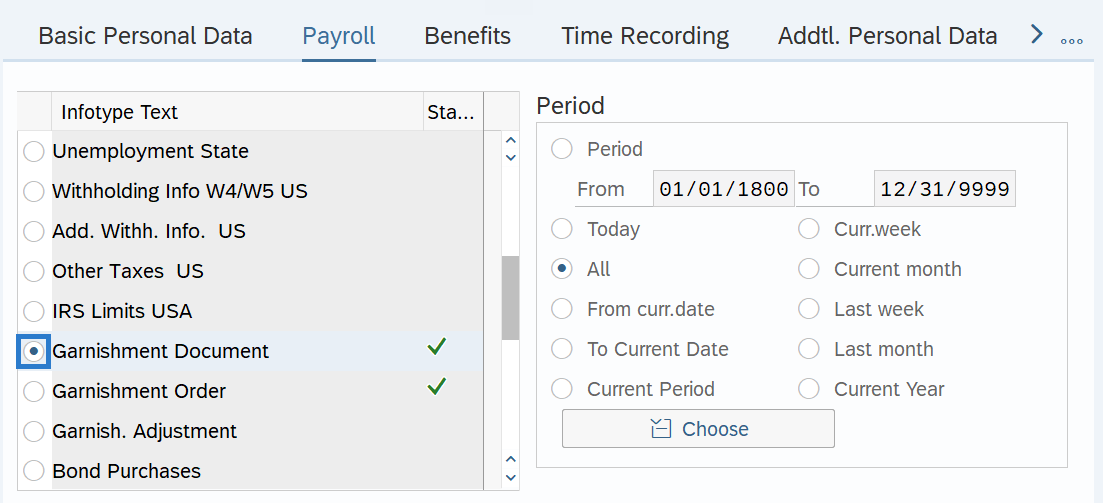

On the Payroll tab, select the Garnishment Order radio button.

-

Step 5

In the Time period section, select the All radio button.

-

Step 6

Click the Overview button.

-

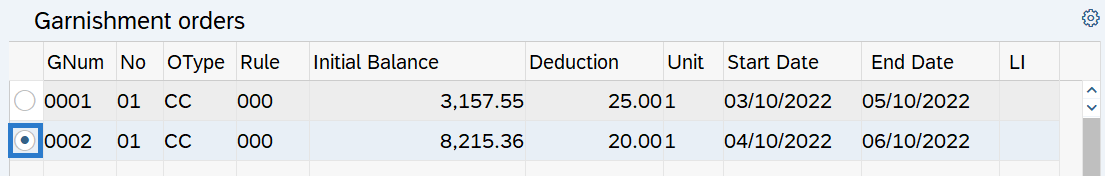

Step 7

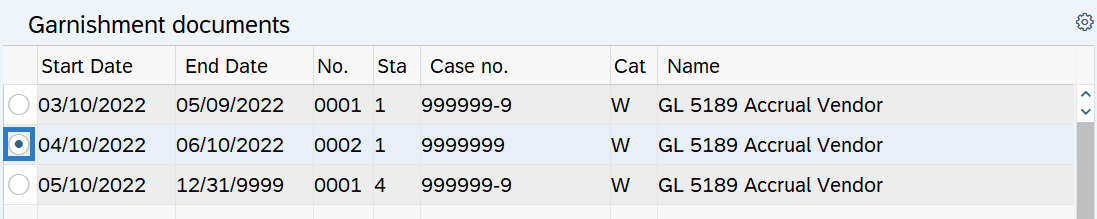

Select the radio button to the left of the Writ that needs to be released.

TIPS:

TIPS:If an employee has multiple garnishments, look at the Garnishment Document (0194) infotype overview to view the Case number, Category and Name columns. HRMS automatically assigns a sequencing number as each new document is created. This sequencing number links the Garnishment Document (No.) to the Garnishment Order (GNum) and will help you identify the correct record.

-

Step 8

Click the Change button.

TIPS:Using the Change button overwrites the existing record.

-

Step 9

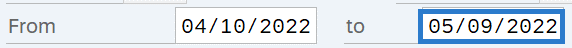

Enter the To date.

TIPS:

TIPS:The To date should reflect the last actual check date the writ is to be processed. If you are uncertain of the check date, refer to the Payroll Calendar.

Garnishments will not process retroactively for a prior pay period.

-

Step 10

Click the Enter button to validate the information.

-

Step 11

Click the Save button.

-

Step 12

Click the Back button to return to the Payroll tab.

-

Step 13

On the Payroll tab, select the Garnishment Document radio button.

-

Step 14

Click the Overview button.

-

Step 15

Select the rdio button to the left of the Writ that needs to be released.

-

Step 16

Click the Copy button.

-

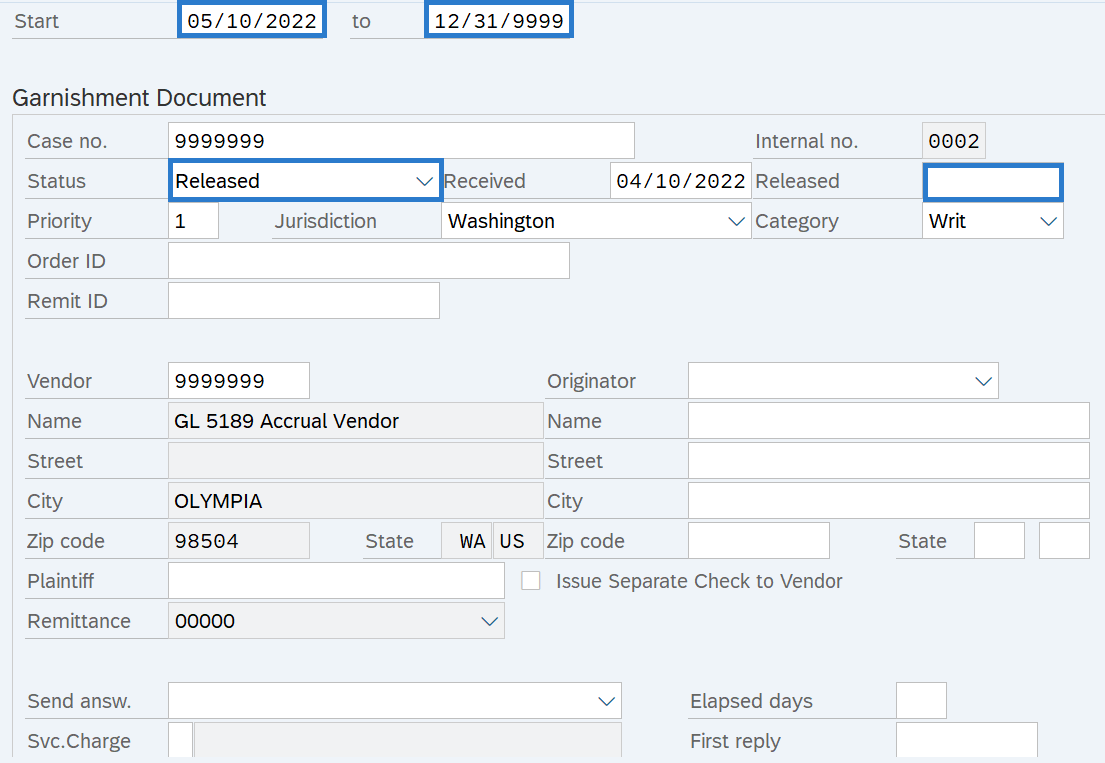

Step 17

Complete the following fields:

The following fields are mandatory:

- Start

- To

- Status

- Released

TIPS:

TIPS:The Start date should reflect the day after the last check date the writ is to be processed. If you are uncertain of the check date, refer to the Payroll Calendar.

The To date should be set to 12/31/9999.

The Status of the garnishment document should be Released.

The Released date should reflect the date the writ release is received by the agency.

-

Step 18

Click the Enter button to validate the information.

-

Step 19

Click the Save button.